|

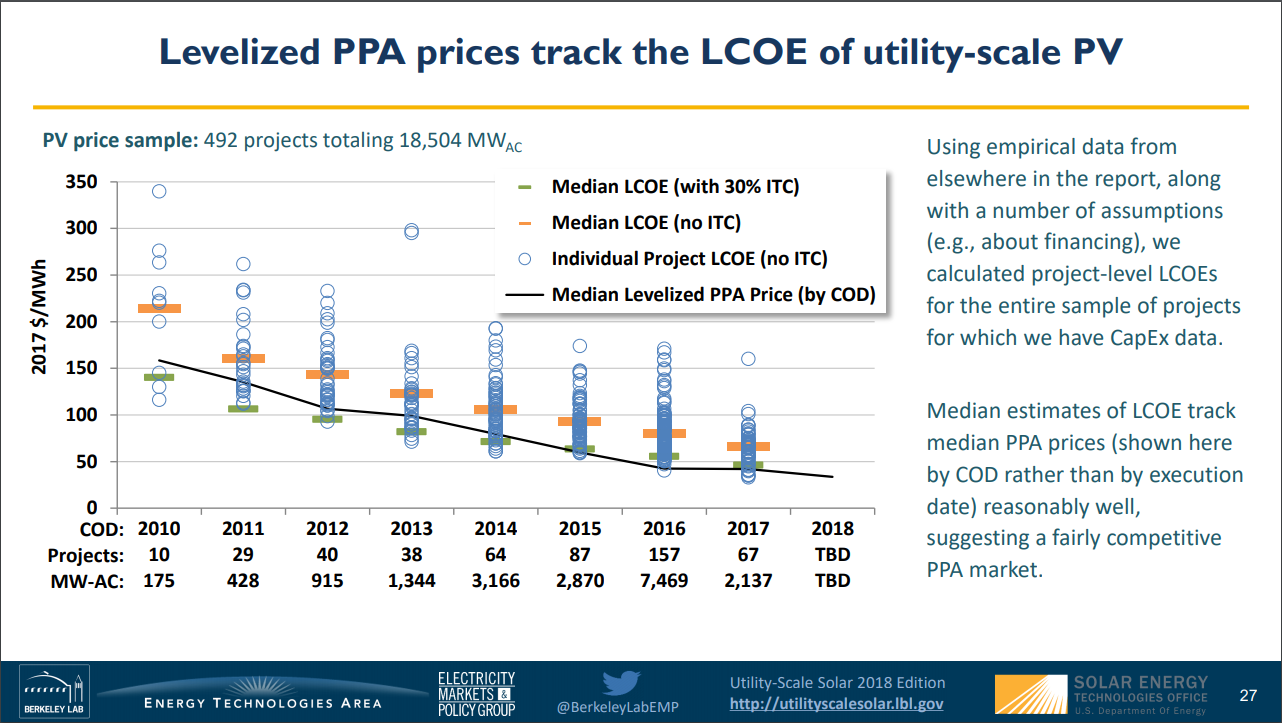

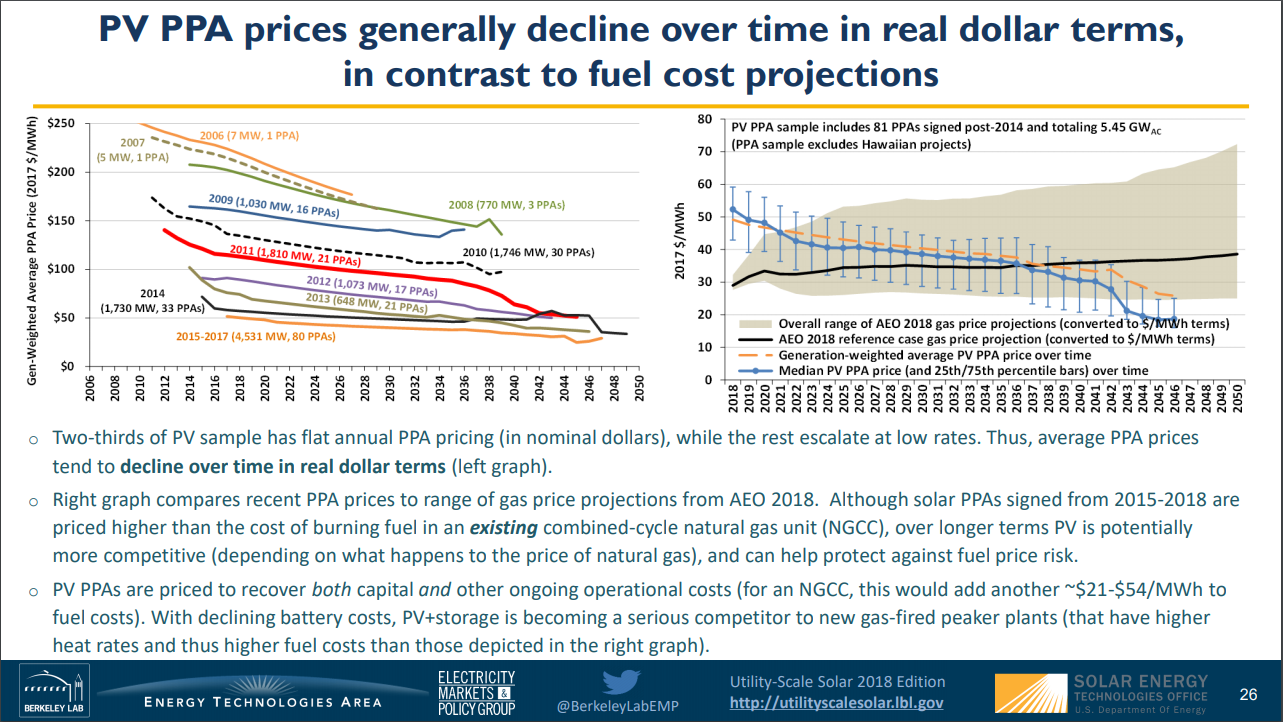

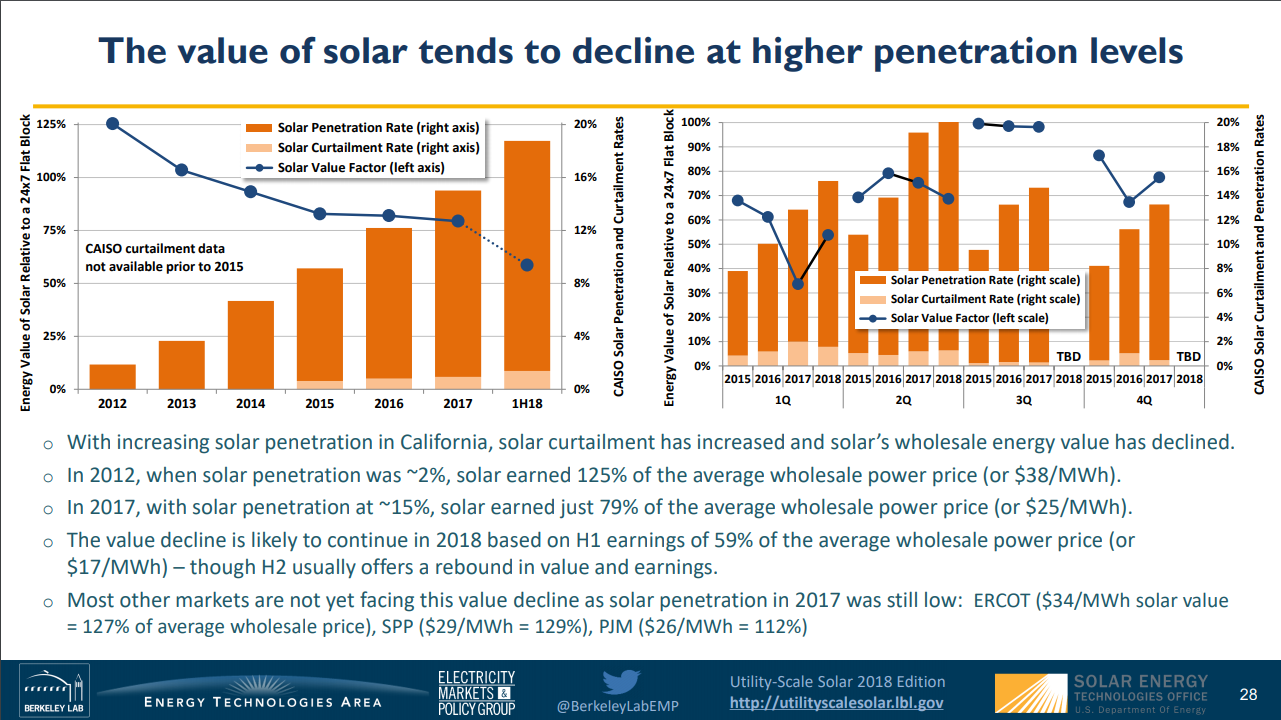

Ground based PV has three distinct problems that Stratosolar solves (cost, storage, backup). It has long been our observation that these problems with PV will be ignored until they become apparent as PV market penetration grows. This NREL report has data that shows that the problems are real and not just the prognostications of naysayers. The first problem is still cost. The NREL chart below shows the cost of utility scale PV electricity since 2010. It shows the dramatic drop in cost from around $0.15/kWh in 2010 to $0.038/kWh in 2018. However this low cost represented by the green bars is the subsidized cost. The unsubsidized cost represented by the yellow bars is about $0.06/kWh in 2018. This is still an impressive number but it is substantially higher than natural gas generation at around $0.03/kWh in 2018 as shown in the right hand graph in the following foil. PV has done very well but this data shows that it still needs subsidies now and for the foreseeable future to compete with natural gas. This contrasts with the growing optimistic press that claims that PV is cheaper than fossil fuels without subsidy. Were this true investment in PV adoption should be growing, but as previous posts have shown, PV investment is actually declining. When PV eventually becomes price competitive it will quickly face the next big problem. The following chart illustrates the problem that solar without storage can only supply a limited amount of electricity demand. It's common sense that solar cannot provide electricity at night, but it is not widely appreciated how little solar can provide before costs start to rise dramatically due to curtailment. Curtailment is where the electricity provided exceeds the current demand and has to be thrown away. As the chart shows, over a year there are lots of occasions where the solar electricity supply exceeds the current demand. This chart is for California which has the highest solar market penetration in the US. It shows how with a solar penetration of around 18% of demand, solar curtailment is about 1.5% or about 10% of the solar power supplied. When power is thrown away it devalues the total wholesale price of PV. As the chart shows, the price received actually reduced more than linearly from $0.038/kWh to less than $0.020/kWh. This means that PV investments are losing money. The California utility PV capacity factor averages around 25%. It's generally understood that the practical upper limit for PV market penetration is around the capacity factor percentage. California is now providing the evidence that curtailment is a real problem at relatively low penetration and that it is getting close to the limit of PV penetration without adding storage. This exposes the extension of the cost problem. Adding storage is adding cost. As the first paragraph shows, PV still has a cost disadvantage so adding storage makes this worse. This does not address the cost or availability of energy storage. The reality is that with the added burden of storage, to be competitive, PV is going to need subsidies for a long time.

When PV plus storage becomes price competitive it will face the third barrier of long duration intermittency. This requires backup to cover the 20% that cannot be provided by PV plus storage. This backup will have to be from natural gas until synthetic fuel is price competitive. This makes a 100% renewable energy solution very far in the future. With current PV technology, Stratosolar can generate electricity for less than $0.02/kWh without subsidy, lower than natural gas. With night-time storage from gravity or batteries for $100/kWh overall electricity can cost $0.030/kWh. Stratosolar does not need long term backup supply, so the natural gas generation can be completely replaced and generation will be 100% renewable CO2 free. This is a complete cheaper replacement for fossil fuels and no subsidies are needed. By Edmund Kelly

Comments

|

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed