|

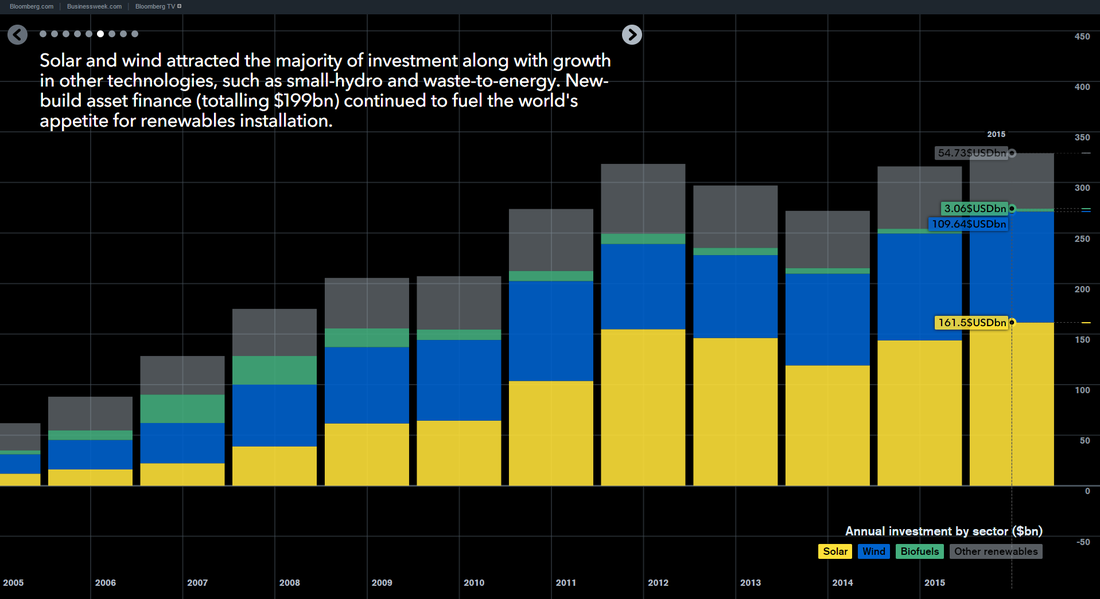

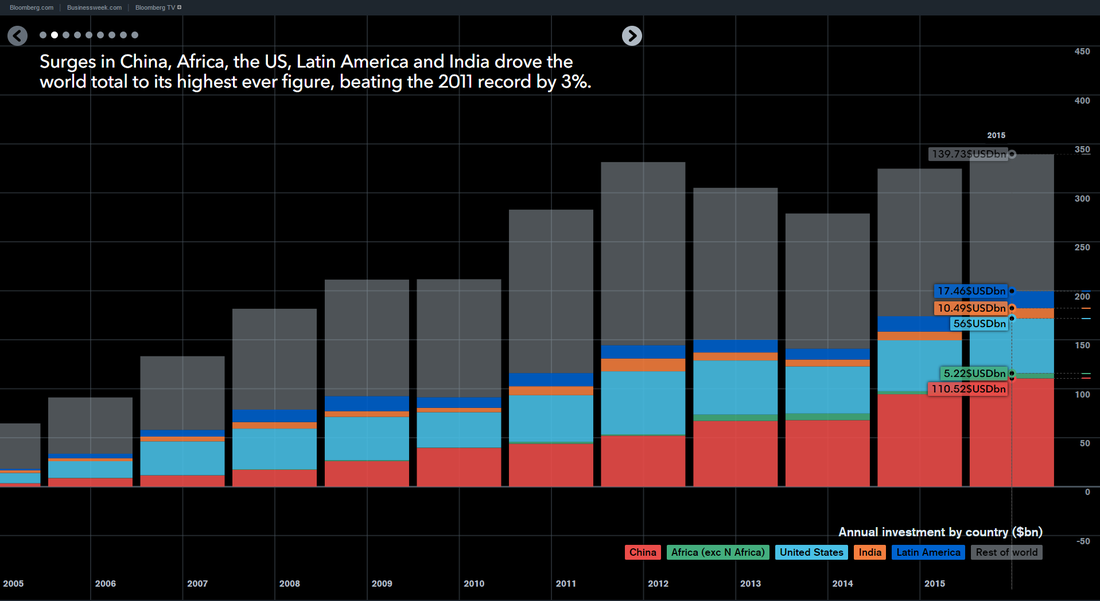

Bloomberg came out with a 2015 update to their report on world investment in clean energy. Above are a couple of charts showing the overall investment by type and by region. Total investment rose slightly (3%) over 2014 to $328B of which $161.5B or 50% went to solar. The overall investment level has not changed significantly for the five years, 2011 to 2015. Over this period solar has stayed about the same percentage of clean energy investment. Annual solar capacity has grown from 25GW to over 50GW, so the average cost of solar has dropped significantly from about $6.40/W($161/25) to $3.20/W($161/50), moving solar closer to wind in cost. PV panel costs have not declined much over this period ( after a dramatic decline around 2011) so most of the solar cost reduction has been from the rest of the system. The rate of these system cost reductions is slowing. The overall world average cost covers a very wide range of systems, from high cost rooftops over $6.00/W to very large utility arrays at less than $1.50/W, along with large regional differences in labour and regulatory costs. As the regional market chart shows, there has been a significant change in where the investments are taking place over the five years. The two biggest trends were the decline of Europe and the rise of China. Without China’s decision to dramatically increase its clean energy investment in 2014 and 2015, the overall market would have declined every year from 2011. Despite dramatic reductions in price, investment in solar has hardly increased. This tells us that solar investment is not yet driven by market forces. The price will have to fall substantially from current levels for solar to become market competitive. Overall the charts present a picture of a stagnant clean energy market. Given the need for government support to maintain the market, the world economic slowdown does not bode well for growth in the clean energy market, particularly in China. Despite its greater than $300B/y size, the current clean energy market is not reducing CO2 emissions by any noticeable amount. Based on these charts it is not on a path to do any better. There is a need for a change. StratoSolar makes today's PV a practical replacement for fossil fuels. Its an incremental improvement of PV, not a dramatic revolutionary new technology. It is easy, quick and cheap to prove its viability. The path we are on is clearly not working. It is worth giving StratoSolar a try. By Edmund Kelly

Comments

The attached white paper is a more comprehensive look at the impact of higher energy costs on reducing GDP growth. This tells us two things. First, we are in serious economic trouble already with a low and declining rate of economic growth from the continually increasing cost of fossil fuels. Second, replacing fossil fuels with more expensive alternative energy sources will only make the problem worse. So far, wind and solar have been a relatively small economic factor, but growth to a level where they can contribute to a significant reduction in CO2 emissions would quickly get us into economic decline, and the political unrest that comes with economic decline. StratoSolar's lower cost of energy production than fossil fuels can reverse the current decline in the rate of economic growth by making energy cheaper on a continuing basis. By Edmund Kelly

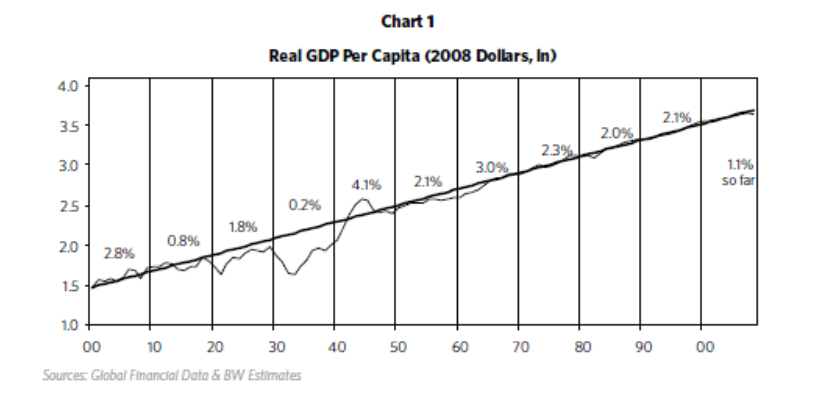

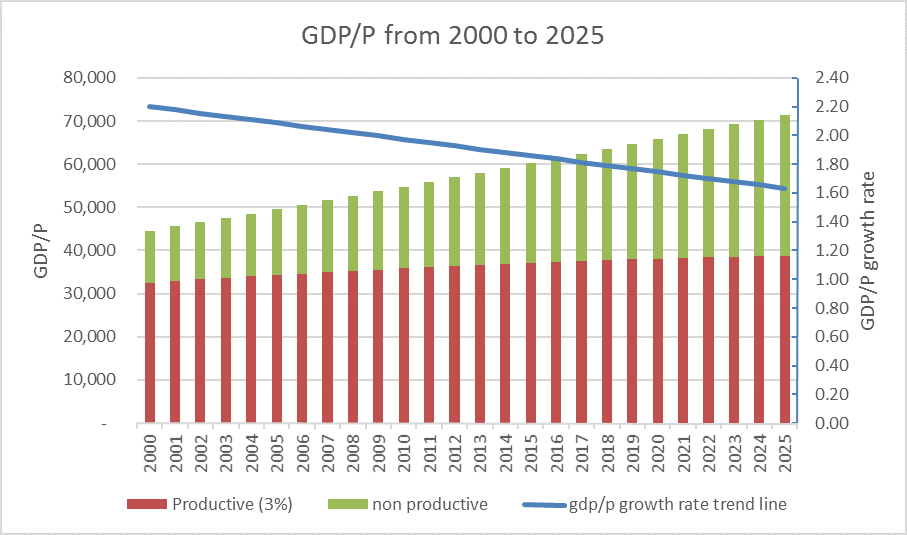

An argument against large scale deployment of alternative energy is the negative impact of the higher cost on gdp growth. The following is an attempt to quantify this effect based on the increasing cost of energy since around 1970. The modern world is based on sustained economic growth. As the chart below shows, US real gdp per capita has maintained an overall 2% per annum growth rate through depression, recessions and two world wars. This has been possible because of technological advances increasing the productivity of all economic sectors. Since around 1970, the cost of producing energy has steadily risen. Initially this was driven by the increasing cost of oil production, and more recently the cost of expensive alternative energy production has also become a significant factor. Energy is a significant part of gdp, so its share growing from around 5% to around 10% of gdp should clearly have been a drag on the growth rate of gdp, reducing it from its long term 2% per annum historical trend. When we examine US GDP growth rate data for various periods from 1960 to today, regardless of the period chosen it is apparent that growth rates have been on a steadily declining trend. The straight line in the graph below shows a snapshot of the actual downward trend from 2000 to 2015 projected forward to 2025. The colored bars also illustrate a simple model that assumes the economy has two sectors. One sector has a high productivity growth rate of 3% and the other sector is stalled out with 0% productivity growth rate. To make the numbers fit the data we need to start with the non productive sector at 25% of GDP. This produces a breakdown like that shown, with the non productive sector continually increasing as the overall growth rate declines. These numbers imply that a larger sector of the economy than just energy is contributing to the recent decline in economic growth rate. Increased energy costs account for about a third of the decline by 2015. The other likely contributors to low growth rate are substantial parts of the financial sector, health care and education. This reduced rate of overall economic growth is causing severe economic problems already, with income inequality and stagnant wages. The problems will only get worse if the growth rate continues on its current downward trend. This illustrates that economic growth is a sensitive thing that cannot survive a large part of the economy becoming less productive. This should make it clear that a competitive, lower cost source of clean energy is a necessary condition for an energy transition that does not destroy economic growth. Current wind and solar are currently several times the needed lower cost and are reducing in cost at too low a rate to be an affordable solution for a long, long time. Other approaches like StratoSolar that can solve the problem without destroying the economy deserve some serious attention.

This white paper covers the topic of the reduction in economic growth caused by the increasing cost of energy.

By Edmund Kelly The UN climate change conference in Paris starting today (Monday 11/30/2015) has focused attention on the CO2 emissions issue The politics is focused on what can be achieved politically, which is non binding commitments to reduce CO2 without specifics on how this will be accomplished. The conference has also prompted many articles and initiatives trying to leverage the publicity associated with the conference.

There are two related items that were specifically noteworthy. To coincide with the conference The Economist magazine has just published a 16 page report on climate change. This is a factual and pragmatic overview of the problem, the potential harm and the various approaches to solutions. The report summarizes the ineffectiveness of current subsidy policies, recognizes the political unlikelihood of a world carbon tax regime, and ends by advocating more investment in R&D. Also to coincide with the conference Bill Gates announced a grand coalition pledging $B to R&D in energy innovation. The breakthrough energy coalition is a collection of VCs, entrepreneurs and tech titans. Its not clear how much money is involved or how it will be spent. It may be good news for innovations like StratoSolar, though many of those in the coalition have rejected the idea in the past. Either way the beginnings of a broader focus on energy R&D is welcome. by Edmund Kelly Bill Gates is perhaps the most influential public advocate for a "technology led" approach to reducing Green House Gas (GHG) emissions. This article, and this site are strong advocates of the "Policy led" approach. Unfortunately, as this article shows, Bill, by advocating that the funds currently used to support the "Policy led" approach be used instead to fund R&D and the "Technology led" approach is adding to the extreme polarization that marks this debate. Those who agree on the urgent need to reduce GHG emissions don't need to waste their time fighting each other. They need to talk to each other and not at each other.

A reasonable analysis would say that both approaches are necessary. It is clear that on the current path, the technologies supported by the policy led approach are not succeeding in reducing overall CO2 emissions and are unlikely to ever have a sufficiently large impact. At a global level, the developing world, which accounts for almost all growth in world energy consumption, has resisted policies to reduce GHG emissions since the 90's and continue to do so, based largely on economic concerns. When viewed at a global level, alternative energy has gone through a series of local boom and bust cycles as policy support has waxed and waned. Currently, Europe which used to be the leader has slipped back as policy has waned and China and Japan have come forward as policy has waxed. The US has gone up and down as policy has oscillated but has not been a significant player at the global level for decades. Because of declining PV prices driven by China, the Investment Tax Credit (ITC) and low interest rates have made PV investable in the US. The ITC and the US PV boom will probably end next year, a reminder of the fickle "boom and bust" nature of the "policy driven" approach. The subsidy level for alternative energy investment worldwide is about $100B/year, about half of the $200B/year world investment in alternative energy electricity generation, which in turn is about half of the $400B/year investment in electricity generation. It is going to have a hard time increasing significantly from this already significant level. We need better clean energy technologies, but as Bill Gates points out, the investment level in energy R&D is pitifully low. The "policy led" advocates have to accept this reality. "Policy led" has to accept a change to include significant R&D in a wider range of speculative technologies, not just subsidizing an entrenched status quo. By Edmund Kelly This post from 2012 discussed Bill gates negative perspective on alternative energy as a means to reduce CO2 emissions. Apparently Bill has not changed his opinion much since then as he discussed in a recent interview with the Financial Times described in this article in The Register . One thing about Bill is he puts his money where his mouth is. He claims to have invested $1B in non fossil energy R&D, and will spend at least $1B more.

Bill is explicit in his reasons for his negative opinion of wind and solar, citing cost, intermittency and no viable storage technology. StratoSolar solves all three of these problems for solar. Perhaps we can get Bill to take a look? By Edmund Kelly By Edmund Kelly

There was a recent article in IEEE Spectrum that explained why Google halted an energy research effort called RE<C (Renewable Energy less than Coal). It prompted this critical analysis by Joe Romm. Its rare to see this perspective on clean energy discussed in any detail, so I was pleasantly surprised to see two articles on this topic. Between them they explained two positions that have much in common but differ in important ways. The Google engineers discussed how they had started with the goal of renewable energy less than coal and after several years of effort came to the conclusion that current technologies were not going to achieve that goal. In large part this realization came from the understanding that the problem was far larger than they had initially understood. Google halted their efforts in 2011. Google invests heavily in alternative energy deployment and in its operations is very focused on reducing energy, so halting RE<C was in no way a vote against clean energy or dealing with climate change. Joe tried to paint the Goggle engineers as confused and misguided. Joe is a strong advocate for the status quo opinion on how to deal with climate change. Basically that position is; what we have with current wind and solar is good enough and what is needed is policy change, preferably a carbon tax. This tax will somehow magically cause fossil fuels to decline and alternative energy to prosper. Joe does not see RE<C as a necessary or desirable condition for dealing with climate change. At its core this is a view that politics can dominate the large scale economics of energy. When Joe discusses the problems with nuclear power he is happy to use the facts of nuclear costs to counter the optimistic promises of nuclear advocates. In contrast when Joe discusses energy policy he uses the optimistic promises of carbon taxes rather that the facts of decades of failure to get agreement on such policies and the overwhelming evidence that such policies are unlikely to ever be approved at a global level. On top of that there is no clear evidence that such taxes will have the desired consequences. Developing nations, where most new energy consumption is concentrated see higher cost energy as a threat to their development. The central debate is simple. Some (including Bill Gates) see RE<C as a necessary condition for the world to deal with climate change. This opinion is guided by the facts on the ground and the central importance of economics in decision making. Joe and the status quo clean energy consensus he represents see economics as secondary to policy, and believe that advocacy will achieve policy change and policy change will lead to the demise of fossil fuels and the rise of clean energy. StratoSolar is a solution to RE<C. As Joe makes clear, the clean energy status quo does not believe that such solutions can exist and that they are not necessary. Unfortunately this perspective is self fulfilling in ensuring no such solution sees the light of day. By Edmund Kelly By Edmund Kelly

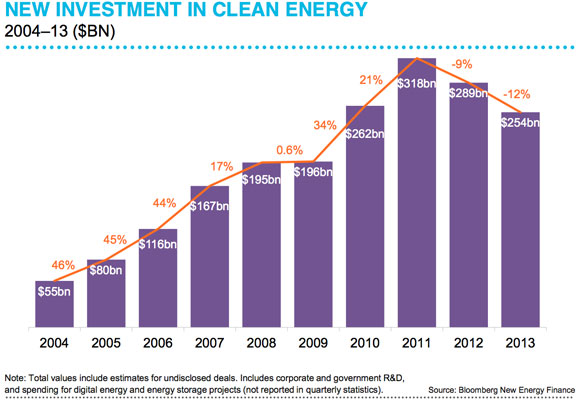

This article provides more evidence that the optimistic hopes for rapid growth in world PV installations seem to finally be running up against the economic and practical constraints. China in 2014 is a good example. China's PV goal for 2014 was 14 GW. It now appears actual installations will be about 10 GW (as was predicted earlier). In 2013 the bulk of PV installations in China were large utility scale. In 2014 they wanted to move the bulk to rooftop installations. This was motivated by growing electricity transmission bottlenecks. Rooftop installations don't need new transmission but take longer and are considerably more expensive than large installations. So China was caught between a rock and a hard place. Utility systems mean building lots of expensive long distance transmission that takes years and has political opposition. Rooftop PV is more expensive and less efficient and is also relatively slow to install. Neither option could meet the 14 GW goal. The projections for next year are also for 10 GW. That would be three years in a row at about 10 GW. This just adds one more piece of evidence to the case that none of today's carbon free energy technologies are practical or economically viable alternatives to fossil fuels. This includes wind, solar, hydro, bio and nuclear. All require government support to survive and governments cannot afford to support any or all of them at the significantly higher level needed to displace fossil fuels. The advocates of each technology are happy to take government subsidies and keep tilting at windmills as long as government keeps providing the subsidies. There are attempts at advanced versions of wind, solar and nuclear, but investment levels are miniscule. We are spending over $250B on installing clean technologies that cannot succeed, but investing a tiny fraction of that on R&D for technologies that might succeed. This is especially true for system solutions like Nuclear or large Solar. In part its because government is bad at and should not be involved in picking winners. Finding a structure to finance large scale energy R&D has proved elusive. It would take venture investments at a considerably larger scale than current venture capital funds can support. For a portfolio approach to work a fund would need maybe $100B to invest in maybe 100 ventures over maybe a decade. Given the scale of energy, one success would be enough. Clean energy investment likely to get limited support from growth of subsidies going forward11/23/2014 By Edmund Kelly World Renewable Energy Subsidies projected to grow from $110B in 2013 to $230B in 2030. Its interesting how the same information can be seen with very different perspectives. This article takes a positive spin, but growing from $110B to $230B in 15 years only represents a 5% annual growth rate. It is also very rare for articles to use the word subsidy. The word that is usually used is Policy. From the graph below, 2013 clean energy investment was $254B, of which PV accounted for about $110B. Subsidies were 110/254 or 43%. At 43% coverage, $230B of subsidies in 2030 will cover about $535B of clean energy investment. This 43% seems reasonable, as reducing costs for wind and solar generation will be offset by growing subsidies for energy storage and offshore wind costs. Numbers are numbing. These numbers seem large, but will only build a small amount of clean energy supply relative to what is needed to replace fossil fuels. The graph shows that clean energy investment has been in decline. The declines in 2012 and 2013 were due to diminishing subsidies. Reduction of one time American stimulus funds and the reduced FIT subsidies in Europe. China, and Japan have dramatically increased subsidies recently which seems to have stopped the decline. 2014 is predicted to about match 2013 at about $250B.

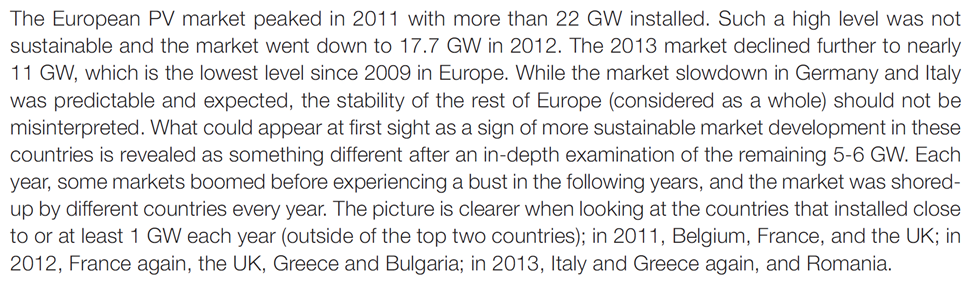

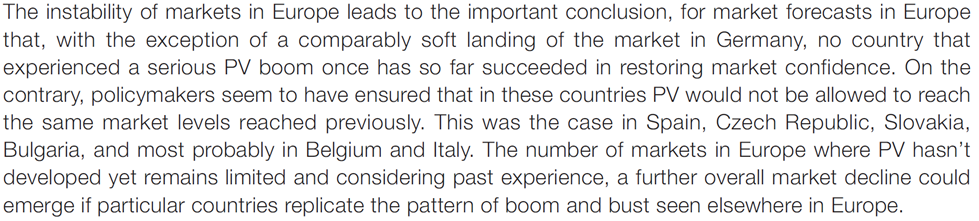

Given the general stabilization in investment since 2009 and the strong dependence on the amount of subsidy, to predict high growth means predicting higher levels of subsidy. US subsidies will almost certainly decline in 2016. Europe's recession, Japan's recession, and China's slowdown don’t bode well for increased subsidies. The projected 5% annual growth in subsidy and by inference in clean energy investment seems realistic when taken in perspective. This is not a path to reducing fossil fuel consumption. By Edmund Kelly This report titled “Beyond Boom and Bust” , was published in April 2012 and I commented on it in this blog post. It was the work of several bodies and individuals, including the Brookings Institute. It argued that US clean energy policy was producing boom and bust cycles, but making no progress in reducing atmospheric CO2. They advocated a more results driven “technology led” policy. The recent EPIA report on PV market outlook for 2014 to 2018 had an interesting section that described the recent behavior of the PV market in Europe as a series of unsynchronized national boom and busts that were hidden by looking at the overall European market statistics. To quote from page 31: PV seems to have always and everywhere followed a path of governments introducing subsidies, investors responding enthusiastically producing a rapid growth boom. Governments then belatedly see the costs mount and reduce subsidies, causing a market bust. Then investor confidence is broken and difficult to restore. Europe has few countries that have not gone through this cycle. Europe has gone from being the biggest PV market to number three or four, with little sign of a likely recovery.

The recent US rapid PV growth is driven by US subsidies enabling profitable investment in PV. The expiration of the Investment Tax Credit in 2016 will burst this bubble, just like all the rest. The governments in Japan and China are early in the subsidy cycle so the boom phase is only building up. In a year or two the costs will be un-sustainable and the bust will inevitably follow. All of this makes it virtually impossible for PV to reduce in cost. Low and unpredictable PV market growth will not encourage investment in newer plant and equipment that can reduce costs. At current cost levels PV market cannot grow without more subsidies. As the boom and bust cycles clearly illustrate, more subsidy is unlikely to be forthcoming. As the “Beyond Boom and Bust” report argued, current US clean energy subsidy policies are not succeeding. They only considered the US, but as we can see, the problem is worldwide. Perhaps it is time to consider the “technology led” policy reforms they advocated. By Edmund Kelly |

Archives

December 2023

Categories

All

|

||||||||||||

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed