|

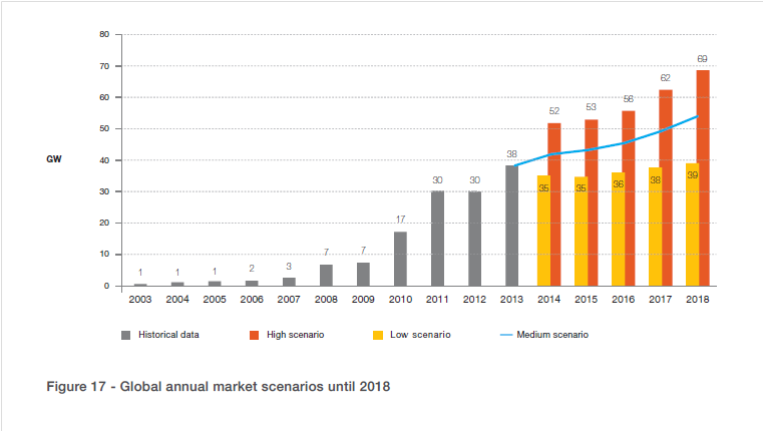

This sixty page report EPIA Global Market Outlook for Photovoltaics 2014-2018 paints a pretty accurate picture of the recent history of the global PV market and has realistic projections for the near term. It has detailed information for each geography and market segment. The graph below from the report shows the near term overall world market projection with optimistic, pessimistic and realistic scenarios. The realistic middle scenario shows slow overall market growth, but no spectacular take off.

The conclusion of the report is a welcome return to reality about the future prospects for PV and a marked contrast to the over optimistic assessments that still seem to pervade the PV business. The central point of the conclusion is that “ The PV market remains in most countries a policy driven market, as shown by the significant market decreases in countries where harmful and retrospective political measures have been taken.” A policy driven market is a euphemism for a subsidy driven market. This lines up with my assessments of the prospects for PV business over the last several years as published in this blog. PV growing at this rate is fine for the PV business, but will not make PV a significant source of electricity anytime soon. It is not sufficient growth to drive costs down, so the business will need subsidy for the foreseeable future. The conclusion of the report backs this assessment as it clearly states that growth is dependent on “sustainable support schemes”. i.e. more subsidies. At some point those that promote current policies in the belief that they will reduce CO2 emissions have to stand back and make a realistic assessment of what they are accomplishing, or more accurately failing to accomplish. By putting all their eggs in the current wind and solar baskets, they are actually precluding investment in possibly better technologies. The psychology seems to be driven by a fear that admitting that current wind and solar are failing, will lead to nothing being done, and something is better than nothing. The reality is that investing only in failure guarantees failure. By Edmund Kelly

Comments

If we focus on new electricity generation capacity worldwide a pattern emerges that somewhat explains the lack of progress on reducing CO2 emissions. New electricity generation investment is about $400B/y, $200B/y in wind and solar and $200B/y in coal, gas, nuclear and hydro. Another $300B/y is invested worldwide in electricity transmission and distribution.

Looking at how the investment is apportioned between countries, a convenient division is between OECD and non OECD. This is a pretty accurate division between developed nations and developing nations. Developed nations have a relatively low growth in overall electricity capacity, with most new generation replacing old generation. Developing nations are growing their overall electricity generation capacity at a rapid rate to balance their rapid GDP growth. Interestingly, from a dollar perspective OECD and non OECD spend about the same on wind and solar, about $100B/y. Developing nations spend most of the $200B/y that is spent on coal, gas, nuclear and hydro, over 66%. They also spend most of the investment for transmission and distribution, about 66% or $200B/y. Because of the rapid pace and large scale of development, developing countries follow a well proven path of investing in low risk, proven, safe, and cheap technologies. Developing countries account for the bulk of investment in electricity infrastructure: about $450B/y (200 T&D + 150 G + 100 A)of the $700B/y. (T&D is transmission and Distribution, G is conventional Generation and A is Alternative generation) All of the OECD invests about $250B/y (100T&D +50G + 100A). In the OECD, wind and solar investment exceeds other generation by a significant margin, but in the non OECD the ratio is reversed. We are at point where PV is still too expensive to compete without subsidies. So what do Europe and America do? Introduce tariffs to protect domestic producers from Chinese imports. This protection supports already inefficient subsidized industries. What is the incentive to reduce costs through innovation when profits are guaranteed and competition is blocked? PV at current price levels will not become a significant enough producer of energy to have any affect on reducing CO2 emissions. Perhaps rising PV prices will break the cycle of over optimism about PV and get some focus on investments that might lead to competitive, clean, sustainable sources of electricity. Investors in Solar projects in the US and Europe think it burnishes their image as responsible planet aware companies when all they are really doing is partaking in corporate welfare on a grand scale. Public funds are subsidizing half the costs of private PV investment and guaranteeing large profits. Their actions prop up inefficient PV industries who rely on subsidies and now protective tariffs. There is little incentive to lower cost to where the PV business can grow without subsidies and perhaps help reducing CO2 emissions. Solar investors are reinforcing the equivalent of fiddling while Rome burns. The developing world (non OECD) is on a path to a high energy future based on fossil fuels. It is simply the affordable path and as such the only viable path out of poverty. Most of the of the doubling of world energy consumption by 2050 is projected to come from the developing world, by which time it will consume more energy than the developed world.

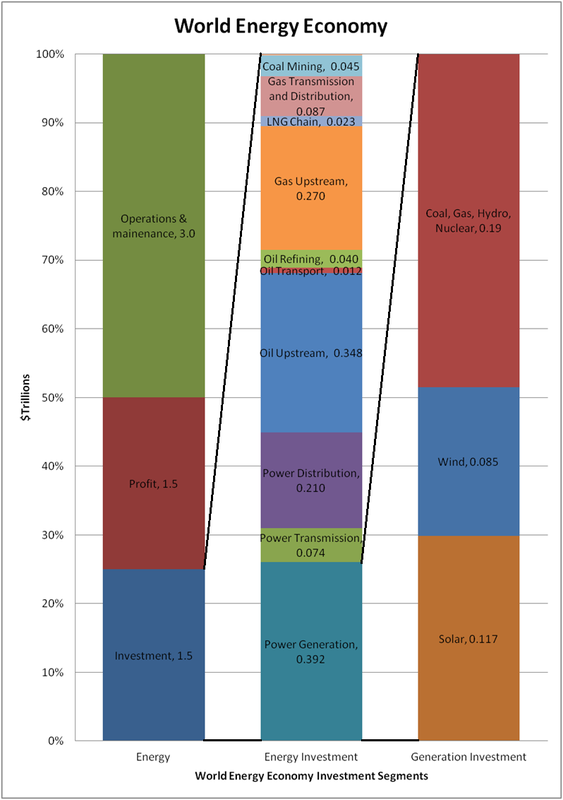

The developed world (OECD) is already high energy and despite much weeping and gnashing of teeth, is projected to continue burning more fossil fuels at current rates into the foreseeable future. Interestingly, the world already spends about $200B/y on alternative energy generation, over half its $400B/y overall investment in new electricity generation. This is divided roughly equally between the OECD and non-OECD countries. This is an objective measure of the considerable amount the world is collectively currently willing and able to pay for fossil fuel free energy. Unfortunately this currently only buys about 17GW average generation, or about 1% of world electricity generation, or about 0.1% of world primary energy. This is insufficient to reduce CO2 emissions which are projected to rise every year into the foreseeable future. The level needed to be on a path to reduce CO2 emissions is 500GW to 1TW average new clean generation every year. This is twenty to fifty times current levels. This highlights the patently obvious but constantly ignored fundamental nature of the problem. To paraphrase James Carville “Its the economics, stupid.” This succinct phrase gets to the heart of political reality. No matter if the energy problem is seen as climate change, energy security, resource depletion or poverty, the real problem is the economics. Energy is just too big a part of the world economy for it not to be so. Significantly increasing the cost of energy by replacing fossil fuels with current high cost wind, solar and nuclear will never be politically acceptable. So we are at an impasse. The current technologies lead to policy proposals that are politically unacceptable and a very polarized debate that can never succeed in forming a consensus. The politically viable solution to this economic problem is new sources of clean sustainable energy at lower cost than fossil fuel energy. Unfortunately the current energy policy consensus is frozen like a deer in the headlights. The common wisdom is no such present or near future low cost technology exists and the need for immediate action means we should find ways to finance more of current high cost technologies. Unfortunately this policy approach violates the first law of politics and as such has failed and is doomed to continue to fail. Breaking the impasse needs fresh thinking to get more options on the table. The consensus that there is no possible low cost energy alternatives is a self fulfilling prophecy if it leads to no attempt to search for such solutions. Policy proposals tend to be broad and vague. Here is an explicit proposal that is not meant to compete with the status quo. Relative to world energy investment of about $1.6T/y, $10B/y seems an affordable amount to spend on energy R&D focused exclusively on high risk, clean electricity generation, power plant solutions. This is not basic research and it is not government R&D. A model is Space-X. Space-X is a private company focused on a product and works on fixed price contracts with fixed deliverables. Its like venture funding. Say The US, Europe, and China each established $3B/y venture funds to fund high risk energy development companies. By high risk, I mean high risk. Already, despite starvation levels of investment, some such companies exist. There are several fusion energy companies. There are several companies focused on sustainable fission of Thorium and U238. There are high altitude wind companies, wind on the ocean, solar in space, the desert, and the stratosphere. Funding these and others to start with would bring out a lot more. Companies would start at say $10M/y or more depending on their current stage of development. Funding would be for fixed deliverables and if on successful paths a few would get to say $500M/y, keeping the average at around 100 companies at $100M/y. This portfolio approach would lead to exploring many approaches and the probability of significant advances in less than five years. One significant success is all that is needed. Its not inconceivable that private equity would eventually join the party, and share the risks and rewards. By Edmund Kelly This chart visually illustrates the economics of energy discussed in the previous post. The left column shows all major energy segments. The middle column expands the energy investment segment and the right column expands the power generation investment segment. The numbers in each segment are Trillions of dollars. Its interesting that Solar is the biggest segment of power generation investment but it provides the lowest average power, a testament to the political power of renewable energy.

By Edmund Kelly Looking at the money, for 2013, world GDP was $72T, of which energy was $6T, or about 8% of GDP. That $6T can be thought of as the income of the overall energy industry. This income balances with industry profit, investment and O&M. From IEA data the energy industry investment part was about $1.5T, of which about $0.8T was in oil and natural gas infrastructure, $0.4T was investment in electricity generation and $0.3T was investment on electricity transmission and distribution.

From Bloomberg data, investment in wind and solar generation in 2013 was about $200B, with additional clean tech investment of about $50B on smart grid, biomass and bio fuels. Some of the investment in transmission and distribution is to integrate wind and solar and some smart grid spending is also related to wind and solar integration. So current investment in clean energy generation is over half of all investment in electricity generation . I have to admit I found this surprising. I always see alternative energy as the underdog, not the biggest player. That $200B bought about 45GW ($82B) of nameplate wind and about 35GW ($114B) of nameplate solar. Using average generation as the metric, conventional power plant capacity runs on average at about 50% utilization worldwide, so the world’s almost 6TW installed capacity generates an average 3TW of power. The 45GW of new wind generates an average of about 12GW and the 35GW of new solar generates an average of about 5GW, for a total of about 17GW of new average generation. That's 17/3000 or about 0.5% of current average electricity generation. The other $200B bought about 140GW of coal, gas, hydro and Nuclear power plants, mostly in China and India, that generate more than 70GW of average power or about four times the 17GW average of the new wind and solar. When we account for the cost of fuel, wind and solar electricity averages about two to three times the cost of electricity from other sources. Most of the investment in new electricity generation is driven by economic growth which needs to add about 3% of new generation every year. If just that increase was met with current wind and solar, it would cost close to $1T/y. That does not cover replacing the existing generation. Of the $200B spent for wind and solar, government subsidies account for at least half, or $100B. This is a look at the money. The bottom line is that wind and solar are already the biggest money part of electricity generation but are not providing much electricity. To scale wind and solar up just to meet current new generation demand would mean they would probably be the biggest industry on the planet. By Edmund Kelly Alternative energy exists solely because of a political will to make it so. It has been uneconomic from its modern inception in the 1970's, driven by the first oil crises. As a result, market driven economic viability has never been a central part of the alternative energy mindset. At its core it has been driven by two perceptions. The first was simply the need for a clean fossil fuel replacement largely regardless of cost. The second was that given time, costs would reduce to make them more acceptable.

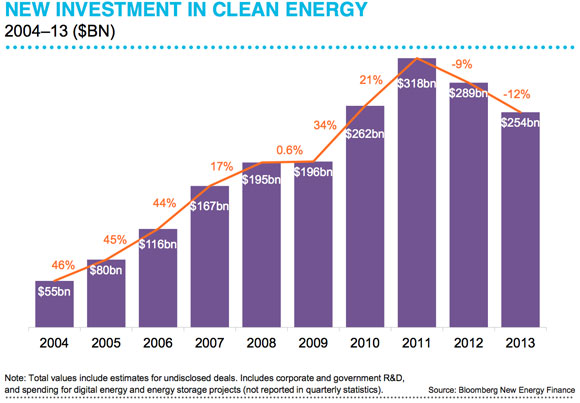

The political will influenced government to provide subsidies to nurture the business. These subsidies now exceed $100B/y of investment worldwide and prop up a total investment of about $250B/y. However a business that depends so heavily on government support is subject to all the problems of such reliance. Firstly government support is volatile, driven by who wins elections. Secondly, subsidized industries are notoriously inefficient. Any long term subsidy regime encourages business that live off the subsidies with little or no incentive to improve. The perception that costs would reduce has been borne out by time, but the path has been a rocky one. The recent history of PV shows the erratic nature of this progress. On a day to day basis no one sees the big picture. When PV prices were stable for a decade, the perception was of stagnation which led to betting on thin film PV. When prices were falling the perception was they would continue to fall, regardless of fundamentals. Also, market size of a heavily subsidized industry is not perceived as inextricably tied to the size of subsidy. If government continues to support the PV business, costs will decline to a point where PV is competitive for some fraction of energy for sunny locations, but to be a complete solution other technologies like long distance transmission and storage have to become economically viable as well. The current rate of improvement put that point out beyond 2050. This is the status quo. Governments willing to provide limited subsidy, a business happy to live of this subsidy with its current size and rate of growth and an alternative energy political consensus that thinks this is actually working. This status quo is not reducing CO2 emissions and will not reduce CO2 emissions out to 2050. Realists point out that change of the degree necessary to reduce CO2 takes many decades and huge political will. While alternative energy imposes large new costs, the current small political will for change is directly measured by the small amount we are collectively willing to pay for subsidies. The only way to increase the political will is to reduce the cost at a faster rate or better yet turn things around and make clean energy an economic benefit. This perception is sadly lacking. The optimists place their hope in technological breakthroughs, and so we get daily updates on basic research, most of which we know will go nowhere, but create the illusion of progress. The sad reality is that basic research takes decades to make it from the lab to the market and decades more to achieve large scale. To scale quickly a technology needs both a long gestation to viability and to be mass producible. PV has recently demonstrated that it is at this point. The rapid scalability has surprised governments that provided subsidies assuming a slower ability to scale. Germany spent over $150B in two years for about 15GW before they adjusted. China just ramped to over 12GW in one year from a standing start for a lot less. So PV technology is at a point where we can make and deploy as much as we can afford. The problem is the high cost of the resulting electricity, especially if you count the costs of intermittency and storage, is just too much money for economies to sustain. StratoSolar is only PV in a new location. It reduces the cost of resulting PV electricity to market competitive levels and increases the reliability of the supply. There is no new technology or resource that limits its ability to scale. If it is proven viable, the major thing that needs to scale is PV manufacturing, the thing that has already demonstrated scalability. This is a lot like computers in the late 1980s. A large CMOS semiconductor manufacturing business had matured and companies like Sun Microsystems that built computers based on this technology rapidly scaled to volume in the millions. This pattern repeated itself for PCs in the 10s to 100s of millions and recently for mobile phones in the billions, as the cost of computers reduced with volume over time. The common elements are ability to scale supply and an affordable product with sufficient demand to match the supply. From an investment perspective the risk is like betting on a Sun Microsystems. They had engineering and market risk, but they were fundamentally enabled by available semiconductor technology. They were small investments in small teams that integrated existing technologies to build new products for very large new businesses. The market demand they produced could be met by the scalable semiconductor supply. Similarly, StratoSolar can create a demand that can be met by a scalable PV semiconductor supply. It’s continuing the triumph of the semiconductor age. by Edmund Kelly This Bloomberg graph shows world investment in clean energy declining over recent years. These declines are due to reducing government subsidies in turn reducing investment. This illustrates that government subsidies drive the market, a point that is rarely discussed, but is extremely important if you want to predict future market trends, as Bloomberg tries to do. If you read the analysis and projections, the fact that they depend almost 100% on predicting subsidies is never really stated. That’s because government actions are fickle and hard to impossible predict for timescales of years.

A bigger issue is that market size is determined by the amount of subsidy. At least one half of the clean energy investment shown is from subsidies. That is a minimum of $125B in 2013. Given that to make a significant impact on energy, we need to provide ten to one hundred times current yearly wind and solar alternative energy capacity additions, the implication is very large government subsidies of $1.25T/y to $12.5T/y. However, overall world subsidies seem set to decline further in 2014 and beyond, not grow. Europe has scaled back its clean energy agenda and the US with cheap gas is likely to reduce subsidies even more. Growth in China and India is slowing. Wind and solar power generation costs may reduce, but transmission, storage and other infrastructure costs will easily make up for this. None of this bodes well for reducing CO2 for the foreseeable future. The only rational strategy is to get an energy source that does not need subsidies to be a profitable investment. Wind and Solar cannot do this. As the numbers show, wind and solar are very large business and can survive and profit within the reduced subsidy domain. They can live happily and profitably off of current subsidies while blocking any potential competitors from any serious attention. While clean energy advocates continue to believe that wind and solar are the only answer, and consider any position that questions this as heresy, no progress can be made. By Edmund Kelly This is the Solve For <X> hosted hangout on air for StratoSolar video recording with the addition of pictures when referenced in the discussion. The length of the video and the dialogue is unaltered.

On Tuesday Jan 14th, between 10:00 and 10:30am PST, Solve for X is hosting a google+ hangout on air for StratoSolar. It's a hosted event where I'm asked a series of questions by a moderator and the audience can also ask questions. I have never done anything like this so I'm not really sure how it will work, but people can watch and participate live and there ends up being a YouTube recording of the event.

The link https://plus.google.com/u/0/events/cv1m6fasvccse8uvlnlk9n0gf4g is to sign up to attend the hangout, post questions ahead of time, and watch it when it happens on the 14th Another way to ask questions during the event would be to tweet me at @edkellyus It's an interesting experiment. Please sign up if you can and let others that might be interested know as well. Also, as I mentioned previously, the StratoSolar solve for x moonshot video has got high ratings on the solve for x site. If you login you can rate the video in various ways. If you have not done this already, please do. https://www.solveforx.com/moonshots/stratosolar-edmund-kelly Edmund Kelly |

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed