|

Its interesting that the two major alternatives to fossil fuel energy (wind+ solar and nuclear) are mostly at odds with each other. In the debate, they both point out the weaknesses of the other, and to an objective outsider clearly paint a picture where neither is a viable solution. The problems with cost overruns on new nuclear plants in the US and Europe have sharpened the debate recently with Toshiba’s announcement of massive losses from its Westinghouse division. The pointers at the bottom below show three perspectives on Toshiba’s woes.

My most recent blog posts have focused on the problems with intermittent wind and solar. Nuclear clearly has its problems too. Toshiba’s and others (Areva) problems at minimum show how hard current nuclear is, without even getting to how it could be modified to be more sustainable and load follow. With reactors being shut down in Europe, the US and Japan and cost overruns leading to no new orders, nuclear is not going anywhere. China is the only country adding any significant nuclear capacity. This would seem to end what had been seen as the beginnings of a nuclear revival. Most nuclear advocacy centers on new designs to remedy problems with current reactors. Nuclear takes a long time from experimental to demonstration to production power plants. Minimally the sequence takes decades and costs billions to tens of billions of dollars. So, nuclear power and wind and solar face similar problems. Neither are viable replacements for fossil fuels and it will take significant development of new unproven technologies to make them so. Compare this with StratoSolar. Much of StratoSolar is just today's PV. The unproven parts are relatively simple engineering based on existing mass produced technologies. To follow the nuclear model, the first step is to build an experimental platform. This could be done in less than a year for a few million dollars. An experimental nuclear reactor is many years and hundreds of millions of dollars. Relative to a new nuclear reactor, StratoSolar demonstration and production platform steps are equally as fast and low cost as the experimental platform. The point is that StratoSolar is no more speculative than wind, solar and nuclear, when the development paths of each that lead to viability are objectively analyzed. The perspective that wind, solar and nuclear are all unproven and speculative is not the perspective of their advocates. Wishful thinking rules the day. Recently Bill Gates led the founding of Breakthrough Energy Ventures (BEV), a fund to invest in long term energy ventures. Given Bill Gates fondness for nuclear power, funding nuclear power is probably the focus of the fund. Given the funding required to get to production plants, its very unlikely that a private fund could raise the tens of billions required even to develop one new plant. Presumably the plan is to fund the earlier cheaper development stages and persuade governments to foot the major bills. Perhaps we can persuade BEV to fund StratoSolar? It might be high risk but its cheap and fast. Its actually a typical venture funded opportunity. By Edmund Kelly Rod Adams: reporter http://www.theenergycollective.com/rodadams/2398838/toshiba-announces-6-3b-writedown-229m-construction-company-acquisition Jim Green: Friends of the earth: http://www.theenergycollective.com/energy-post/2399091/nuclear-safety-undermines-nuclear-economics Michael Schellenberger: The breakthrough institute http://www.theenergycollective.com/shellenberger/2398737/nuclear-industry-must-change-die

Comments

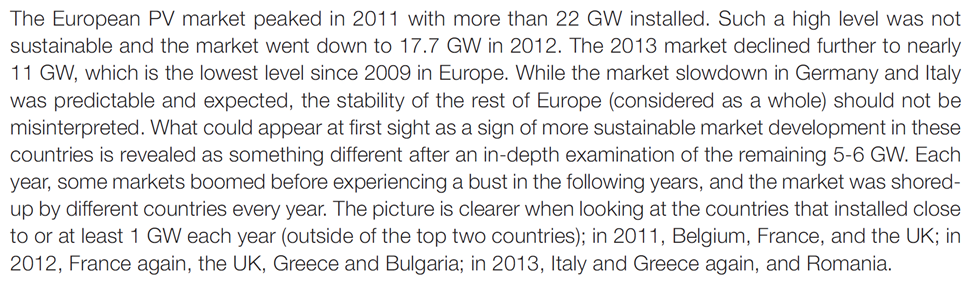

This report titled “Beyond Boom and Bust” , was published in April 2012 and I commented on it in this blog post. It was the work of several bodies and individuals, including the Brookings Institute. It argued that US clean energy policy was producing boom and bust cycles, but making no progress in reducing atmospheric CO2. They advocated a more results driven “technology led” policy. The recent EPIA report on PV market outlook for 2014 to 2018 had an interesting section that described the recent behavior of the PV market in Europe as a series of unsynchronized national boom and busts that were hidden by looking at the overall European market statistics. To quote from page 31: PV seems to have always and everywhere followed a path of governments introducing subsidies, investors responding enthusiastically producing a rapid growth boom. Governments then belatedly see the costs mount and reduce subsidies, causing a market bust. Then investor confidence is broken and difficult to restore. Europe has few countries that have not gone through this cycle. Europe has gone from being the biggest PV market to number three or four, with little sign of a likely recovery.

The recent US rapid PV growth is driven by US subsidies enabling profitable investment in PV. The expiration of the Investment Tax Credit in 2016 will burst this bubble, just like all the rest. The governments in Japan and China are early in the subsidy cycle so the boom phase is only building up. In a year or two the costs will be un-sustainable and the bust will inevitably follow. All of this makes it virtually impossible for PV to reduce in cost. Low and unpredictable PV market growth will not encourage investment in newer plant and equipment that can reduce costs. At current cost levels PV market cannot grow without more subsidies. As the boom and bust cycles clearly illustrate, more subsidy is unlikely to be forthcoming. As the “Beyond Boom and Bust” report argued, current US clean energy subsidy policies are not succeeding. They only considered the US, but as we can see, the problem is worldwide. Perhaps it is time to consider the “technology led” policy reforms they advocated. By Edmund Kelly If we focus on new electricity generation capacity worldwide a pattern emerges that somewhat explains the lack of progress on reducing CO2 emissions. New electricity generation investment is about $400B/y, $200B/y in wind and solar and $200B/y in coal, gas, nuclear and hydro. Another $300B/y is invested worldwide in electricity transmission and distribution.

Looking at how the investment is apportioned between countries, a convenient division is between OECD and non OECD. This is a pretty accurate division between developed nations and developing nations. Developed nations have a relatively low growth in overall electricity capacity, with most new generation replacing old generation. Developing nations are growing their overall electricity generation capacity at a rapid rate to balance their rapid GDP growth. Interestingly, from a dollar perspective OECD and non OECD spend about the same on wind and solar, about $100B/y. Developing nations spend most of the $200B/y that is spent on coal, gas, nuclear and hydro, over 66%. They also spend most of the investment for transmission and distribution, about 66% or $200B/y. Because of the rapid pace and large scale of development, developing countries follow a well proven path of investing in low risk, proven, safe, and cheap technologies. Developing countries account for the bulk of investment in electricity infrastructure: about $450B/y (200 T&D + 150 G + 100 A)of the $700B/y. (T&D is transmission and Distribution, G is conventional Generation and A is Alternative generation) All of the OECD invests about $250B/y (100T&D +50G + 100A). In the OECD, wind and solar investment exceeds other generation by a significant margin, but in the non OECD the ratio is reversed. We are at point where PV is still too expensive to compete without subsidies. So what do Europe and America do? Introduce tariffs to protect domestic producers from Chinese imports. This protection supports already inefficient subsidized industries. What is the incentive to reduce costs through innovation when profits are guaranteed and competition is blocked? PV at current price levels will not become a significant enough producer of energy to have any affect on reducing CO2 emissions. Perhaps rising PV prices will break the cycle of over optimism about PV and get some focus on investments that might lead to competitive, clean, sustainable sources of electricity. Investors in Solar projects in the US and Europe think it burnishes their image as responsible planet aware companies when all they are really doing is partaking in corporate welfare on a grand scale. Public funds are subsidizing half the costs of private PV investment and guaranteeing large profits. Their actions prop up inefficient PV industries who rely on subsidies and now protective tariffs. There is little incentive to lower cost to where the PV business can grow without subsidies and perhaps help reducing CO2 emissions. Solar investors are reinforcing the equivalent of fiddling while Rome burns. There has been a series of recent articles that paint a picture of the improving state of the PV business. This article highlights that China is starting to deal with the zombie 2nd tier companies. The first tier like Jinko, Trina, Canadian, Sun Edison are pretty strong. This Jinko report shows them profitable with panel ASPs of $0.63/W in China. This matches well with $0.75/W in the US and Europe. China is lower cost because it has cheaper financing and cheaper labor. Also there is starting to be life in the Polysilicon market as polysilcon price has rebounded from $15/kg to $20/kg, with several new factories being announced by REC in China and GTAT in Malaysia.

China is the key. As European demand collapsed last year, China's new subsidies for local deployment provided the foundation for their PV panel makers and confidence for future stability. However if prices stay stable at current levels, more subsidy will be needed to grow the market. Projects in the US are profitable with current subsidies and apparently there is enough investor confidence in solar to support projects with IRRs below 10%. Projects in Texas have been bid at PPAs of $0.05/kWh based on low financing costs and current subsidies. Chinese panel makers are becoming project developers as a means to ensure a market for their panels, following the example of US panel manufacturers First Solar and Sunpower that have successfully used this strategy to survive with uncompetitive panels. Overall PV growth projections seem to hinge on new markets in the developing world. Panel prices should stabilize at current levels of around $0.75/W, or even rise over the next few years as the industry returns to profitability. This is all good news, but does not paint a picture where the PV market is likely to grow to the level needed to make a significant impact on CO2 emissions any time soon. By Edmund Kelly Alternative energy exists solely because of a political will to make it so. It has been uneconomic from its modern inception in the 1970's, driven by the first oil crises. As a result, market driven economic viability has never been a central part of the alternative energy mindset. At its core it has been driven by two perceptions. The first was simply the need for a clean fossil fuel replacement largely regardless of cost. The second was that given time, costs would reduce to make them more acceptable.

The political will influenced government to provide subsidies to nurture the business. These subsidies now exceed $100B/y of investment worldwide and prop up a total investment of about $250B/y. However a business that depends so heavily on government support is subject to all the problems of such reliance. Firstly government support is volatile, driven by who wins elections. Secondly, subsidized industries are notoriously inefficient. Any long term subsidy regime encourages business that live off the subsidies with little or no incentive to improve. The perception that costs would reduce has been borne out by time, but the path has been a rocky one. The recent history of PV shows the erratic nature of this progress. On a day to day basis no one sees the big picture. When PV prices were stable for a decade, the perception was of stagnation which led to betting on thin film PV. When prices were falling the perception was they would continue to fall, regardless of fundamentals. Also, market size of a heavily subsidized industry is not perceived as inextricably tied to the size of subsidy. If government continues to support the PV business, costs will decline to a point where PV is competitive for some fraction of energy for sunny locations, but to be a complete solution other technologies like long distance transmission and storage have to become economically viable as well. The current rate of improvement put that point out beyond 2050. This is the status quo. Governments willing to provide limited subsidy, a business happy to live of this subsidy with its current size and rate of growth and an alternative energy political consensus that thinks this is actually working. This status quo is not reducing CO2 emissions and will not reduce CO2 emissions out to 2050. Realists point out that change of the degree necessary to reduce CO2 takes many decades and huge political will. While alternative energy imposes large new costs, the current small political will for change is directly measured by the small amount we are collectively willing to pay for subsidies. The only way to increase the political will is to reduce the cost at a faster rate or better yet turn things around and make clean energy an economic benefit. This perception is sadly lacking. The optimists place their hope in technological breakthroughs, and so we get daily updates on basic research, most of which we know will go nowhere, but create the illusion of progress. The sad reality is that basic research takes decades to make it from the lab to the market and decades more to achieve large scale. To scale quickly a technology needs both a long gestation to viability and to be mass producible. PV has recently demonstrated that it is at this point. The rapid scalability has surprised governments that provided subsidies assuming a slower ability to scale. Germany spent over $150B in two years for about 15GW before they adjusted. China just ramped to over 12GW in one year from a standing start for a lot less. So PV technology is at a point where we can make and deploy as much as we can afford. The problem is the high cost of the resulting electricity, especially if you count the costs of intermittency and storage, is just too much money for economies to sustain. StratoSolar is only PV in a new location. It reduces the cost of resulting PV electricity to market competitive levels and increases the reliability of the supply. There is no new technology or resource that limits its ability to scale. If it is proven viable, the major thing that needs to scale is PV manufacturing, the thing that has already demonstrated scalability. This is a lot like computers in the late 1980s. A large CMOS semiconductor manufacturing business had matured and companies like Sun Microsystems that built computers based on this technology rapidly scaled to volume in the millions. This pattern repeated itself for PCs in the 10s to 100s of millions and recently for mobile phones in the billions, as the cost of computers reduced with volume over time. The common elements are ability to scale supply and an affordable product with sufficient demand to match the supply. From an investment perspective the risk is like betting on a Sun Microsystems. They had engineering and market risk, but they were fundamentally enabled by available semiconductor technology. They were small investments in small teams that integrated existing technologies to build new products for very large new businesses. The market demand they produced could be met by the scalable semiconductor supply. Similarly, StratoSolar can create a demand that can be met by a scalable PV semiconductor supply. It’s continuing the triumph of the semiconductor age. by Edmund Kelly

It's a while since I discussed the topic of subsidies. It's a difficult topic to understand, and usually provokes defensive reactions from solar energy supporters.

This recent interview with Shyam Mehta, a GTM PV researcher provides good current information and perspective on the PV business.

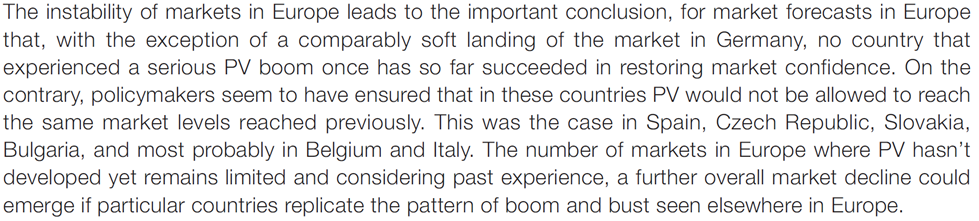

As can be seen from the chart, there were dramatic changes in the composition of PV demand from 2012 to 2013 but no overall growth in volume or revenue. Basically the PV demand went to markets where there were new or growing subsidies and left markets where subsidies declined. Overall, China probably adjusted its subsidies upward mostly to ensure their PV industry survived the drop in European demand driven by the drop in European subsidies.

This is not a well behaved or predictable market. The predictions are totally dependant on predicting subsidies. The GTM forecast is predicting that Europe will regain an appetite for increased subsidies in 2015 and beyond. Its hard to know what the basis for this is. The predicted growth in the US is based on the subsidies that are in place remaining until they diminish in 2016, when US demand is predicted to drop about 50%. The biggest unknown is Asia. Japan's commitment to expanding PV seems pretty solid at least for a few years. China's demand is hard to predict. If it mostly depends on propping up the local PV business they don't have much need to increase demand substantially going forward. Overall it seems a bit optimistic to be predicting an average 20% PV market growth over each of the next two years. Long term, subsidies would be required to grow substantially to maintain a 20% growth rate, which could see prices halve by about 2025, and the cost of subsidies leveling off. A rough estimate of the PV market in 2013 is 30GW, worth about $90B of which $50B is subsidies. If PV prices have stabilized, growth of 20%/y implies growth in subsidies to around $100B in 2017. For the US the 2013 PV numbers are about 4GW installed, worth about $12B, of which about $7B is subsidies. The projected growth implies about $14B in PV subsidies by 2016. That's about the entire alternative energy subsidies in 2013, so it will be noticed. What is the appetite for subsidies? The US spent about $150B from 2008 to 2013, or $30B/y. A lot of that was ARRA one time expenditures. 2014 subsidies are projected to total about $12B. Solar is taking more of the pie. The current US congress would not be predicted to increase alternative energy subsidies, and could easily cut them. This is all rather long winded, but the bottom line is the PV market size is completely defined by subsidies and projecting PV growth means realistically projecting increased subsidies. Given the pain level associated with today’s subsidy levels, (witness Germanys's pullback) its difficult to see significant increases in world total subsidies to the level necessary to sustain substantial PV growth. By Edmund Kelly A simple question is why can’t ground PV do the same thing as the StratoSolar scenario? The simple answer is it is too expensive and it won’t get cheap enough anytime soon. The sharp drop in PV prices over the last few years have stopped, and there is no rational basis for them to fall further for a long time. A good thing about the recent price drops is it has raised awareness of PV and its potential for further improvement. A bad thing is it has created over optimistic and unrealistic assessments of PV’s chance to be a significant energy provider in the short term.

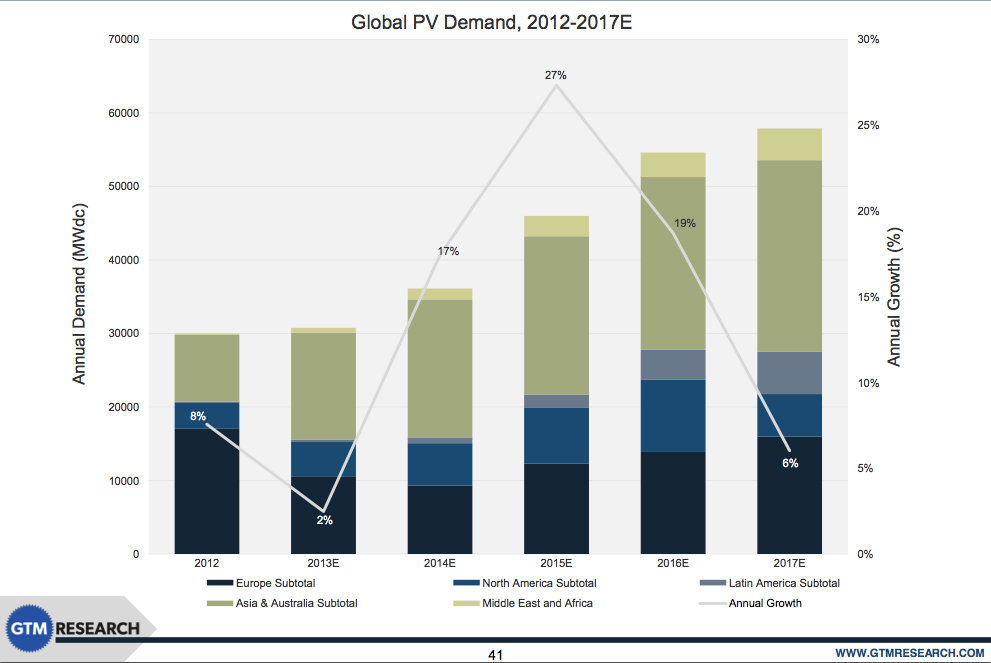

In the end, energy is all about politics and economics. StratoSolar PV panels have an average utilization of 40%. Ground PV panels have an average utilization of about 13%. Based on a simple analysis, ground PV electricity costs three times as much, and importantly this is significantly more than electricity costs today. That means that it can only be sold with the help of subsidies. As Germany has demonstrated, profitability drives investment. By providing subsidies that guaranteed profitable investment, German private industry jumped at the opportunity and installations grew very rapidly. Japan and China are following Germany’s lead. But things are actually worse than this. Its always tempting measure solar with the best utilization from sunny places, but unfortunately with solar its all about geography. There are very few places with good solar near population centers. Southern California is a rare example. Take Germany as a more representative example. PV utilization in Germany is around 11% from the published data. Germany could do a deal with a sunny location and build HV transmission lines to transport the power. This has numerous problems. On purely money terms, as panels have reduced in cost, and transmission lines have not, its likely that the better PV utilization in the desert will not cover the HV transmission costs. Don’t forget that the transmission lines will have the low PV utilization, which more than doubles the cost compared to conventional HV transmission lines. On top of this are the political constraints. HV transmission lines are not liked, and the countries where the panels and HV transmission lines are placed may not be the most politically stable. Even in the US, politics and economics will favor New York, for example, building in New York rather than dealing with getting power from New Mexico via transmission lines through many states. What this means is that ground PV discriminates, and northern climes get to pay twice as much, or more for electricity. Economics will also dictate that southern climes will get most of the synthetic fuel business. Because of the lower utilization, ground PV electricity will always cost 3X StratoSolar electricity. This factor makes StratoSolar economic for electricity, and then fuels long before ground PV. The learning curve is good but not that good. The learning curve will not continue for ever, and when it slows it will create a permanent cost barrier that ground PV will never overcome. StratoSolar is far less variable with geography, so Germany or New York, for example could provide all their energy needs, both electricity and fuel, locally. So to summarize, ground PV is too far from viability today, and too variable with geography to ever be an easy political choice. StratoSolar is viable today, and does not discriminate against geography. The StratoSolar capital investment for both PV plants and synthetic fuel plants will average a sustainable $0.6T/year, in line with current world energy investment. $2T/year capital investment for ground PV is a lot harder to imagine. By Edmund Kelly Analysis of the PV market in 2012 have continued to roll in. They vary considerably in their estimates of PV capacity installed, several estimating capacity installed exceeded 30GWp. A recent report from NPD Solarbuzz was less optimistic. According to the market research firm, PV demand in 2012 reached 29GW, up only 5% from 27.7 GW in 2011. Notably, the growth figure is the lowest and the first time in a decade that year-over-year market growth was below 10%..“During most of 2012, and also at the start of 2013, many in the PV industry were hoping that final PV demand figures for 2012 would exceed the 30GW level,†explained Michael Barker, Senior Analyst at NPD Solarbuzz..“Estimates during 2012 often exceeded 35GW as PV companies looked for positive signs that the supply/demand imbalance was being corrected and profit levels would be restored quickly. Ultimately, PV demand during 2012 fell well short of the 30GW mark.†As usual, the industry and analyst projections going forward are for things to improve dramatically. A more sober analysis would say that the market will continue its painful restructuring with slow to modest growth. The analyses tend to focus on GW installed but a look at the dollar numbers is more revealing of the state of the industry and its likely future. This graph shows a simple analysis of relevant dollar numbers rather than GW installed numbers for 2010, 2011,2012 and an estimate for 2013 based on a forecast of an increase of 20% in GW installed, which may be optimistic.

The Total line shows the total world dollars spent on PV systems, which includes PV panels and Bulk of Systems (BOS). This line has been relatively constant at between $50B and $60B. Over this timeframe the combined reduction in panel and BOS costs has offset the decline in subsidy. The panel line shows that revenue to PV panel makers has been declining significantly. The increase in GW has not offset the fall in PV panel prices, and the revenue decline will continue in 2013. As is known the PV panel business has a capacity to produce about 60GW/year, but demand is about 30GW/year. This has led to severe industry restructuring and low panel prices that in many cases are below the cost of production. There is no new investment in capacity, so the current panel prices are unlikely to fall significantly if most manufacturers are already losing money. The subsidy line shows an estimate of the amount of total world subsidy. This, as is well known has been declining, but the decline has been dramatic. Germany alone pumped in over $100B over 2009-2011, but is now well below $10B/year. China has stepped in energetically, and there is support in Japan and the US, but it still only adds up to half of what Europe used to support, and the overall subsidy amount continues to decline. The PV business is still driven by subsidies. They have declined from about 60% to about 40% of the business, but are still necessary, as current PV systems do not make electricity at competitive costs despite the dramatic PV panel price decline. The overall net effect of panel price declines and subsidy declines has been a market with fairly constant overall revenue. If worldwide subsidies increased that would drive growth which would use up the excess panel manufacturing capacity which would lead to profit and investment in new more efficient capacity and panel price declines that would reduce the need for subsidy. If subsidies continue to decrease, there is little room for PV-panel prices to decline further, and so the overall business will shrink. None of this is coordinated at a world level, so it could go either way. The prospects for increased subsidies overall worldwide seems low, given the current economic focus on austerity in Europe and the US. This has been a long article to get to the simple conclusion that the PV business is unlikely to grow dramatically in the near future and current PV panel prices are likely to prevail for at least several years. Also, optimistic projections for PV panel price reductions based on projecting the recent dramatic drop forward are not realistic, and estimates based on the historical long term trend are likely to prove more accurate. PV at around 30GW/year installation is a tiny fraction of world electricity generation (5000TW), never mind world total energy. The only way to get a dramatic growth in PV is to either get PV to produce electricity at a cost that generates sufficient profit to attract private investment, or massively increase world subsidies. StratoSolar offers the profitable investment path. Our current design if deployed today with current PV cells would generate electricity for $0.06/kWh with very conservative platform cost estimating. This is profitable without subsidy in almost all markets. By Edmund Kelly Now that 2012 is behind us it is useful to see how things have worked out in the PV market during 2012 and how they look going forward.

As my early 2011 blog posts predicted, there was little growth in 2012 over 2011. The overall GW installed in 2012 grew slightly over 2011 (from 27GW to about 29GW), largely because Germany installed 7.5GW, as opposed to their 3.5GW goal. The overall dollar size of the PV panel market shrank by about 50% as industry consolidation drove panel prices down to around $0.70/Wp and installed utility projects to about $2.40/Wp in the US. Projections going forward are for about a 20% annual increase in installed capacity. Panel prices will stabilize somewhere between $0.70 and $1.00 as the shakeout continues into 2013 and then slowly decline from there in future years as the installed capacity grows. This leaves prices still too high to compete without subsidies even in the best sunny locations. This means the market size is still determined by the amount of subsidy, which with reducing subsidies explains the modest growth projections (China and Japan are exceptions). PV has yet to become a significant % of the grid in any geography, so as yet additional costs for backup and transmission are not being counted. This will change going forward and act as a further brake on possible PV growth. Green advocates like Greenpeace need to become more realistic in their assessments. Current wind and solar will not make a significant impression on CO2 reduction before 2035 and currently could easily be adding to CO2 rather than reducing it. The impact is so small as not to be measurable in the current atmospheric CO2 levels. Unrealistic optimistic wishful thinking are damaging the prospects for any meaningful policy to reduce CO2. NREL and other researchers bring out studies that purport to show that the world could adapt to run on mostly wind and solar, but don’t spell out the costs. More importantly in a world where the US is a decreasing influence on energy and everyone has to act together, what the US does alone is increasingly irrelevant. As I keep repeating, a PV solution that enables today’s PV cells to produce cost competitive electricity without any subsidy, eliminates reliability and backup costs and long transmission lines, and does this for all geographies including cloudy and/or northern locations deserves some consideration. By Edmund Kelly Germany has acted sooner than expected and more agressively than expected in cutting PV subsidies. Link |

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed