|

Thisarticle in Renewables Energy Focus magazine provides more details on the state of the PV market as companies report their earnings. SPV Market Research puts the PV panel market in 2012 at 25GWp and $20B. Panel maker losses exceed $4B. This comes as Suntech the number six PV panel manufacturer declares bankruptcy.

2013 is not shaping up as much better than 2012. Major shifts in regional demand are underway, driven by where the subsidies are growing or declining. European demand is shrinking with reduced subsidy, but China has a profitable FIT and a goal of 10GW, and the generous FIT in Japan is projected to see 6GW installed. The Japanese growth will be met by Japanese panel makers despite their lack of market competitiveness, which may not help the PV business generally. Current panel prices combined with subsidies are also driving growth in the US(primarily California), which may see 5GW installed in 2013. The story is the same everywhere. Subsidies drive the market, and their amount determines the market size. The overall PV market is not likely to grow significantly in 2013 over 2012. As prices stabilize, and even rise a bit to restore profitability, the historical learning curve of PV panel price versus cumulative volume is still holding up very well. This is important to understand as it establishes the realistic fundamentals that should drive expectations for what can be achieved by PV. There has been a tendency to take an optimistic view of PV competitiveness based on extrapolating short term trends, or localized successes (like Germany) driven by large subsidies. PV has made great strides, but is still only competitive with a large subsidy in normal geography, or with a smaller subsidy in a sunny geography like California. The historical learning curve will take many years of current production rates to get PV panel prices down to competitive levels. To put things in perspective, PV on a world average has less than a 15% utilization. StratoSolar is 40% utilization on average. For ground PV panels to match StratoSolar, prices will have to more than halve from current levels to about $0.30/Watt. This will take a long time, perhaps decades. It’s a catch 22 for ground PV. Prices will only fall with volume, but volume will only happen with lower prices. StratoSolar competitive energy pricing has the potential to fundamentally change the energy market by driving PV volume installation now. By Edmund Kelly

Comments

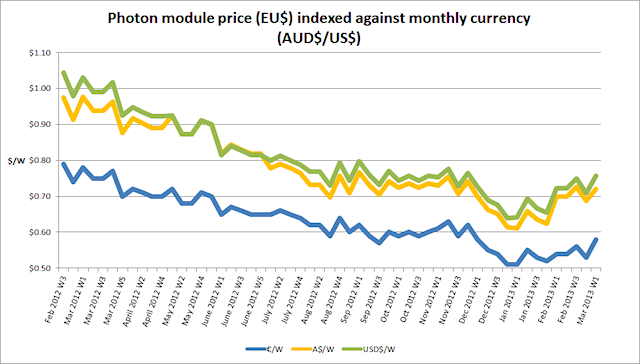

As I have repeated a few times, PV panel prices cannot keep falling. It seems there is evidence that prices have started to go up. Below is a graph from a blog article from Nigel Morris at this site. The $0.70/Wp price point seems to have been restored. Its early days, earlier than I would have expected, but may indicate that enough of the excess capacity has been worked off to where the big players can exert some control on prices.

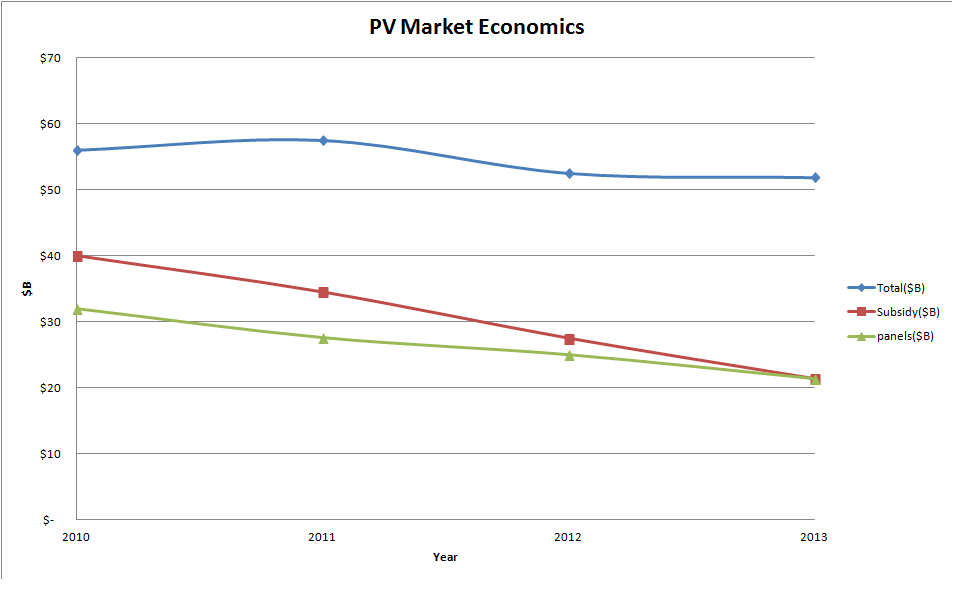

Update 03/07/2013 Another report showing PV panel and cell prices stabilizing, this one showing $0.60/W in China. http://www.enfsolar.com/news/Chinese-Panel-Manufacturers-%E2%80%93-1.6GWp-of-2012-Stock-Unsold By Edmund Kelly Analysis of the PV market in 2012 have continued to roll in. They vary considerably in their estimates of PV capacity installed, several estimating capacity installed exceeded 30GWp. A recent report from NPD Solarbuzz was less optimistic. According to the market research firm, PV demand in 2012 reached 29GW, up only 5% from 27.7 GW in 2011. Notably, the growth figure is the lowest and the first time in a decade that year-over-year market growth was below 10%..“During most of 2012, and also at the start of 2013, many in the PV industry were hoping that final PV demand figures for 2012 would exceed the 30GW level,†explained Michael Barker, Senior Analyst at NPD Solarbuzz..“Estimates during 2012 often exceeded 35GW as PV companies looked for positive signs that the supply/demand imbalance was being corrected and profit levels would be restored quickly. Ultimately, PV demand during 2012 fell well short of the 30GW mark.†As usual, the industry and analyst projections going forward are for things to improve dramatically. A more sober analysis would say that the market will continue its painful restructuring with slow to modest growth. The analyses tend to focus on GW installed but a look at the dollar numbers is more revealing of the state of the industry and its likely future. This graph shows a simple analysis of relevant dollar numbers rather than GW installed numbers for 2010, 2011,2012 and an estimate for 2013 based on a forecast of an increase of 20% in GW installed, which may be optimistic.

The Total line shows the total world dollars spent on PV systems, which includes PV panels and Bulk of Systems (BOS). This line has been relatively constant at between $50B and $60B. Over this timeframe the combined reduction in panel and BOS costs has offset the decline in subsidy. The panel line shows that revenue to PV panel makers has been declining significantly. The increase in GW has not offset the fall in PV panel prices, and the revenue decline will continue in 2013. As is known the PV panel business has a capacity to produce about 60GW/year, but demand is about 30GW/year. This has led to severe industry restructuring and low panel prices that in many cases are below the cost of production. There is no new investment in capacity, so the current panel prices are unlikely to fall significantly if most manufacturers are already losing money. The subsidy line shows an estimate of the amount of total world subsidy. This, as is well known has been declining, but the decline has been dramatic. Germany alone pumped in over $100B over 2009-2011, but is now well below $10B/year. China has stepped in energetically, and there is support in Japan and the US, but it still only adds up to half of what Europe used to support, and the overall subsidy amount continues to decline. The PV business is still driven by subsidies. They have declined from about 60% to about 40% of the business, but are still necessary, as current PV systems do not make electricity at competitive costs despite the dramatic PV panel price decline. The overall net effect of panel price declines and subsidy declines has been a market with fairly constant overall revenue. If worldwide subsidies increased that would drive growth which would use up the excess panel manufacturing capacity which would lead to profit and investment in new more efficient capacity and panel price declines that would reduce the need for subsidy. If subsidies continue to decrease, there is little room for PV-panel prices to decline further, and so the overall business will shrink. None of this is coordinated at a world level, so it could go either way. The prospects for increased subsidies overall worldwide seems low, given the current economic focus on austerity in Europe and the US. This has been a long article to get to the simple conclusion that the PV business is unlikely to grow dramatically in the near future and current PV panel prices are likely to prevail for at least several years. Also, optimistic projections for PV panel price reductions based on projecting the recent dramatic drop forward are not realistic, and estimates based on the historical long term trend are likely to prove more accurate. PV at around 30GW/year installation is a tiny fraction of world electricity generation (5000TW), never mind world total energy. The only way to get a dramatic growth in PV is to either get PV to produce electricity at a cost that generates sufficient profit to attract private investment, or massively increase world subsidies. StratoSolar offers the profitable investment path. Our current design if deployed today with current PV cells would generate electricity for $0.06/kWh with very conservative platform cost estimating. This is profitable without subsidy in almost all markets. By Edmund Kelly |

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed