|

By Edmund Kelly

This article provides more evidence that the optimistic hopes for rapid growth in world PV installations seem to finally be running up against the economic and practical constraints. China in 2014 is a good example. China's PV goal for 2014 was 14 GW. It now appears actual installations will be about 10 GW (as was predicted earlier). In 2013 the bulk of PV installations in China were large utility scale. In 2014 they wanted to move the bulk to rooftop installations. This was motivated by growing electricity transmission bottlenecks. Rooftop installations don't need new transmission but take longer and are considerably more expensive than large installations. So China was caught between a rock and a hard place. Utility systems mean building lots of expensive long distance transmission that takes years and has political opposition. Rooftop PV is more expensive and less efficient and is also relatively slow to install. Neither option could meet the 14 GW goal. The projections for next year are also for 10 GW. That would be three years in a row at about 10 GW. This just adds one more piece of evidence to the case that none of today's carbon free energy technologies are practical or economically viable alternatives to fossil fuels. This includes wind, solar, hydro, bio and nuclear. All require government support to survive and governments cannot afford to support any or all of them at the significantly higher level needed to displace fossil fuels. The advocates of each technology are happy to take government subsidies and keep tilting at windmills as long as government keeps providing the subsidies. There are attempts at advanced versions of wind, solar and nuclear, but investment levels are miniscule. We are spending over $250B on installing clean technologies that cannot succeed, but investing a tiny fraction of that on R&D for technologies that might succeed. This is especially true for system solutions like Nuclear or large Solar. In part its because government is bad at and should not be involved in picking winners. Finding a structure to finance large scale energy R&D has proved elusive. It would take venture investments at a considerably larger scale than current venture capital funds can support. For a portfolio approach to work a fund would need maybe $100B to invest in maybe 100 ventures over maybe a decade. Given the scale of energy, one success would be enough.

Comments

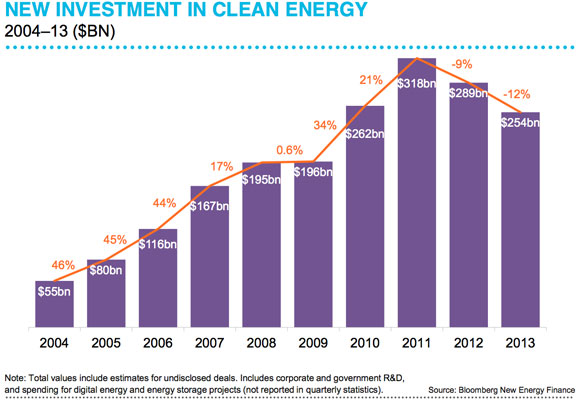

Clean energy investment likely to get limited support from growth of subsidies going forward11/23/2014 By Edmund Kelly World Renewable Energy Subsidies projected to grow from $110B in 2013 to $230B in 2030. Its interesting how the same information can be seen with very different perspectives. This article takes a positive spin, but growing from $110B to $230B in 15 years only represents a 5% annual growth rate. It is also very rare for articles to use the word subsidy. The word that is usually used is Policy. From the graph below, 2013 clean energy investment was $254B, of which PV accounted for about $110B. Subsidies were 110/254 or 43%. At 43% coverage, $230B of subsidies in 2030 will cover about $535B of clean energy investment. This 43% seems reasonable, as reducing costs for wind and solar generation will be offset by growing subsidies for energy storage and offshore wind costs. Numbers are numbing. These numbers seem large, but will only build a small amount of clean energy supply relative to what is needed to replace fossil fuels. The graph shows that clean energy investment has been in decline. The declines in 2012 and 2013 were due to diminishing subsidies. Reduction of one time American stimulus funds and the reduced FIT subsidies in Europe. China, and Japan have dramatically increased subsidies recently which seems to have stopped the decline. 2014 is predicted to about match 2013 at about $250B.

Given the general stabilization in investment since 2009 and the strong dependence on the amount of subsidy, to predict high growth means predicting higher levels of subsidy. US subsidies will almost certainly decline in 2016. Europe's recession, Japan's recession, and China's slowdown don’t bode well for increased subsidies. The projected 5% annual growth in subsidy and by inference in clean energy investment seems realistic when taken in perspective. This is not a path to reducing fossil fuel consumption. By Edmund Kelly By Edmund Kelly

This article in Green World Investor discusses the current state of Polysilicon production. Solar Polysilicon prices have stabilized at $20/kg to $25/kg. The surviving Polysilicon vendors are making money at this price level and are investing in efficient new plants. High cost producers have exited the business. This points to health in the business as efficiencies are restoring profit margins and the viability of the poly producers. Its not clear if PV wafer and PV module vendors have similarly restored some level of profit. China has shown reluctance to let inefficient businesses fail. Many seem to be able to sell at cost, but are not repaying their debt. China invested over $50B in PV companies a few years back. This Poly pricing reinforces the reality of the last year which has seen PV panel prices stabilize at around $0.70/W. Historically the PV panel business has seen long periods of price stability and it is reasonable to expect current prices to persist for several years so long as supply and demand stay in balance. If China, Japan and the US maintain current subsidy levels, then this volume level should see PV panel prices slowly decline. The republican congress will probably let the PV investment tax credit expire in 2016 which will reduce US investment levels significantly. These price points are still far too high to compete with fossil fuels. The recent IEA 2014 roadmap is also in line with this assessment. PV may be on a path to be competitive on a LCOE basis in a decade or so, but backup, storage and transmission costs will still have to be accounted for. StratoSolar's 3X boost along with gravity energy storage would significantly alter this calculus for the better. |

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed