|

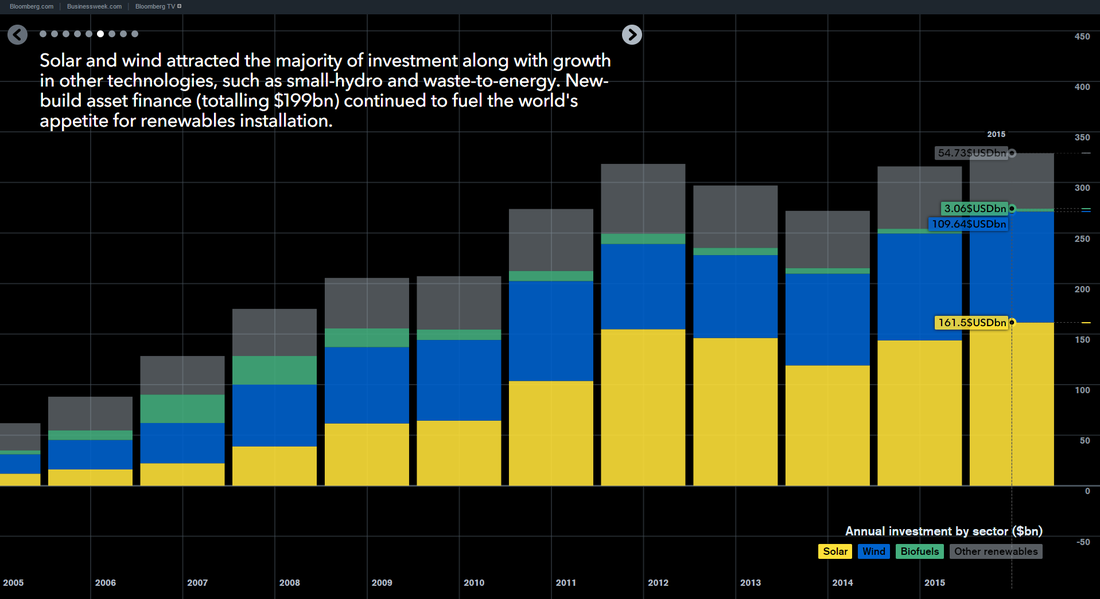

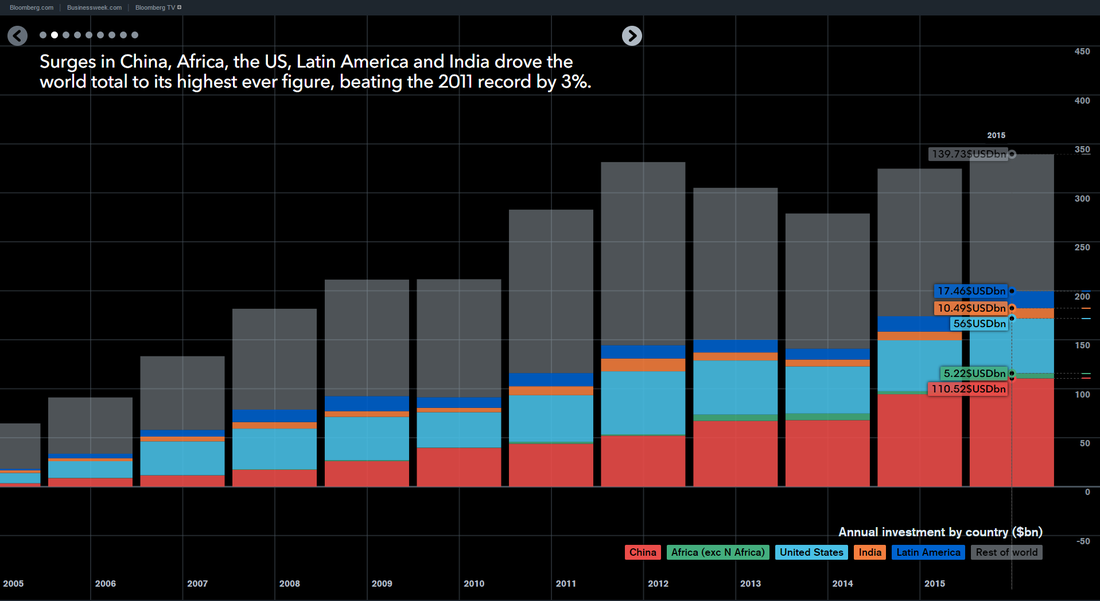

Bloomberg came out with a 2015 update to their report on world investment in clean energy. Above are a couple of charts showing the overall investment by type and by region. Total investment rose slightly (3%) over 2014 to $328B of which $161.5B or 50% went to solar. The overall investment level has not changed significantly for the five years, 2011 to 2015. Over this period solar has stayed about the same percentage of clean energy investment. Annual solar capacity has grown from 25GW to over 50GW, so the average cost of solar has dropped significantly from about $6.40/W($161/25) to $3.20/W($161/50), moving solar closer to wind in cost. PV panel costs have not declined much over this period ( after a dramatic decline around 2011) so most of the solar cost reduction has been from the rest of the system. The rate of these system cost reductions is slowing. The overall world average cost covers a very wide range of systems, from high cost rooftops over $6.00/W to very large utility arrays at less than $1.50/W, along with large regional differences in labour and regulatory costs. As the regional market chart shows, there has been a significant change in where the investments are taking place over the five years. The two biggest trends were the decline of Europe and the rise of China. Without China’s decision to dramatically increase its clean energy investment in 2014 and 2015, the overall market would have declined every year from 2011. Despite dramatic reductions in price, investment in solar has hardly increased. This tells us that solar investment is not yet driven by market forces. The price will have to fall substantially from current levels for solar to become market competitive. Overall the charts present a picture of a stagnant clean energy market. Given the need for government support to maintain the market, the world economic slowdown does not bode well for growth in the clean energy market, particularly in China. Despite its greater than $300B/y size, the current clean energy market is not reducing CO2 emissions by any noticeable amount. Based on these charts it is not on a path to do any better. There is a need for a change. StratoSolar makes today's PV a practical replacement for fossil fuels. Its an incremental improvement of PV, not a dramatic revolutionary new technology. It is easy, quick and cheap to prove its viability. The path we are on is clearly not working. It is worth giving StratoSolar a try. By Edmund Kelly

Comments

The attached white paper is a more comprehensive look at the impact of higher energy costs on reducing GDP growth. This tells us two things. First, we are in serious economic trouble already with a low and declining rate of economic growth from the continually increasing cost of fossil fuels. Second, replacing fossil fuels with more expensive alternative energy sources will only make the problem worse. So far, wind and solar have been a relatively small economic factor, but growth to a level where they can contribute to a significant reduction in CO2 emissions would quickly get us into economic decline, and the political unrest that comes with economic decline. StratoSolar's lower cost of energy production than fossil fuels can reverse the current decline in the rate of economic growth by making energy cheaper on a continuing basis. By Edmund Kelly

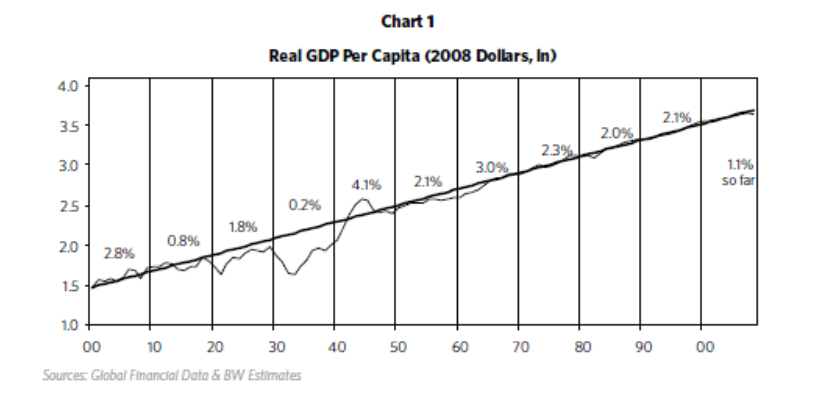

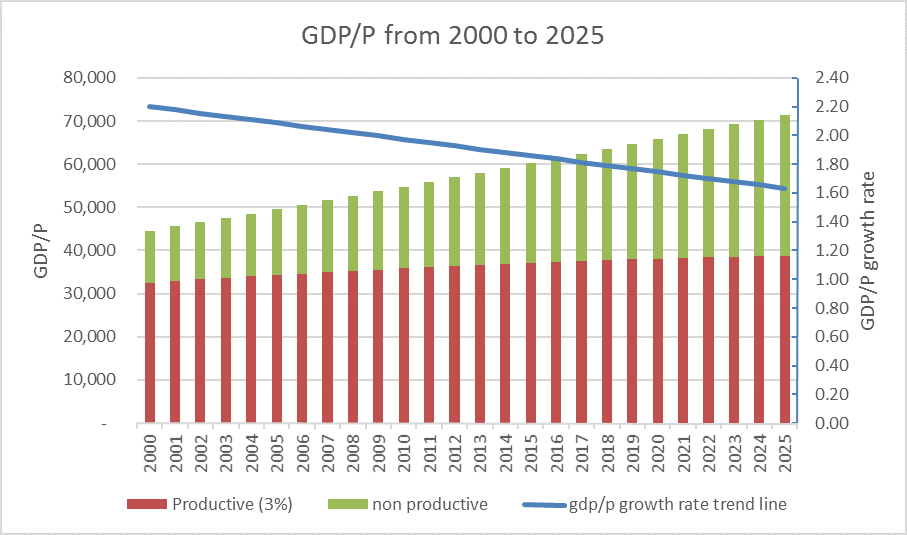

An argument against large scale deployment of alternative energy is the negative impact of the higher cost on gdp growth. The following is an attempt to quantify this effect based on the increasing cost of energy since around 1970. The modern world is based on sustained economic growth. As the chart below shows, US real gdp per capita has maintained an overall 2% per annum growth rate through depression, recessions and two world wars. This has been possible because of technological advances increasing the productivity of all economic sectors. Since around 1970, the cost of producing energy has steadily risen. Initially this was driven by the increasing cost of oil production, and more recently the cost of expensive alternative energy production has also become a significant factor. Energy is a significant part of gdp, so its share growing from around 5% to around 10% of gdp should clearly have been a drag on the growth rate of gdp, reducing it from its long term 2% per annum historical trend. When we examine US GDP growth rate data for various periods from 1960 to today, regardless of the period chosen it is apparent that growth rates have been on a steadily declining trend. The straight line in the graph below shows a snapshot of the actual downward trend from 2000 to 2015 projected forward to 2025. The colored bars also illustrate a simple model that assumes the economy has two sectors. One sector has a high productivity growth rate of 3% and the other sector is stalled out with 0% productivity growth rate. To make the numbers fit the data we need to start with the non productive sector at 25% of GDP. This produces a breakdown like that shown, with the non productive sector continually increasing as the overall growth rate declines. These numbers imply that a larger sector of the economy than just energy is contributing to the recent decline in economic growth rate. Increased energy costs account for about a third of the decline by 2015. The other likely contributors to low growth rate are substantial parts of the financial sector, health care and education. This reduced rate of overall economic growth is causing severe economic problems already, with income inequality and stagnant wages. The problems will only get worse if the growth rate continues on its current downward trend. This illustrates that economic growth is a sensitive thing that cannot survive a large part of the economy becoming less productive. This should make it clear that a competitive, lower cost source of clean energy is a necessary condition for an energy transition that does not destroy economic growth. Current wind and solar are currently several times the needed lower cost and are reducing in cost at too low a rate to be an affordable solution for a long, long time. Other approaches like StratoSolar that can solve the problem without destroying the economy deserve some serious attention.

This white paper covers the topic of the reduction in economic growth caused by the increasing cost of energy.

By Edmund Kelly |

Archives

December 2023

Categories

All

|

||||||||||||

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed