|

The StratoSolar concept is usually greeted with a high degree of skepticism. The obvious way to answer this skepticism is to build it and demonstrate that the system works reliably and delivers low cost electricity. This creates a catch 22 situation: It is necessary to raise money to demonstrate viability. However, without a demonstration of viability it is impossible to raise money.

Independent investors like venture capital or private equity are unable and unwilling to quantify the risks of something that appears so different. Despite the view that venture capital invests in risky things, the reality is that they are mostly herd followers, and won't touch anything that has un-quantified risk. The financing problem is further compounded by the fact that there are no general energy companies that have R&D budgets to fund energy as a general category. The energy field is isolated factions, each only concerned with their own business and wary of competition. Oil and gas, coal, nuclear, wind, solar and bio-fuel are separate islands. They raise capital individually and spend it exclusively on their sector. Oil and gas have the most money to invest, but they see exploration as their R&D and other sectors as competitors. In theory, government should see a big energy picture, but in practice democratic governments treat energy as multiple separate political constituencies and funds flow separately to each sector. The only government funded sector that treats energy somewhat broadly is research, so peer reviewed science projects get some relatively small R&D funding. This funding flows through pretty rigid highly regulated channels within academia and the national labs. The current US system provides no funding channel for possible new power system level entrants. Compounding this difficult funding landscape is the polarization of public opinion. People are drawn into camps. Environmentalists see current wind, solar and bio-fuels as the solution and any new contender as a devious plot to undermine their support and delay or stop dealing with the climate problem. Those who think wind and solar are impractical and favor nuclear only want nuclear. Those who don't accept climate change or don't want the government involved favor burning fossil fuels. This polarization of society is reflected in possible investors, most of whom fall into one of these polarized camps. This makes it hard for anything new to get consideration. In pursuing investment we have gradually evolved an approach that uses engineering ingenuity to reduce the cost of the first step that proves viability. This is in the hope that a smaller investment enlarges the potential initial investor pool. This is based on the expectation that seeing is believing and that crossing the divide to a minimal functioning system will give confidence to larger high risk investors attracted by potential for very large profit. Our other approach is to try and provide data and insight, mostly via the web site and blog, that can help reduce the general impression of science fiction by explaining the concept in more detail and with more context. This unfortunately only works for those willing to make a significant effort, and is a pretty hard sell. Overall raising money for this venture has proven to be a far more complex problem than the actual technical design. By Edmund Kelly

Comments

All approaches to eliminating CO2 emissions rely on a transition to a predominately electricity based energy system. We have EIA projections for energy demand in 2050, so it is possible to model different fossil fuel free energy systems that meet this energy demand. This is not an attempt to predict how the future will unfold, but by showing all the pieces and their relationships it helps in understanding the impact of various technologies on the overall system.

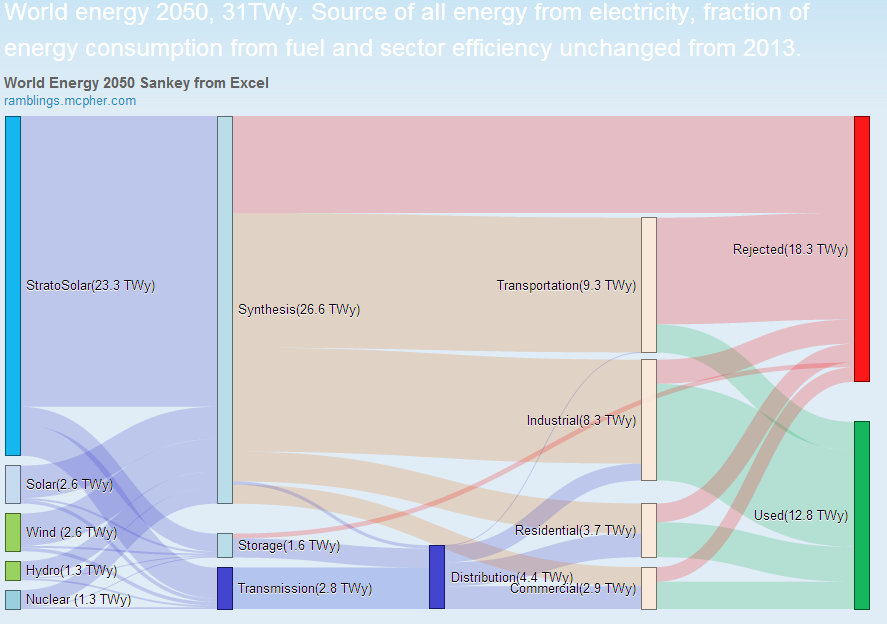

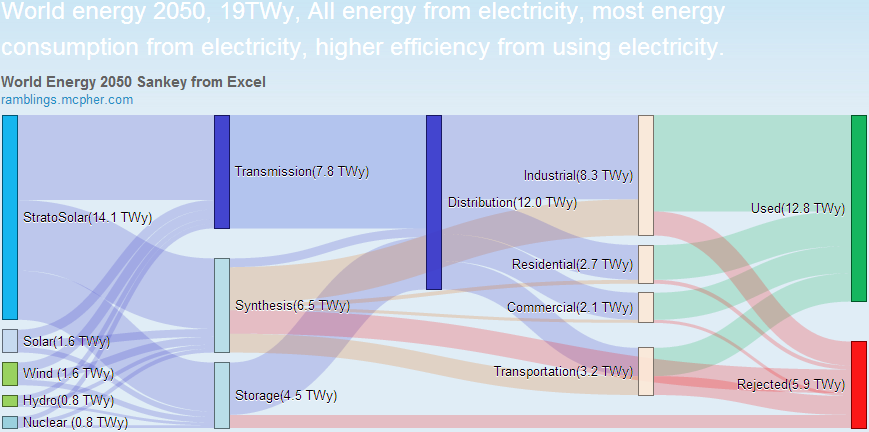

Today there is no significant electricity storage, and fuel synthesis from electricity is equally insignificant. The need to handle intermittent energy sources, and the need to provide liquid fuel for transportation mean that both technologies are necessary at significant scale by 2050 if fossil fuels are to be replaced. The relative cost of energy from each and the sector energy efficiency and demand for either fuel or electricity will determine the relative size of storage and synthesis. The range of possible outcomes is large and dependent on too many variables to predict. We only show centralized large scale storage but distributed storage at the destination, like batteries in transportation, residential or commercial sectors will also affect the balance of demand between fuel and electricity. Fuel synthesis and electricity storage only exist today as small research prototype systems. Alternative energy is too expensive, and synthesis and storage add considerable expense on top of the cost of energy they take in, so there is no economic incentive to invest in either. The fundamental enabler for storage and synthesis is cheap electricity. Today we make electricity from fossil fuel. An electricity economy inverts this and makes synthetic fuel from electricity. If the synthetic fuel has to compete with fossil fuel, it needs to be cheaper. This means electricity has to be very cheap. Today's $4.00/gal gasoline is $0.10/kWh. The cost of electricity plus the cost of paying for the synthesis plant have to at least match this. If StratoSolar electricity costs $0.06/kWh initially, that leaves $0.04/kWh to pay for synthesis and conversion energy losses. That's about $0.80/Wp capital cost. That capital cost is a stretch for mature fuel synthesis but is not possible with today's technology. Investing in these technologies at the scale necessary for the decade or so needed will only happen when it is clear that electricity is cheap and will get cheaper. So the clean energy cost target is not competing with today's electricity, but being considerably cheaper. Wind and solar are about a factor of two too expensive to compete with electricity in favorable markets today. That makes them four to six times too expensive to compete with fossil fuels using synthetic fuels. Sankey diagrams are very useful for visualizing energy systems. They simultaneously show the elements of a system and their interconnectedness, along with a quantative representation of the magnitudes of the elements and the energy flows between them. Here are sankey diagrams for two possible StratoSolar driven energy scenarios that satisfy the projected energy demand in 2050. The first scenario assumes that the sectors consume fuel and energy like they do today. The second scenario assumes that sectors adjust to consume more of the considerably cheaper electricity, and their efficiency improve because of this. By Edmund Kelly Most approaches to improving PV focus on reducing the cost and increasing the efficiency. StratoSolar instead, is based on exploiting a more solar rich environment. A comparison with two other approaches that try to exploit more solar rich environments may better help in understanding StratoSolar. The two other approaches are to exploit the sunshine in deserts and sunshine in outer space. Both have been investigated extensively and are sufficiently plausible to have received significant funding. The most notable desert project is DESERTEC, which aims to exploit sunshine in North Africa and transmit the electricity to Europe. Space based solar power (SBSP) was researched heavily by the DOE in the seventies, and revisited by NASA in the late nineties. A SBSP start-up company called Solaren obtained a PPA in 2012 from PG&E in California to deliver power in 2016.

In the DESERTEC case, the average PV utilization in North Africa is about 25% versus the average of less than 15% for the whole of Europe. The benefit is less than a factor of two overall. Offset against the benefit is the cost of High Voltage(HV) transmission over an average distance of 2000km. Given that this transmission is tied to the generation, its relatively easy to calculate the transmission cost. At today's PV costs HV transmission about matches the cost of generation. Transmission cost should reduce when HVDC transmission develops, but PV will also reduce in cost, so the ratio may not change much. DESERTEC wants to exploit Concentrated Solar Power(CSP) but CSP prices are high and not falling, so that may not work out. For Space based power, the advantage is constant almost 24/7/365 power. Measured using the ground based PV metrics, SBSP has a utilization of 130%, due to the higher intensity sunshine in space. Offset against this is the expected 50% loss in microwave conversion, transmission and receiving which could be regarded as reducing utilization to 65%. PV efficiency would be higher at a colder operating temperature. PV panel lifetimes in space are short due to damage from cosmic rays. There would be advantages to a CSP solution in space, but the complexity is significantly higher than PV. The big problem with SBSP is the very high cost of launching the material into space, and then the assembly and maintenance costs in space. StratoSolar can be viewed as an intermediate point between desert power and space power. Because of night-time interruption, its average utilization is around 40%, and can exceed 50% with one axis tracking. This is higher than the desert, but lower than space. Its transmission costs are low, 20km straight down versus 2000km from the desert or 35,786km via microwaves from GEO. Its equivalent of launch costs is gas bags full of Hydrogen which are very low cost. In the Stratosphere there is no weather or dust, very nearly like outer space, but there is still enough atmosphere to protect PV from cosmic rays, so without ground based weathering degradation or space based degradation, panels may have very long lives, exceeding thirty years. StratoSolar, unlike the desert, does not need water for washing or cooling, which adds to its major benefit over the desert in that it is situated near the demand for energy with few restrictions on where it can be situated. So when viewed against deserts and space, both of which have received considerable attention, despite significant problems, perhaps StratoSolar can be seen as a possible contender from science fact, and not something from science fiction. By Edmund Kelly World energy use is rising with GDP growth, mostly in China and other rapidly developing economies.

Most of this energy comes from burning fossil fuels. There is a well agreed political goal to try to limit CO2 to 450ppm to limit the risks of climate change. Today the OECD consumes a little more than half of world energy (71,480TWh). By 2050, OECD countries are projected to consume little more than today (92,380TWh), but non OECD countries are projected to consume more than twice as much as OECD countries (198,526TWh). Most of this growth in energy consumption will be driven by economic growth in non OECD countries. Most of this energy will come from burning fossil fuels. Non fossil fuel energy supply, particularly wind and solar is projected to grow substantially from (21,392TWh) today to (70,703TWh) by 2050, but will only account for about 25% of all energy in 2050. The problem is the higher cost of alternative energy competes with economic growth. If you are poor, economic growth is far more important. The only rational solution to this conundrum is to find a source of alternative energy that is cheaper than fossil fuel energy. This allows economic growth while reducing CO2. The fundamentals driving these IEA projections are economic. Alternative energy from wind and solar is not market competitive, nor expected to be for the foreseeable future, so its market size is driven by the scale of government subsidies and taxes. Because of competing national objectives, world agreement is not possible, so alternative energy grows based on political will in individual nations. This will, as with all things political is very fickle. The IEA projections assume that fossil energy supply will grow to meet demand, and CO2 reduction will remain a low priority. The known supplies of coal and gas will likely meet projected demand. Oil is more problematic. Oil demand already regularly exceeds supply and given economic growth, fuel efficiency will have to improve at a rapid rate to keep supply and demand in balance. Looking objectively at these numbers a few things are pretty apparent. 1) Long before 2050 the world will face a CO2 crunch 2) An oil crunch driven by demand constantly exceeding supply is highly likely. 3) What OECD countries do will hardly matter. The non OECD countries will be the major CO2 emitters and oil consumers. These oil and CO2 crunches are big sources of potential conflict. The oil crunch will increase the cost of oil. This will reduce economic growth. As the CO2 affects become more obvious and more difficult to deny, the demarcation line will be more between OECD and non OECD countries, rather than within OECD countries as at present. As stated earlier , the only rational way to avoid these looming conflicts is to find a CO2 free energy source that is cheaper than fossil fuels. This removes clean energy as an impediment to economic growth. Instead it has the opposite effect. It enhances economic growth. This is the point where as usual I plug StratoSolar as a clean and cheap energy source that meets all the requirements. By Edmund Kelly A simple question is why can’t ground PV do the same thing as the StratoSolar scenario? The simple answer is it is too expensive and it won’t get cheap enough anytime soon. The sharp drop in PV prices over the last few years have stopped, and there is no rational basis for them to fall further for a long time. A good thing about the recent price drops is it has raised awareness of PV and its potential for further improvement. A bad thing is it has created over optimistic and unrealistic assessments of PV’s chance to be a significant energy provider in the short term.

In the end, energy is all about politics and economics. StratoSolar PV panels have an average utilization of 40%. Ground PV panels have an average utilization of about 13%. Based on a simple analysis, ground PV electricity costs three times as much, and importantly this is significantly more than electricity costs today. That means that it can only be sold with the help of subsidies. As Germany has demonstrated, profitability drives investment. By providing subsidies that guaranteed profitable investment, German private industry jumped at the opportunity and installations grew very rapidly. Japan and China are following Germany’s lead. But things are actually worse than this. Its always tempting measure solar with the best utilization from sunny places, but unfortunately with solar its all about geography. There are very few places with good solar near population centers. Southern California is a rare example. Take Germany as a more representative example. PV utilization in Germany is around 11% from the published data. Germany could do a deal with a sunny location and build HV transmission lines to transport the power. This has numerous problems. On purely money terms, as panels have reduced in cost, and transmission lines have not, its likely that the better PV utilization in the desert will not cover the HV transmission costs. Don’t forget that the transmission lines will have the low PV utilization, which more than doubles the cost compared to conventional HV transmission lines. On top of this are the political constraints. HV transmission lines are not liked, and the countries where the panels and HV transmission lines are placed may not be the most politically stable. Even in the US, politics and economics will favor New York, for example, building in New York rather than dealing with getting power from New Mexico via transmission lines through many states. What this means is that ground PV discriminates, and northern climes get to pay twice as much, or more for electricity. Economics will also dictate that southern climes will get most of the synthetic fuel business. Because of the lower utilization, ground PV electricity will always cost 3X StratoSolar electricity. This factor makes StratoSolar economic for electricity, and then fuels long before ground PV. The learning curve is good but not that good. The learning curve will not continue for ever, and when it slows it will create a permanent cost barrier that ground PV will never overcome. StratoSolar is far less variable with geography, so Germany or New York, for example could provide all their energy needs, both electricity and fuel, locally. So to summarize, ground PV is too far from viability today, and too variable with geography to ever be an easy political choice. StratoSolar is viable today, and does not discriminate against geography. The StratoSolar capital investment for both PV plants and synthetic fuel plants will average a sustainable $0.6T/year, in line with current world energy investment. $2T/year capital investment for ground PV is a lot harder to imagine. By Edmund Kelly The following describes a StratoSolar deployment. The key point this illustrates is the simplicity. This is not an "all of the above strategy" with lots of moving parts and government interventions to subsidize or tax various market participants. The impact on land and existing infrastructure is indirect, and not an impediment to deployment. China in particular could adopt this strategy and replace coal without penalizing GDP growth.

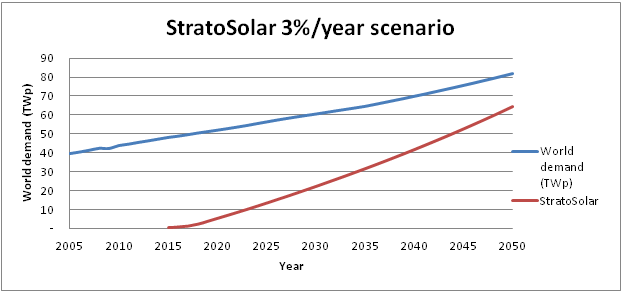

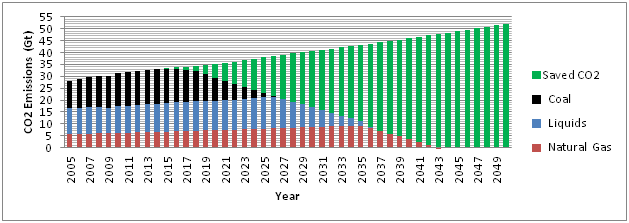

This shows that meeting the 450ppm CO2 goal in a realistic time frame with a realistic cost is feasible. Ground PV is still too expensive and will always be a factor of two to three behind in cost. The political costs and delays of land use and grid upgrades will further limit the scope and time frames of what is achievable. The key enabler is economic viability without subsidy. StratoSolar deployment sequence: Step 1) Deploy StratoSolar initially at $1.50/Wp, $0.06/kWh. This is profitable in most markets and volume growth is not constrained by amount or availability of subsidy. Step 2) After about 25GWp of cumulative production, StratoSolar initial learning curve takes costs down to $1.00/Wp, $0.04/kWh. Step 3) Start deploying electrolysers costing $0.50/W making hydrogen for $3.00/kg. This provides fuel for nighttime and winter electricity generation for $0.08/kWh and starts an electrolyser learning curve that will reduce the $/W electlolyser cost. Step 4) Continue deploying StratoSolar to 1TWP cumulative capacity. Costs reduce to $0.50/Wp, $0.02/kWh. Electrolysers reduce to $0.20/W, Hydrogen reduces to $1.25/kg, nighttime electricity reduces to $0.04/kWh. Step 5) Start liquid fuel synthesis using hydrogen and CO2. Synthetic gasoline costs $3.00/gallon. This starts a learning curve for fuel synthesis plants. Step 6) By the 10TWp cumulative deployment point costs are down to $0.25/Wp, $0.01/kWh, $0.60/kg for Hydrogen, and synthetic gasoline costs $1.00/gallon. This does not discuss time frames. These will depend on time to acceptance. The cumulative TWp needed to replace all world energy demand projected for 2045 is around 80TWp. The two time alligned graphs below illustrate a yearly StratoSolar goal of replacing 3% of world energy demand. Yearly StratoSolar production would need to ramp fairly quickly to 1.5TWp by 2020 and then increase slowly to about 2.5TWp by 2045 to meet increasing world energy demand. 3% is pretty aggressive, but not excessive and aligns with a 30 year plant life. Yearly world investment never exceeds $1T/y, as costs fall with cumulative installed capacity. For reference current world energy is about 8% of GDP, or about $6T/y. The 3%/year replacement scenario shown in the graph replaces about 80% of world energy with StratoSolar by 2050 with the remaining energy coming from the current projections for nuclear, hydro and other renewables. The CO2 emissions reduction chart below shows the CO2 reduction associated with this StratoSolar deployment scenario. We show a simple sequence with coal being replaced first, then oil, and finally gas. The reality would be along these lines but with less distinct transitions. Coal is the obvious first target as the biggest and dirtiest emitter and the easiest to replace with electricity. Oil is next as its high cost make it the easiest to replace with cost competitive synthetic fuels. Natural gas is last because it is the logical partner to solar, it’s the cleanest, and its low cost keeps it cost competitive for longer. The most striking aspect of the graph is the illustration of the scale of CO2 emissions saved. Cumulative CO2 emissions between 2005 and 2043 are 1,800Gt with business as usual versus 820Gt with StratoSolar. By 2043 CO2 emissions could be zero, whereas business as usual is pumping out over 50Gt/year . 820Gt is well within the 450ppm CO2 goal of 1,700Gt. Sources: History: U.S. Energy Information Administration (EIA), International Energy Statistics database (as of March2011), website www.eia.gov/ies; and International Energy Agency, Balances of OECD and NonOECD Statistics (2010),website www.iea.org (subscription site). Projections: EIA, Annual Energy Outlook 2011, DOE/EIA0383(2011) (Washington, DC:May 2011); AEO2011 National Energy Modeling System, run REF2011.D020911A, website www.eia.gov/aeo, and World Energy. By Edmund Kelly Thisarticle in Renewables Energy Focus magazine provides more details on the state of the PV market as companies report their earnings. SPV Market Research puts the PV panel market in 2012 at 25GWp and $20B. Panel maker losses exceed $4B. This comes as Suntech the number six PV panel manufacturer declares bankruptcy.

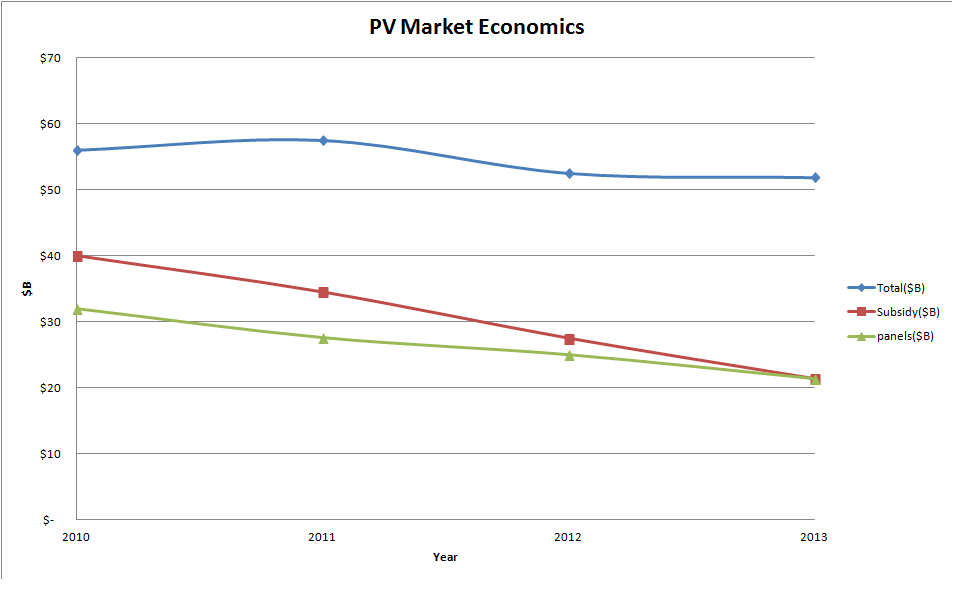

2013 is not shaping up as much better than 2012. Major shifts in regional demand are underway, driven by where the subsidies are growing or declining. European demand is shrinking with reduced subsidy, but China has a profitable FIT and a goal of 10GW, and the generous FIT in Japan is projected to see 6GW installed. The Japanese growth will be met by Japanese panel makers despite their lack of market competitiveness, which may not help the PV business generally. Current panel prices combined with subsidies are also driving growth in the US(primarily California), which may see 5GW installed in 2013. The story is the same everywhere. Subsidies drive the market, and their amount determines the market size. The overall PV market is not likely to grow significantly in 2013 over 2012. As prices stabilize, and even rise a bit to restore profitability, the historical learning curve of PV panel price versus cumulative volume is still holding up very well. This is important to understand as it establishes the realistic fundamentals that should drive expectations for what can be achieved by PV. There has been a tendency to take an optimistic view of PV competitiveness based on extrapolating short term trends, or localized successes (like Germany) driven by large subsidies. PV has made great strides, but is still only competitive with a large subsidy in normal geography, or with a smaller subsidy in a sunny geography like California. The historical learning curve will take many years of current production rates to get PV panel prices down to competitive levels. To put things in perspective, PV on a world average has less than a 15% utilization. StratoSolar is 40% utilization on average. For ground PV panels to match StratoSolar, prices will have to more than halve from current levels to about $0.30/Watt. This will take a long time, perhaps decades. It’s a catch 22 for ground PV. Prices will only fall with volume, but volume will only happen with lower prices. StratoSolar competitive energy pricing has the potential to fundamentally change the energy market by driving PV volume installation now. By Edmund Kelly Analysis of the PV market in 2012 have continued to roll in. They vary considerably in their estimates of PV capacity installed, several estimating capacity installed exceeded 30GWp. A recent report from NPD Solarbuzz was less optimistic. According to the market research firm, PV demand in 2012 reached 29GW, up only 5% from 27.7 GW in 2011. Notably, the growth figure is the lowest and the first time in a decade that year-over-year market growth was below 10%..“During most of 2012, and also at the start of 2013, many in the PV industry were hoping that final PV demand figures for 2012 would exceed the 30GW level,†explained Michael Barker, Senior Analyst at NPD Solarbuzz..“Estimates during 2012 often exceeded 35GW as PV companies looked for positive signs that the supply/demand imbalance was being corrected and profit levels would be restored quickly. Ultimately, PV demand during 2012 fell well short of the 30GW mark.†As usual, the industry and analyst projections going forward are for things to improve dramatically. A more sober analysis would say that the market will continue its painful restructuring with slow to modest growth. The analyses tend to focus on GW installed but a look at the dollar numbers is more revealing of the state of the industry and its likely future. This graph shows a simple analysis of relevant dollar numbers rather than GW installed numbers for 2010, 2011,2012 and an estimate for 2013 based on a forecast of an increase of 20% in GW installed, which may be optimistic.

The Total line shows the total world dollars spent on PV systems, which includes PV panels and Bulk of Systems (BOS). This line has been relatively constant at between $50B and $60B. Over this timeframe the combined reduction in panel and BOS costs has offset the decline in subsidy. The panel line shows that revenue to PV panel makers has been declining significantly. The increase in GW has not offset the fall in PV panel prices, and the revenue decline will continue in 2013. As is known the PV panel business has a capacity to produce about 60GW/year, but demand is about 30GW/year. This has led to severe industry restructuring and low panel prices that in many cases are below the cost of production. There is no new investment in capacity, so the current panel prices are unlikely to fall significantly if most manufacturers are already losing money. The subsidy line shows an estimate of the amount of total world subsidy. This, as is well known has been declining, but the decline has been dramatic. Germany alone pumped in over $100B over 2009-2011, but is now well below $10B/year. China has stepped in energetically, and there is support in Japan and the US, but it still only adds up to half of what Europe used to support, and the overall subsidy amount continues to decline. The PV business is still driven by subsidies. They have declined from about 60% to about 40% of the business, but are still necessary, as current PV systems do not make electricity at competitive costs despite the dramatic PV panel price decline. The overall net effect of panel price declines and subsidy declines has been a market with fairly constant overall revenue. If worldwide subsidies increased that would drive growth which would use up the excess panel manufacturing capacity which would lead to profit and investment in new more efficient capacity and panel price declines that would reduce the need for subsidy. If subsidies continue to decrease, there is little room for PV-panel prices to decline further, and so the overall business will shrink. None of this is coordinated at a world level, so it could go either way. The prospects for increased subsidies overall worldwide seems low, given the current economic focus on austerity in Europe and the US. This has been a long article to get to the simple conclusion that the PV business is unlikely to grow dramatically in the near future and current PV panel prices are likely to prevail for at least several years. Also, optimistic projections for PV panel price reductions based on projecting the recent dramatic drop forward are not realistic, and estimates based on the historical long term trend are likely to prove more accurate. PV at around 30GW/year installation is a tiny fraction of world electricity generation (5000TW), never mind world total energy. The only way to get a dramatic growth in PV is to either get PV to produce electricity at a cost that generates sufficient profit to attract private investment, or massively increase world subsidies. StratoSolar offers the profitable investment path. Our current design if deployed today with current PV cells would generate electricity for $0.06/kWh with very conservative platform cost estimating. This is profitable without subsidy in almost all markets. By Edmund Kelly The US spent/will spend over $150B on clean energy between 2009 and 2014, over $58B of which was one time ARRA expenditure. $108B went on deployment of mostly wind and solar. What did we get for $108B? About two thirds went to double our capacity of wind power and one third on ethanol subsidies. Doubling wind sounds impressive, but wind only accounts for about 3% of electricity generation, and less than 0.5% of overall energy. That means the new wind added accounts for less than 0.2% of total energy. The reduction in CO2 from this is not perceptible. To have had an impact of 20% of energy, spending would have to have been 100 times greater, or about $5T. This is clearly not affordable and gets to the crux of the matter. The only rational argument for spending so much for so little is that it will eventually result in lower cost energy. However all the evidence is that wind energy is getting more expensive, and will continue to do so. Wind turbines don’t scale, and most manufacturing efficiencies have been exploited. New sites are less productive or need transmission investment, which raises cost. Offshore wind costs two to three times as much and is the majority of projected wind growth.

We seem to have a classic impasse. There is the camp where cost is the issue and CO2 is ignored or argued away, and the camp where CO2 is the issue and cost is ignored or argued away. We need a camp where both cost and CO2 matter. Say we had spent the $108B on building prototypes of new nuclear power plants, or infrastructure elements like CAES storage, CCS, thermal storage, high temperature solar receivers, high altitude wind, large scale electrolysis and fuel synthesis to name a few. Now we would be six years ahead in building and testing new things that would be adding to or subtracting from the deployable technology list as opposed to the speculative drawing board list. $18B a year could fund 36 $500M a year projects. To avoid factional fighting a rational plan would have CO2 reduction at affordable cost as the only determining factors. Clearly StratoSolar should be on the list. The alternatives to fossil fuels have several well-known problems, but land use is rarely raised as a limiting factor. Generally this seems to be because only limited solutions for particular geographies are considered. This is a simple analysis of land use for all energy for some major industrial countries. It shows that nuclear, wind and ground solar are very constrained in their ability to scale to a full solution by land use limits alone.

LAND USE km2/TWh/y Nuclear Wind Ground PV StratoSolar exclusion 72 77 13 2.5 occupied <1 2 13 <1 The table above shows land use in km2 per TWh per year for various energy alternatives. Exclusion is land area affected but still available for limited use. For nuclear the exclusion area is the international standard 30km radius evacuation zone. This is the area of possible permanent contamination in a major accident and rationally should not include any major urbanization. We assume 5GW plants. For wind the exclusion area is more restricted only allowing agriculture. The area estimate is based on NREL data and assumes an optimistic 5MW/km2. Ground PV exclusion allows for no other use. StratoSolar exclusion use is similar to nuclear allowing anything but dense urban use. Occupied shows the land area actually occupied. EIA 2009 km2 km2 km2 km2 km2 QuadBtu TWh/y nuclear wind ground PV StratoSolar Total Land Japan 21.863 4,000 286,707 307,770 50,701 10,140 377,930 Germany 14.355 2,777 199,021 213,642 35,195 7,039 357,114 France 11.29 2,184 156,527 168,026 27,680 5,536 551,500 England 9.349 1,808 129,617 139,139 22,921 4,584 242,900 Spain 6.508 1,259 90,228 96,857 15,956 3,191 505,370 Italy 7.838 1,516 108,668 116,651 19,217 3,843 301,336 USA 99.278 19,203 1,376,412 1,477,528 243,403 48,681 9,526,468 The table above estimates the excluded land area required by each energy alternative to supply all current energy for the major industrialized countries listed and also lists the land area of each country. This gives a sense of the scalability of the different resources. It’s pretty clear that for Japan and Europe wind and nuclear don’t have the room to scale, and ground PV given that it fully uses the land it’s on is also implausibly large. Even the US would find it practically and politically impossible to find the necessary land, once we exclude mountains, rivers and lakes. The StratoSolar land area required is by far the smallest, and has the least impact on use, excluding only dense urban. Based upon this data, StratoSolar is the only viable alternative for a complete energy solution not constrained by the availability of land. |

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed