|

I had thought that the PV business was stabilizing, but apparently the stiffening of the US tariff regime and presumably continuing declines in Europe have caused PV panel prices to soften on the spot market due to oversupply. This article paints a gloomy picture of the state of the PV business and discusses the possibility of a new wave of bankruptcies.

Comments

This report titled “Beyond Boom and Bust” , was published in April 2012 and I commented on it in this blog post. It was the work of several bodies and individuals, including the Brookings Institute. It argued that US clean energy policy was producing boom and bust cycles, but making no progress in reducing atmospheric CO2. They advocated a more results driven “technology led” policy. The recent EPIA report on PV market outlook for 2014 to 2018 had an interesting section that described the recent behavior of the PV market in Europe as a series of unsynchronized national boom and busts that were hidden by looking at the overall European market statistics. To quote from page 31: PV seems to have always and everywhere followed a path of governments introducing subsidies, investors responding enthusiastically producing a rapid growth boom. Governments then belatedly see the costs mount and reduce subsidies, causing a market bust. Then investor confidence is broken and difficult to restore. Europe has few countries that have not gone through this cycle. Europe has gone from being the biggest PV market to number three or four, with little sign of a likely recovery.

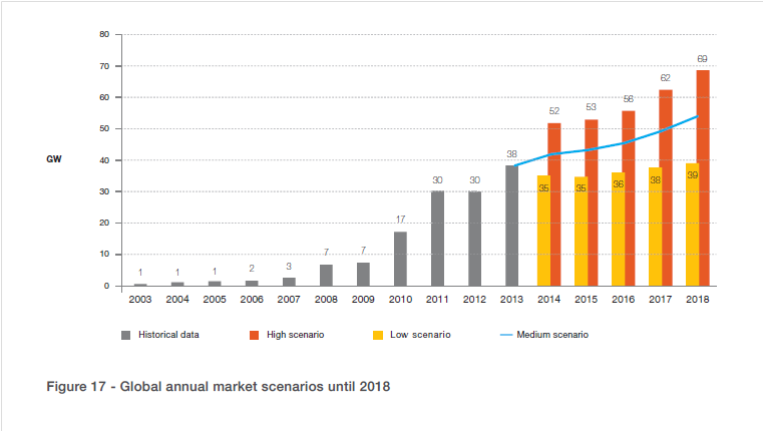

The recent US rapid PV growth is driven by US subsidies enabling profitable investment in PV. The expiration of the Investment Tax Credit in 2016 will burst this bubble, just like all the rest. The governments in Japan and China are early in the subsidy cycle so the boom phase is only building up. In a year or two the costs will be un-sustainable and the bust will inevitably follow. All of this makes it virtually impossible for PV to reduce in cost. Low and unpredictable PV market growth will not encourage investment in newer plant and equipment that can reduce costs. At current cost levels PV market cannot grow without more subsidies. As the boom and bust cycles clearly illustrate, more subsidy is unlikely to be forthcoming. As the “Beyond Boom and Bust” report argued, current US clean energy subsidy policies are not succeeding. They only considered the US, but as we can see, the problem is worldwide. Perhaps it is time to consider the “technology led” policy reforms they advocated. By Edmund Kelly This sixty page report EPIA Global Market Outlook for Photovoltaics 2014-2018 paints a pretty accurate picture of the recent history of the global PV market and has realistic projections for the near term. It has detailed information for each geography and market segment. The graph below from the report shows the near term overall world market projection with optimistic, pessimistic and realistic scenarios. The realistic middle scenario shows slow overall market growth, but no spectacular take off.

The conclusion of the report is a welcome return to reality about the future prospects for PV and a marked contrast to the over optimistic assessments that still seem to pervade the PV business. The central point of the conclusion is that “ The PV market remains in most countries a policy driven market, as shown by the significant market decreases in countries where harmful and retrospective political measures have been taken.” A policy driven market is a euphemism for a subsidy driven market. This lines up with my assessments of the prospects for PV business over the last several years as published in this blog. PV growing at this rate is fine for the PV business, but will not make PV a significant source of electricity anytime soon. It is not sufficient growth to drive costs down, so the business will need subsidy for the foreseeable future. The conclusion of the report backs this assessment as it clearly states that growth is dependent on “sustainable support schemes”. i.e. more subsidies. At some point those that promote current policies in the belief that they will reduce CO2 emissions have to stand back and make a realistic assessment of what they are accomplishing, or more accurately failing to accomplish. By putting all their eggs in the current wind and solar baskets, they are actually precluding investment in possibly better technologies. The psychology seems to be driven by a fear that admitting that current wind and solar are failing, will lead to nothing being done, and something is better than nothing. The reality is that investing only in failure guarantees failure. By Edmund Kelly If we focus on new electricity generation capacity worldwide a pattern emerges that somewhat explains the lack of progress on reducing CO2 emissions. New electricity generation investment is about $400B/y, $200B/y in wind and solar and $200B/y in coal, gas, nuclear and hydro. Another $300B/y is invested worldwide in electricity transmission and distribution.

Looking at how the investment is apportioned between countries, a convenient division is between OECD and non OECD. This is a pretty accurate division between developed nations and developing nations. Developed nations have a relatively low growth in overall electricity capacity, with most new generation replacing old generation. Developing nations are growing their overall electricity generation capacity at a rapid rate to balance their rapid GDP growth. Interestingly, from a dollar perspective OECD and non OECD spend about the same on wind and solar, about $100B/y. Developing nations spend most of the $200B/y that is spent on coal, gas, nuclear and hydro, over 66%. They also spend most of the investment for transmission and distribution, about 66% or $200B/y. Because of the rapid pace and large scale of development, developing countries follow a well proven path of investing in low risk, proven, safe, and cheap technologies. Developing countries account for the bulk of investment in electricity infrastructure: about $450B/y (200 T&D + 150 G + 100 A)of the $700B/y. (T&D is transmission and Distribution, G is conventional Generation and A is Alternative generation) All of the OECD invests about $250B/y (100T&D +50G + 100A). In the OECD, wind and solar investment exceeds other generation by a significant margin, but in the non OECD the ratio is reversed. We are at point where PV is still too expensive to compete without subsidies. So what do Europe and America do? Introduce tariffs to protect domestic producers from Chinese imports. This protection supports already inefficient subsidized industries. What is the incentive to reduce costs through innovation when profits are guaranteed and competition is blocked? PV at current price levels will not become a significant enough producer of energy to have any affect on reducing CO2 emissions. Perhaps rising PV prices will break the cycle of over optimism about PV and get some focus on investments that might lead to competitive, clean, sustainable sources of electricity. Investors in Solar projects in the US and Europe think it burnishes their image as responsible planet aware companies when all they are really doing is partaking in corporate welfare on a grand scale. Public funds are subsidizing half the costs of private PV investment and guaranteeing large profits. Their actions prop up inefficient PV industries who rely on subsidies and now protective tariffs. There is little incentive to lower cost to where the PV business can grow without subsidies and perhaps help reducing CO2 emissions. Solar investors are reinforcing the equivalent of fiddling while Rome burns. |

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed