|

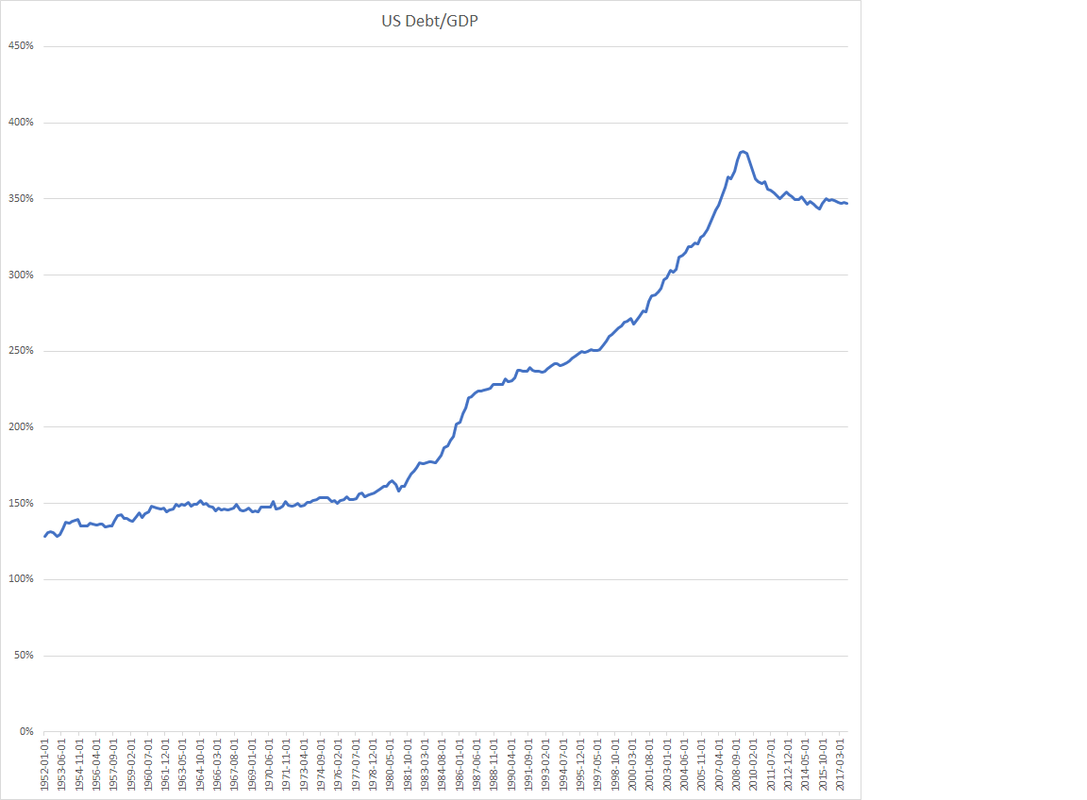

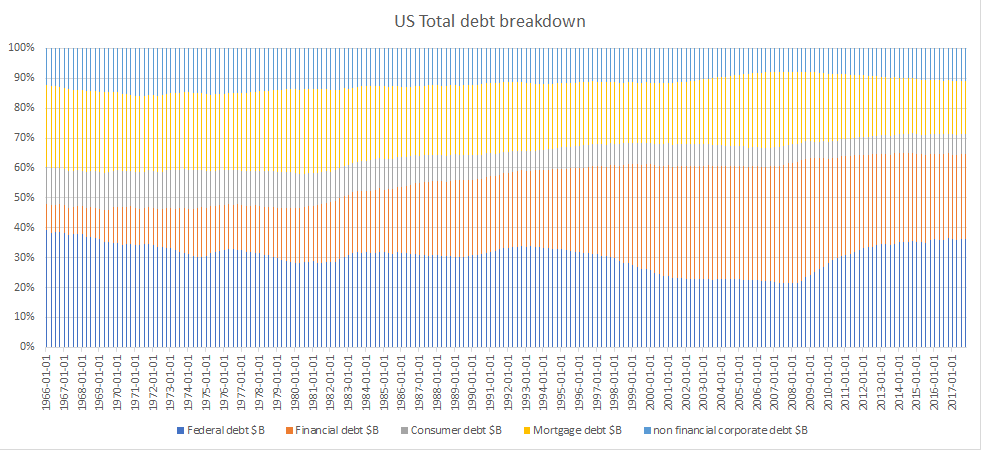

A few years ago I wrote a couple of blog articles on economic growth and inequality. Back then I mentioned a paper by Ray Dalio that discussed a simple model of the economy. Ray observed that the US economy goes through long term cycles where total US debt gradually builds up to unsustainable levels and then declines suddenly causing depressions. This happened in 1929 when total US debt reached 250% of GDP and then in 2008 when debt reached over 350% of GDP. However, as the graph above shows, after a brief decline in 2009 and 2010, US total debt has increased from $54T to over $70T and the debt/gdp ratio has stabilized at around 350%. It seems this level was manageable over the last decade because the fed kept interest rates very low and propped up asset prices with quantitative easing (QE). Dalio describes debt reduction as de-leveraging. It would appear that de-leveraging from the 2008 crisis has not occured. This disaster has yet to unfold. It seems hard to believe that after all the pain of the last decade that the debt problem still remains. The chart below shows the share of debt categories over time. After 2008, US government debt had to rise from 20% to 35% of total debt to deal with the great recession. Mortgage and consumer debt did decline from about 30% of total debt to 25% of total debt with massive foreclosures and layoffs. Financial system debt declined from about 40% to about 30% of total debt. Non-financial corporate debt has risen a few%. Debt at 350% of gdp is unstable and dangerous. So where in the current total US debt does the danger lie? There does not seem to be a housing bubble, and the federal government is still solvent. That leaves the non financial and financial sectors.

While the financial sector debt seems to have shrunk somewhat, it is an opaque sector with lots of debt in shadow banking and opaque financial instruments. QE has inflated all US asset classes, especially stocks and bonds. The corporate world has issued lots of junk bonds and borrowed a lot. Bond rating agencies have been raising red flags. Many corporations have been borrowing to remain alive. Pressure on debt is building from many directions. The fed stopped QE purchases and has been slowly raising interest rates. Oil prices are rising toward $100/barrel again. The probability of US economic slowdown seems more and more likely every day. Emerging markets are in trouble due to a stronger dollar. Financial troubles in Turkey, Venezuela and Argentina are in the headlines. Italy in the hands of right wing populists poses potentially severe systemic risks to European and US banking. Some combination of events will likely trigger a sudden US stock market decline which in turn could expose over leveraged investors and begin the positive feedbacks that exposes more bad debt and leads to major corporate defaults. This was the path followed in the great depression in 1929. Once the real economy is in decline, deleveraging is inevitable and the Fed has fewer tools to deal with a harder problem than 2008. On top of that throw in Trump and his dysfunctional administration and there is ample reason to be concerned. By Edmund Kelly

Comments

|

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed