|

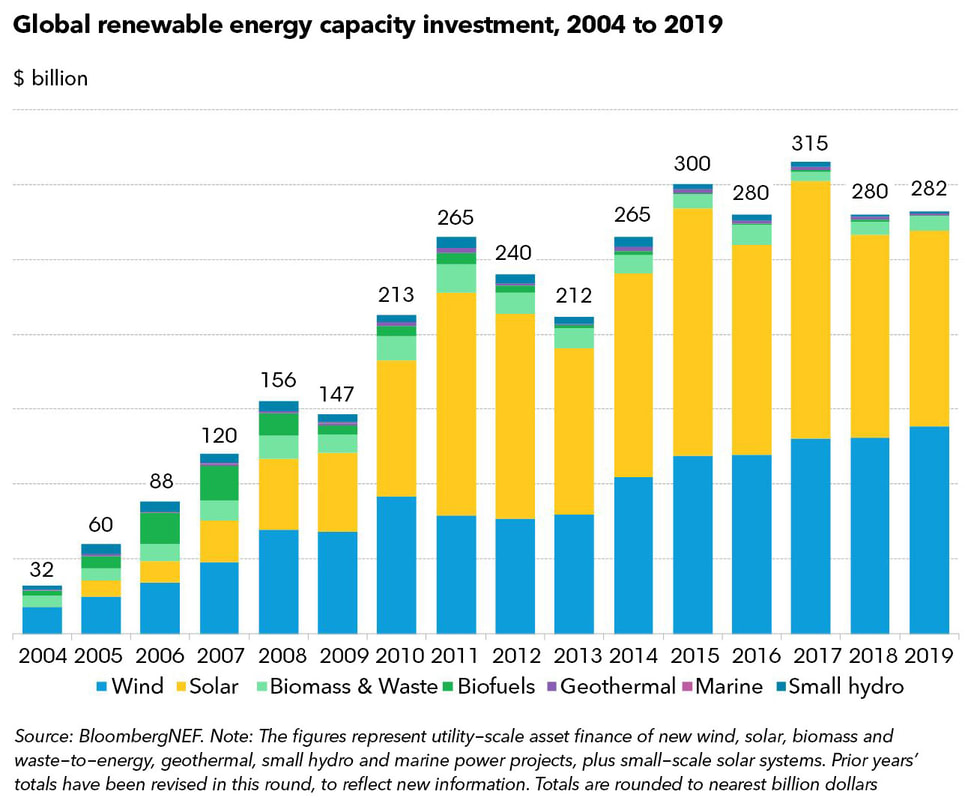

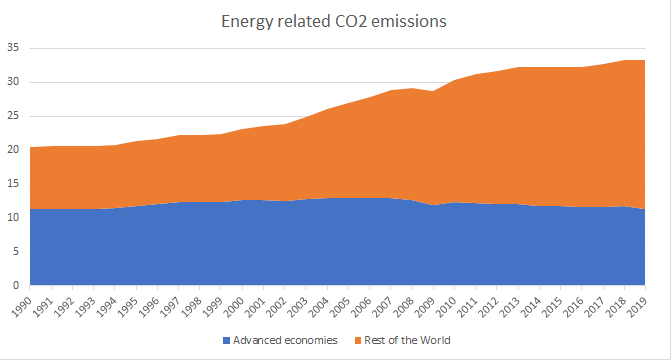

Bloomberg has published their data for renewable energy investment for 2019. This link is to an overview article. The graph above shows the overall 2019 renewable energy capacity investment and its history since 2004. 2019 ended up level with 2018 which extended the flat trend since 2011, to nine years. 2019 was initially looking to be a down year because of severe cutbacks in China, but it was rescued in Q4 by the US which saw a 28% gain over 2018 to a $55.5B total. This was driven by bringing forward projects to benefit from expiring subsidies. Next year will probably be a down year as subsidies decline. Investment in China, Europe, Japan, India and Australia all declined over 2018. While overall investment was flat, the capacity it purchased grew 20GW (12.5%) to 180GW as prices for wind and solar fell. The average $/W is now $1.57/W. In a normal market declining prices should see increasing spending. Prices have declined over 100% over the last nine years but spending has stayed flat. There is no shortage of demand for clean cheap electricity. The only explanation is that despite the amazing drop, prices are still too high and the only thing sustaining demand is still the need for subsidies. This is borne out by the observation that in every market across the world when subsidies are reduced the market shrinks. In 2019 this was obvious as China reduced subsidies and investment shrank. 2019 solar investment in China was one third of 2017 investment. The imminent expiry of US subsidies caused US investment to increase. Germany, once the premier investor in renewable energy now only invests a small fraction of past investment after subsidies were withdrawn. This is just further evidence that we are not on a path to reduce CO2 emissions with current renewable wind and solar energy. The issue is the price of electricity is too high. In addition, as I pointed out in previous posts, even as the cost of capacity falls, additional new costs necessary to grow intermittent capacity keep electricity prices increasing. The optimism driven from the ever decreasing cost of renewable energy capacity is understandable but it is not borne out by the evidence. For renewables to compete with fossil fuels prices have to fall considerably not just for generation but also for storage and transmission. Storage is not yet viable, never mind low cost and transmission costs are rising with NIMBY regulatory forces and the need to bury transmission lines. The expectation that we are on a path to 100% renewable energy is also clearly not borne out by the evidence of constantly increasing levels of atmospheric CO2. The graph below is the latest data for energy related Gigatons of CO2 emissions from the IEA. The overall trend is ever upward. Advanced economies are reducing emissions but the rest of the world is larger by far and increasing faster than the advanced economies are decreasing. Stratosolar can make today's solar energy technology an economically viable replacement for fossil fuel generation for the rest of the world that cannot afford the expensive energy of advanced economies.

By Edmund Kelly

Comments

|

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed