|

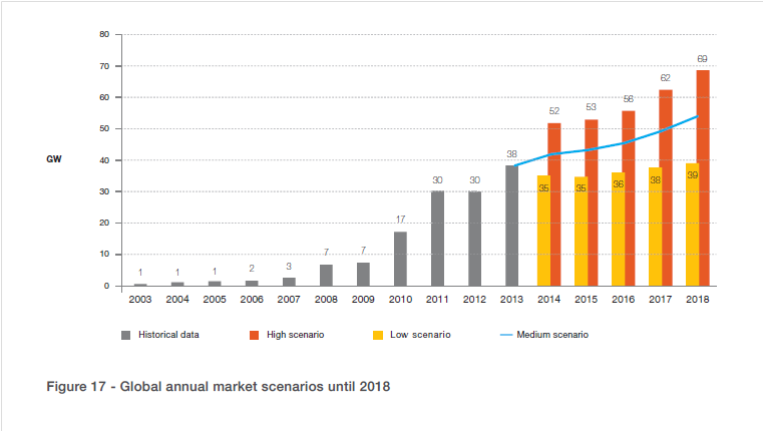

This sixty page report EPIA Global Market Outlook for Photovoltaics 2014-2018 paints a pretty accurate picture of the recent history of the global PV market and has realistic projections for the near term. It has detailed information for each geography and market segment. The graph below from the report shows the near term overall world market projection with optimistic, pessimistic and realistic scenarios. The realistic middle scenario shows slow overall market growth, but no spectacular take off.

The conclusion of the report is a welcome return to reality about the future prospects for PV and a marked contrast to the over optimistic assessments that still seem to pervade the PV business. The central point of the conclusion is that “ The PV market remains in most countries a policy driven market, as shown by the significant market decreases in countries where harmful and retrospective political measures have been taken.” A policy driven market is a euphemism for a subsidy driven market. This lines up with my assessments of the prospects for PV business over the last several years as published in this blog. PV growing at this rate is fine for the PV business, but will not make PV a significant source of electricity anytime soon. It is not sufficient growth to drive costs down, so the business will need subsidy for the foreseeable future. The conclusion of the report backs this assessment as it clearly states that growth is dependent on “sustainable support schemes”. i.e. more subsidies. At some point those that promote current policies in the belief that they will reduce CO2 emissions have to stand back and make a realistic assessment of what they are accomplishing, or more accurately failing to accomplish. By putting all their eggs in the current wind and solar baskets, they are actually precluding investment in possibly better technologies. The psychology seems to be driven by a fear that admitting that current wind and solar are failing, will lead to nothing being done, and something is better than nothing. The reality is that investing only in failure guarantees failure. By Edmund Kelly

Comments

|

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed