|

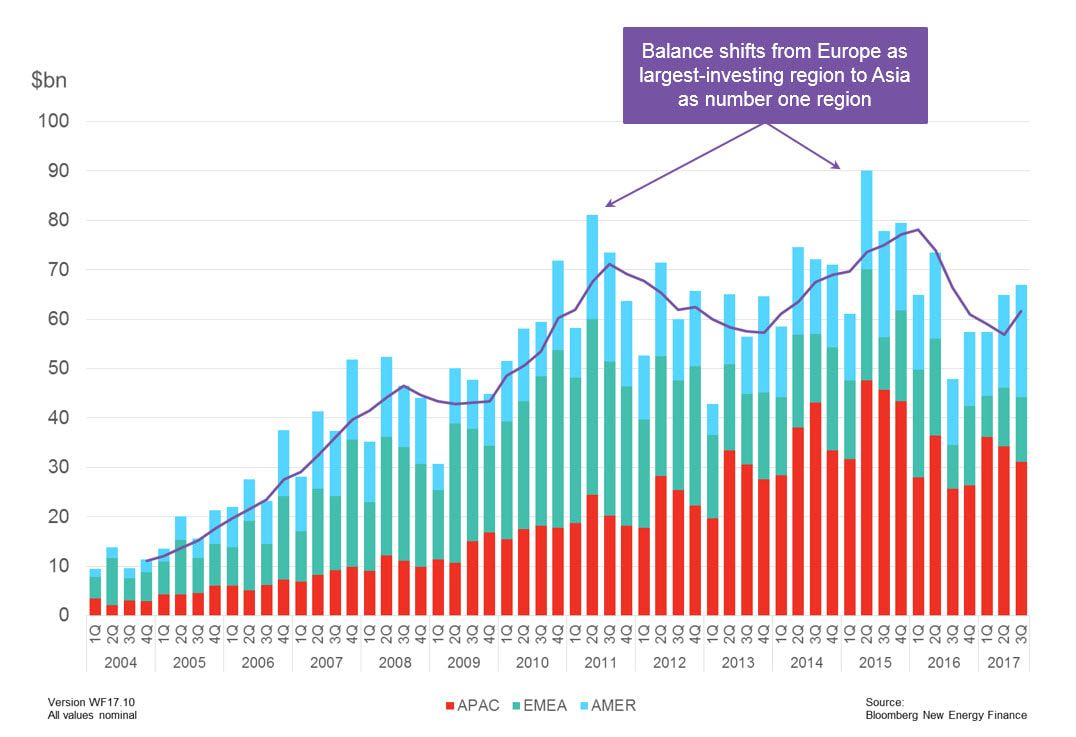

About this time last year I wrote a post based on Bloomberg's (bnef) reporting on global clean energy financing. The theme was the lack of growth in clean energy investment. This time last year the Chinese market was in turmoil after the government lowered its FIT subsidies and a bust seemed imminent. As I discussed in a recent post, China proved resilient and installed way more PV than was predicted taking the 2017 total to possibly over 100GW vs. the 85 GW predicted. Bloomberg’s Q3 2017 investment survey illustrated in the chart above shows that 2017 overall world investment is set to about match 2016 and China’s overall clean energy investment is about the same for 2017 as 2016. So lower PV panel prices have increased the GW of PV installed but within the constraint of a similar overall level of money investment.

This demonstrates that the clean energy market is constrained by the amount of investment which is set by a government subsidy constraint. If PV was market competitive without subsidy, investment should be growing. Examining the quarterly investment chart above shows overall global clean energy investment has been within a narrow range for the last seven years (2011-2017) after ramping up during the previous seven years (2004-2010). Over the last seven years US investment has fluctuated within a narrow range. European investment has fallen significantly, and Chinese investment has grown to offset the European decline. This means that the growth in GW installed of wind and solar has been due to reducing $/W capital costs, not increasing investment. The looming prospect of US tariffs on PV panels is likely to reduce US investment in PV, and the ITC subsidy is phasing out. The prospects are not good for PV investment growth in the US. From the chart, China’s clean energy investment peaked in Q3 2015 and has been steadily declining since. Europe seems set to continue its decline. Overall there does not seem to be much prospect of global growth in clean energy investment. This gets me back to my familiar theme. This latest Bloomberg survey is continuing evidence that the world is not on a track for clean energy to grow at a rate to replace fossil fuels before the end of the 21st century. As I also discuss regularly, there are many impediments beyond just lowering generation costs (like backup, storage and transmission) that will become more significant and must also be overcome. The issue is fundamentally about money as these Bloomberg surveys illustrate. What is needed is a clean energy system solution that beats the current fossil fuel system in cost of energy to the customer. The problem is not just about electricity generation but a complete fossil fuel free energy solution. Stratosolar is such a solution and the web site covers many of the details of why Stratosolar is such a solution in detail. Energy is a complex multi faceted problem that is hard to understand. Deep throat’s advice to “follow the money” gets to the heart of difficult problems when lots of noise gets in the way of understanding as is the case with clean energy. By Edmund Kelly

Comments

|

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed