|

In this blog post in February I discussed BNEF’s forecast for 2018 clean energy investment. This forecast projected clean energy investment in 2018 would match that of 2017. A central theme was the unpredictability of what China would do made the forecast unreliable. This came to pass in June when China announced significant solar cutbacks of around 20 GW for the 2nd half of 2018.

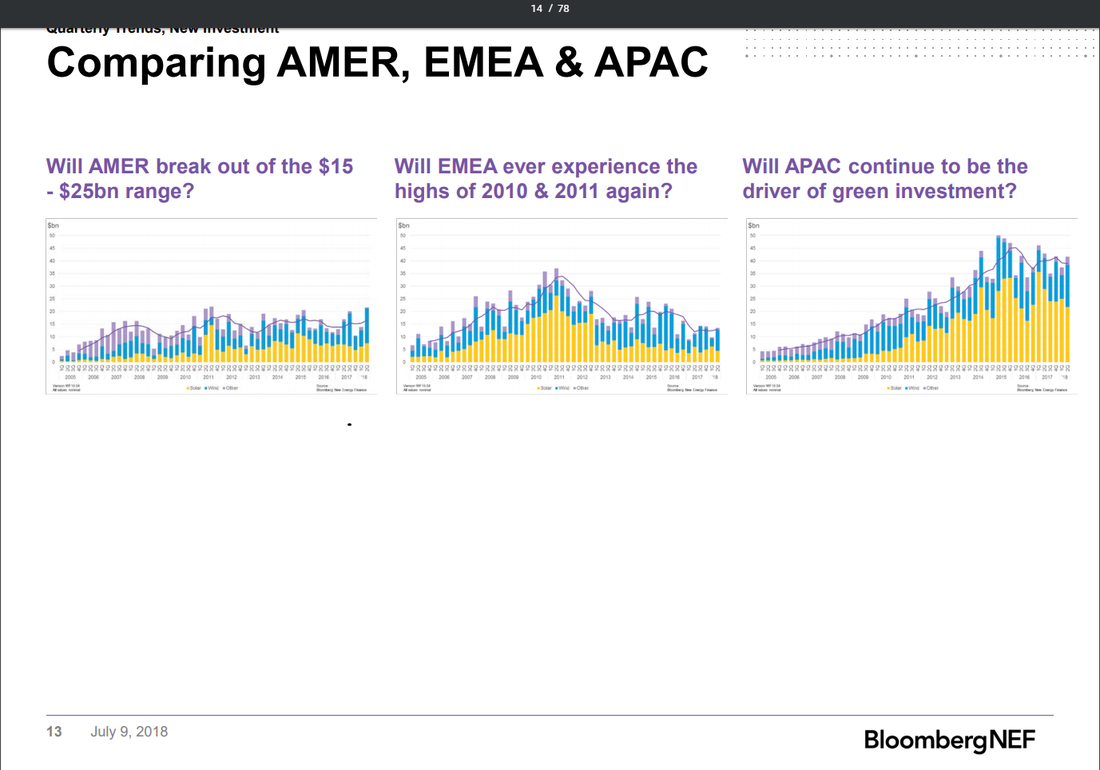

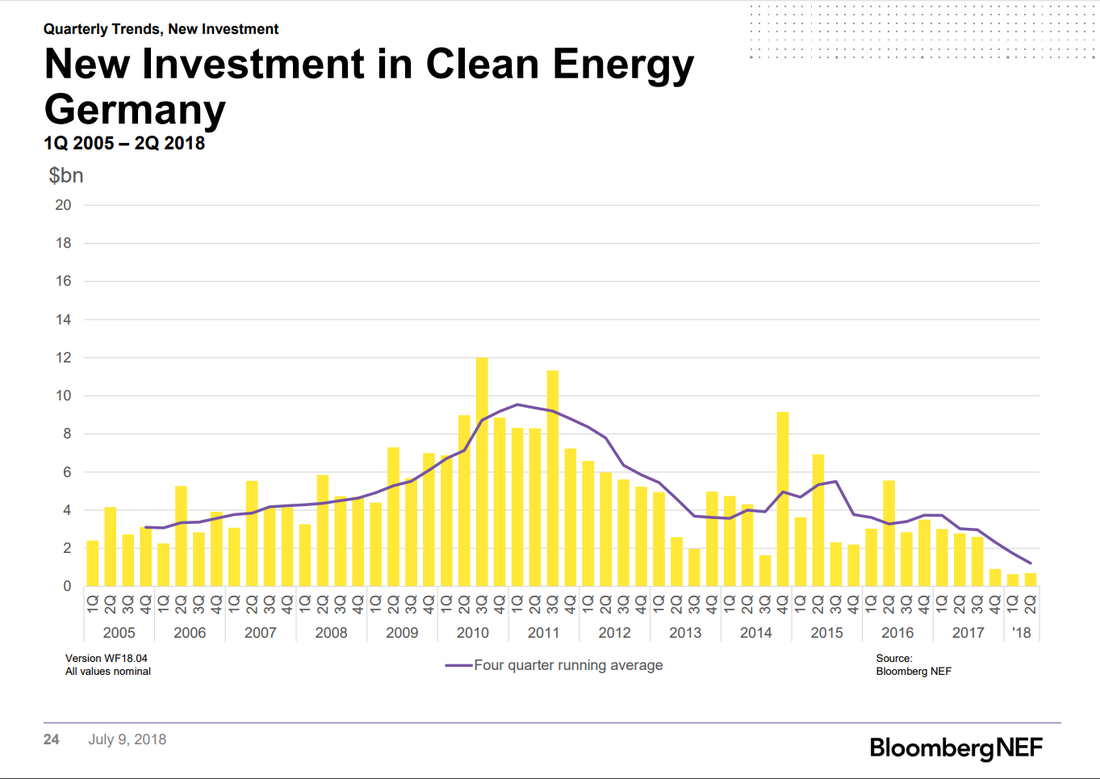

This article discusses the reasons for China’s chaotic solar policy. Basically Investors in Solar manufacturing (like much of Chinese investment) don’t behave like western investors. Investors follow a “if you build it , they will come” approach. They think supply will create the demand. Unfortunately, solar developers can’t develop projects at a rate to match the increased solar manufacturing capacity due to constraints on transmission and distribution. As a result of the reduced demand, PV panels have fallen from around $0.35/W to $0.25/W. This may cause a shakeout in the PV business, but China may prop up companies and not let that happen. Anyway with China’s reduction, clean energy investment will now decline in 2018. Overall investment will stay in the range it has been since 2011. The graphs above show the regional investment trends from 2005 to 2018. Yellow is solar, blue is wind. AMER is america (mostly US), EMEA is Europe and APAC is Asia, which is mostly China. As can be seen America has been in a narrow investment range since 2011. European investment has been declining since 2011 and Chinese investment rose from 2011 to 2015, but has declined slightly since then. With Trump in the White house imposing stiff tariffs on PV panels and US subsidies being eliminated over the next few years, American investment is unlikely to grow for the foreseeable future. It is likely that investment in Europe will continue its downward trend since 2011. China’s reduction in PV deployment probably means that Chinese investment will continue its downward trend since 2015. Germany has long been the driver of clean energy investment in Europe which makes the graph below all the more telling. Investment by Germany over the last three quarters is very low relative to past investment levels. This emphasizes the scale of European decline and is all the more disturbing given Europe's overall enthusiasm for clean energy and meeting the goals of the Paris agreement. The US and China are not uniformly enthusiastic about clean energy and the German reduction to such low level makes a lie of their clean energy aspirations. There is now no one credibly leading the charge for atmospheric CO2 reduction. The overall declining world clean energy investment does not match the optimism about clean energy. This investment level will not reduce atmospheric CO2 levels The only reason for clean energy is to reduce CO2, otherwise why bother? There is lots of hype about 100% renewables and solar and wind cheaper than fossil fuels, but in the real world progress has stalled. The money tells the true story. The problems with intermittent renewables are well understood and are becoming increasingly difficult for clean energy enthusiasts to ignore. Potential solutions are in development but are risky and many years from economic viability. Stratosolar solves all the problems of current intermittent renewables and could be deployed rapidly to provide cheaper energy than fossil fuels in a timeframe that can meet the 450 ppm CO2 goal. By Edmund Kelly

Comments

|

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed