The developed world (OECD) is already high energy and despite much weeping and gnashing of teeth, is projected to continue burning more fossil fuels at current rates into the foreseeable future.

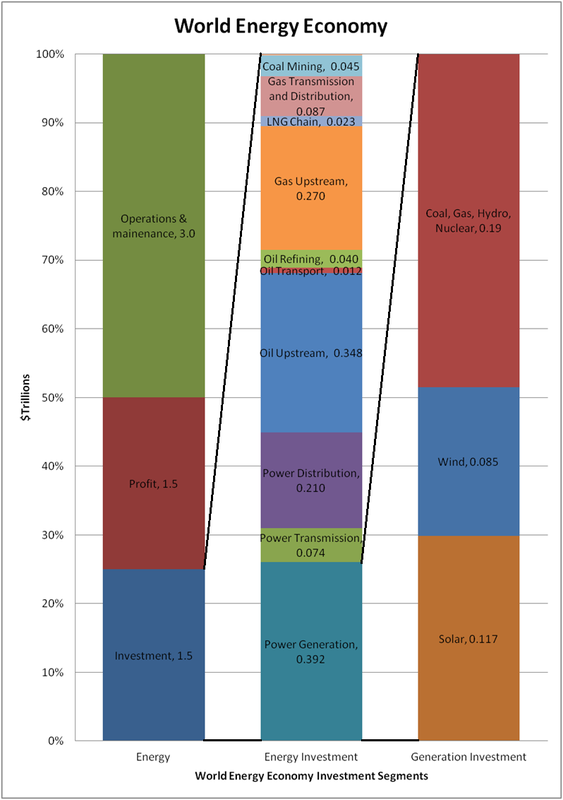

Interestingly, the world already spends about $200B/y on alternative energy generation, over half its $400B/y overall investment in new electricity generation. This is divided roughly equally between the OECD and non-OECD countries. This is an objective measure of the considerable amount the world is collectively currently willing and able to pay for fossil fuel free energy.

Unfortunately this currently only buys about 17GW average generation, or about 1% of world electricity generation, or about 0.1% of world primary energy. This is insufficient to reduce CO2 emissions which are projected to rise every year into the foreseeable future. The level needed to be on a path to reduce CO2 emissions is 500GW to 1TW average new clean generation every year. This is twenty to fifty times current levels.

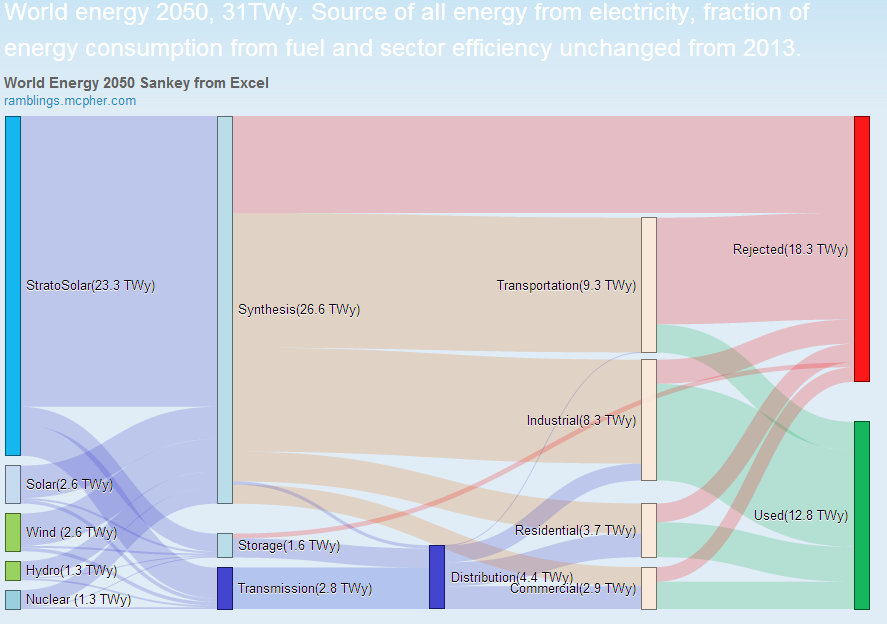

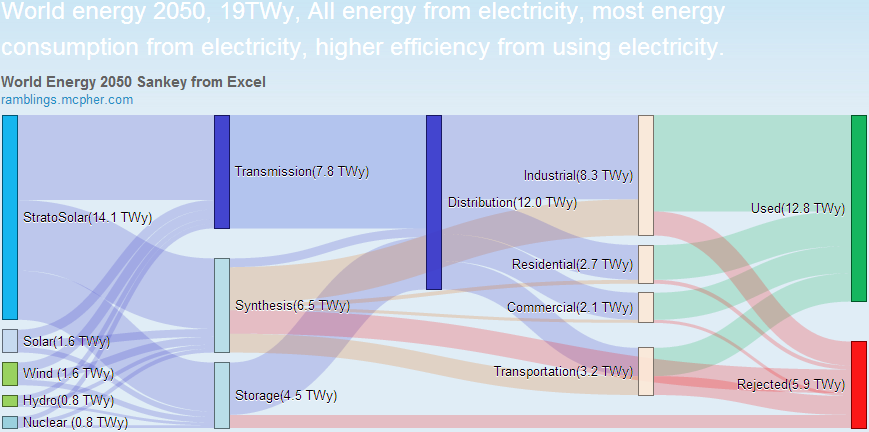

This highlights the patently obvious but constantly ignored fundamental nature of the problem. To paraphrase James Carville “Its the economics, stupid.” This succinct phrase gets to the heart of political reality. No matter if the energy problem is seen as climate change, energy security, resource depletion or poverty, the real problem is the economics. Energy is just too big a part of the world economy for it not to be so. Significantly increasing the cost of energy by replacing fossil fuels with current high cost wind, solar and nuclear will never be politically acceptable.

So we are at an impasse. The current technologies lead to policy proposals that are politically unacceptable and a very polarized debate that can never succeed in forming a consensus.

The politically viable solution to this economic problem is new sources of clean sustainable energy at lower cost than fossil fuel energy. Unfortunately the current energy policy consensus is frozen like a deer in the headlights. The common wisdom is no such present or near future low cost technology exists and the need for immediate action means we should find ways to finance more of current high cost technologies. Unfortunately this policy approach violates the first law of politics and as such has failed and is doomed to continue to fail.

Breaking the impasse needs fresh thinking to get more options on the table. The consensus that there is no possible low cost energy alternatives is a self fulfilling prophecy if it leads to no attempt to search for such solutions.

Policy proposals tend to be broad and vague. Here is an explicit proposal that is not meant to compete with the status quo. Relative to world energy investment of about $1.6T/y, $10B/y seems an affordable amount to spend on energy R&D focused exclusively on high risk, clean electricity generation, power plant solutions. This is not basic research and it is not government R&D. A model is Space-X. Space-X is a private company focused on a product and works on fixed price contracts with fixed deliverables. Its like venture funding. Say The US, Europe, and China each established $3B/y venture funds to fund high risk energy development companies. By high risk, I mean high risk.

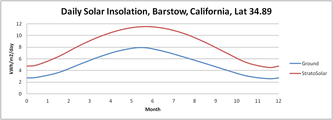

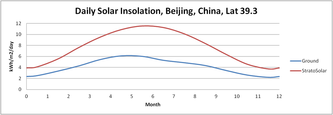

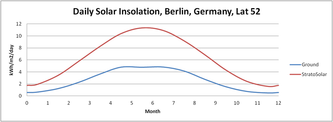

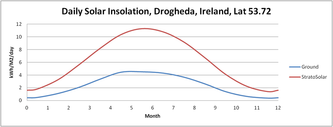

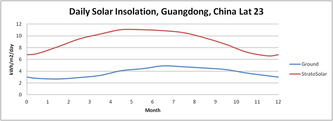

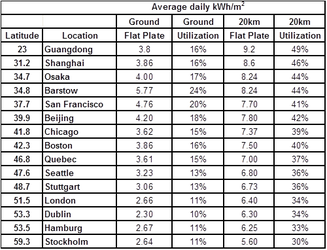

Already, despite starvation levels of investment, some such companies exist. There are several fusion energy companies. There are several companies focused on sustainable fission of Thorium and U238. There are high altitude wind companies, wind on the ocean, solar in space, the desert, and the stratosphere. Funding these and others to start with would bring out a lot more. Companies would start at say $10M/y or more depending on their current stage of development. Funding would be for fixed deliverables and if on successful paths a few would get to say $500M/y, keeping the average at around 100 companies at $100M/y. This portfolio approach would lead to exploring many approaches and the probability of significant advances in less than five years. One significant success is all that is needed. Its not inconceivable that private equity would eventually join the party, and share the risks and rewards.

By Edmund Kelly

RSS Feed

RSS Feed