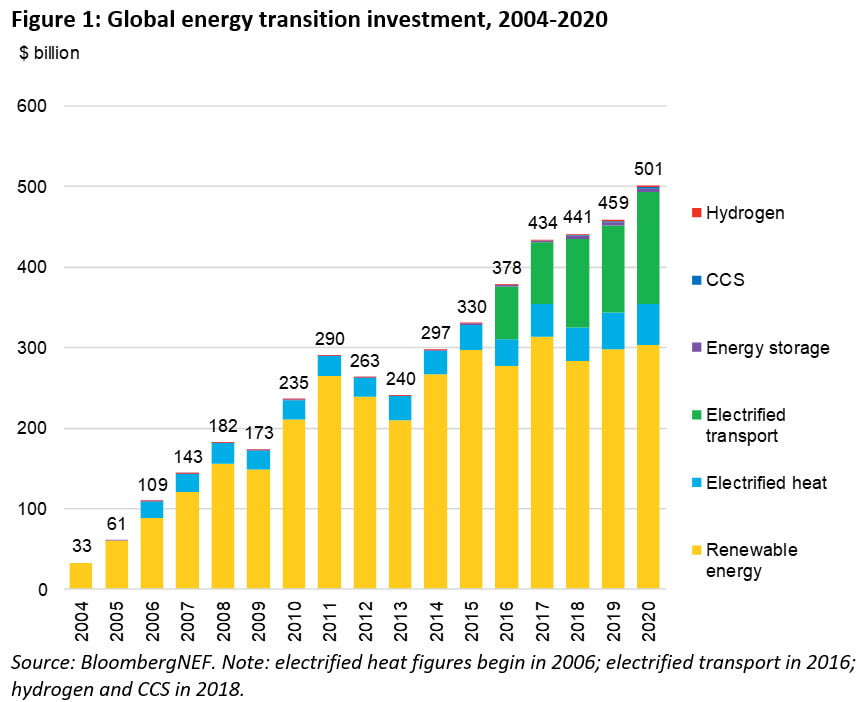

Bloomberg is broadening their clean energy investment survey to cover more than energy generation as shown in the latest graph covering up to the end of 2020 above. The yellow is the clean energy electricity generation component they have covered in the past. As can be seen, clean energy generation for 2020 is substantially unchanged from 2019. Clean energy investment has been substantially constant between $250B and $300B since 2011. This article covers things in more detail. In 2020 China and the US were down while Europe as a whole was up. Previously China was up and Europe was down. These changes are always directly related to policy and subsidy changes in each geography but the overall investment stays the same The bottom line is the world is not increasing its commitment to clean energy and at current levels of investment clean energy will not be significant until the end of the century, not 2040 as is the goal of many countries. The current investment limit is bounded by government support. To increase investment requires stand alone generation that can replace fossil fuel generation at a lower competitive cost without the limit of government support. Because intermittent generation relies on government mandates as well as subsidies, an investment is a complex and high risk venture that does not fit a market based model. The cost of intermittent generation does not reflect the increased price it brings to electricity consumers. This price is a result of the energy generation system as a whole becoming less efficient as it tries to adapt to intermittent generation. These inefficiencies grow exponentially as more intermittent generation is added to the grid and are at the heart of the stagnation in clean energy investment. If clean energy were leading to lower electricity prices, market forces would increase demand. This clearly is not happening. Stratosolar represents a path out of this quagmire but to get out of the quagmire there first has to be an acceptance that there is a quagmire. The investment data clearly demonstrates a quagmire but we seem to have the blind leading the blind into a fantasy future. Falling capital costs enabled record volumes of both solar (132GW) and wind (73GW) to be installed on the basis of the modest increase in dollar investment. This is roughly 200GW.

Total world energy demand is heading for around 30 TW by 2050 or about 1TW average new generation per year. This means that current generation alone is one tenth what is needed without adding in storage, transmission and other costs. Venture capital and private equity investment in renewables and storage increased 51% to $5.9 billion last year. Compare this to the $300B invested in wind and solar projects. Virtually none of this $5.9B was for new clean generation technology. This is the problem Stratosolar faces. There is no investment in new generation ideas. All the limited risk investment goes to storage and other status quo pursuits. By Edmund Kelly

Comments

|

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed