|

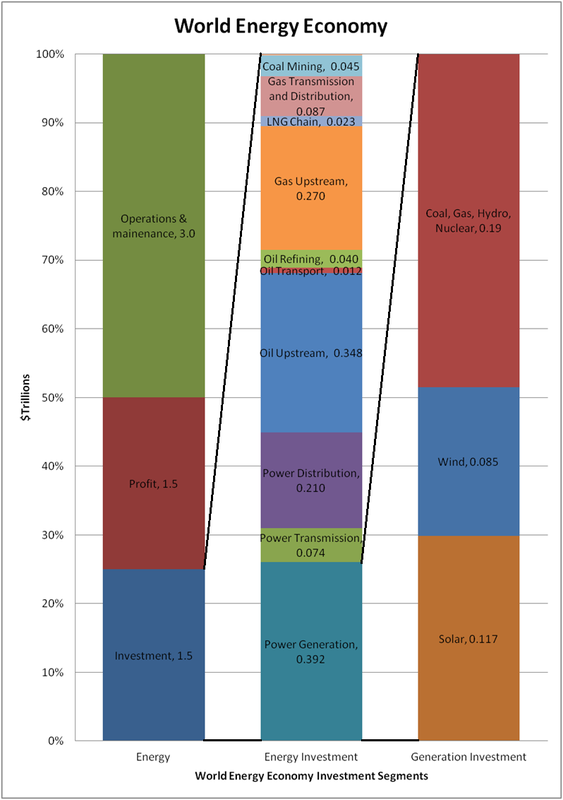

This chart visually illustrates the economics of energy discussed in the previous post. The left column shows all major energy segments. The middle column expands the energy investment segment and the right column expands the power generation investment segment. The numbers in each segment are Trillions of dollars. Its interesting that Solar is the biggest segment of power generation investment but it provides the lowest average power, a testament to the political power of renewable energy.

By Edmund Kelly

Comments

Looking at the money, for 2013, world GDP was $72T, of which energy was $6T, or about 8% of GDP. That $6T can be thought of as the income of the overall energy industry. This income balances with industry profit, investment and O&M. From IEA data the energy industry investment part was about $1.5T, of which about $0.8T was in oil and natural gas infrastructure, $0.4T was investment in electricity generation and $0.3T was investment on electricity transmission and distribution.

From Bloomberg data, investment in wind and solar generation in 2013 was about $200B, with additional clean tech investment of about $50B on smart grid, biomass and bio fuels. Some of the investment in transmission and distribution is to integrate wind and solar and some smart grid spending is also related to wind and solar integration. So current investment in clean energy generation is over half of all investment in electricity generation . I have to admit I found this surprising. I always see alternative energy as the underdog, not the biggest player. That $200B bought about 45GW ($82B) of nameplate wind and about 35GW ($114B) of nameplate solar. Using average generation as the metric, conventional power plant capacity runs on average at about 50% utilization worldwide, so the world’s almost 6TW installed capacity generates an average 3TW of power. The 45GW of new wind generates an average of about 12GW and the 35GW of new solar generates an average of about 5GW, for a total of about 17GW of new average generation. That's 17/3000 or about 0.5% of current average electricity generation. The other $200B bought about 140GW of coal, gas, hydro and Nuclear power plants, mostly in China and India, that generate more than 70GW of average power or about four times the 17GW average of the new wind and solar. When we account for the cost of fuel, wind and solar electricity averages about two to three times the cost of electricity from other sources. Most of the investment in new electricity generation is driven by economic growth which needs to add about 3% of new generation every year. If just that increase was met with current wind and solar, it would cost close to $1T/y. That does not cover replacing the existing generation. Of the $200B spent for wind and solar, government subsidies account for at least half, or $100B. This is a look at the money. The bottom line is that wind and solar are already the biggest money part of electricity generation but are not providing much electricity. To scale wind and solar up just to meet current new generation demand would mean they would probably be the biggest industry on the planet. By Edmund Kelly Alternative energy exists solely because of a political will to make it so. It has been uneconomic from its modern inception in the 1970's, driven by the first oil crises. As a result, market driven economic viability has never been a central part of the alternative energy mindset. At its core it has been driven by two perceptions. The first was simply the need for a clean fossil fuel replacement largely regardless of cost. The second was that given time, costs would reduce to make them more acceptable.

The political will influenced government to provide subsidies to nurture the business. These subsidies now exceed $100B/y of investment worldwide and prop up a total investment of about $250B/y. However a business that depends so heavily on government support is subject to all the problems of such reliance. Firstly government support is volatile, driven by who wins elections. Secondly, subsidized industries are notoriously inefficient. Any long term subsidy regime encourages business that live off the subsidies with little or no incentive to improve. The perception that costs would reduce has been borne out by time, but the path has been a rocky one. The recent history of PV shows the erratic nature of this progress. On a day to day basis no one sees the big picture. When PV prices were stable for a decade, the perception was of stagnation which led to betting on thin film PV. When prices were falling the perception was they would continue to fall, regardless of fundamentals. Also, market size of a heavily subsidized industry is not perceived as inextricably tied to the size of subsidy. If government continues to support the PV business, costs will decline to a point where PV is competitive for some fraction of energy for sunny locations, but to be a complete solution other technologies like long distance transmission and storage have to become economically viable as well. The current rate of improvement put that point out beyond 2050. This is the status quo. Governments willing to provide limited subsidy, a business happy to live of this subsidy with its current size and rate of growth and an alternative energy political consensus that thinks this is actually working. This status quo is not reducing CO2 emissions and will not reduce CO2 emissions out to 2050. Realists point out that change of the degree necessary to reduce CO2 takes many decades and huge political will. While alternative energy imposes large new costs, the current small political will for change is directly measured by the small amount we are collectively willing to pay for subsidies. The only way to increase the political will is to reduce the cost at a faster rate or better yet turn things around and make clean energy an economic benefit. This perception is sadly lacking. The optimists place their hope in technological breakthroughs, and so we get daily updates on basic research, most of which we know will go nowhere, but create the illusion of progress. The sad reality is that basic research takes decades to make it from the lab to the market and decades more to achieve large scale. To scale quickly a technology needs both a long gestation to viability and to be mass producible. PV has recently demonstrated that it is at this point. The rapid scalability has surprised governments that provided subsidies assuming a slower ability to scale. Germany spent over $150B in two years for about 15GW before they adjusted. China just ramped to over 12GW in one year from a standing start for a lot less. So PV technology is at a point where we can make and deploy as much as we can afford. The problem is the high cost of the resulting electricity, especially if you count the costs of intermittency and storage, is just too much money for economies to sustain. StratoSolar is only PV in a new location. It reduces the cost of resulting PV electricity to market competitive levels and increases the reliability of the supply. There is no new technology or resource that limits its ability to scale. If it is proven viable, the major thing that needs to scale is PV manufacturing, the thing that has already demonstrated scalability. This is a lot like computers in the late 1980s. A large CMOS semiconductor manufacturing business had matured and companies like Sun Microsystems that built computers based on this technology rapidly scaled to volume in the millions. This pattern repeated itself for PCs in the 10s to 100s of millions and recently for mobile phones in the billions, as the cost of computers reduced with volume over time. The common elements are ability to scale supply and an affordable product with sufficient demand to match the supply. From an investment perspective the risk is like betting on a Sun Microsystems. They had engineering and market risk, but they were fundamentally enabled by available semiconductor technology. They were small investments in small teams that integrated existing technologies to build new products for very large new businesses. The market demand they produced could be met by the scalable semiconductor supply. Similarly, StratoSolar can create a demand that can be met by a scalable PV semiconductor supply. It’s continuing the triumph of the semiconductor age. by Edmund Kelly This article from NPD solarbuzz discusses early signs of growth in the equipment used to manufacture PV cells and panels. They don't expect a resurgence until 2015. This is further evidence of signs of stabilization in the PV business.

PV panel prices stabilized in 2013, and with China stepping up its purchases, supply and demand are more in balance. PV manufacturers cannot invest in new plant until they are profitable, so the industry seems to be moving to a more solid footing. As the industry consolidates around a few big players, economies of scale and more efficient new plants will drive costs down. Historically, business will first use this cost reduction to restore profit margins rather than reduce prices. All this points to PV panel prices of about $0.75/W for the foreseeable future. Edmund Kelly |

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed