|

Bill Gates is perhaps the most influential public advocate for a "technology led" approach to reducing Green House Gas (GHG) emissions. This article, and this site are strong advocates of the "Policy led" approach. Unfortunately, as this article shows, Bill, by advocating that the funds currently used to support the "Policy led" approach be used instead to fund R&D and the "Technology led" approach is adding to the extreme polarization that marks this debate. Those who agree on the urgent need to reduce GHG emissions don't need to waste their time fighting each other. They need to talk to each other and not at each other.

A reasonable analysis would say that both approaches are necessary. It is clear that on the current path, the technologies supported by the policy led approach are not succeeding in reducing overall CO2 emissions and are unlikely to ever have a sufficiently large impact. At a global level, the developing world, which accounts for almost all growth in world energy consumption, has resisted policies to reduce GHG emissions since the 90's and continue to do so, based largely on economic concerns. When viewed at a global level, alternative energy has gone through a series of local boom and bust cycles as policy support has waxed and waned. Currently, Europe which used to be the leader has slipped back as policy has waned and China and Japan have come forward as policy has waxed. The US has gone up and down as policy has oscillated but has not been a significant player at the global level for decades. Because of declining PV prices driven by China, the Investment Tax Credit (ITC) and low interest rates have made PV investable in the US. The ITC and the US PV boom will probably end next year, a reminder of the fickle "boom and bust" nature of the "policy driven" approach. The subsidy level for alternative energy investment worldwide is about $100B/year, about half of the $200B/year world investment in alternative energy electricity generation, which in turn is about half of the $400B/year investment in electricity generation. It is going to have a hard time increasing significantly from this already significant level. We need better clean energy technologies, but as Bill Gates points out, the investment level in energy R&D is pitifully low. The "policy led" advocates have to accept this reality. "Policy led" has to accept a change to include significant R&D in a wider range of speculative technologies, not just subsidizing an entrenched status quo. By Edmund Kelly

Comments

By Edmund Kelly

The rapid drop in PV panel prices in 2011 has led some optimists to predict continuing rapid price declines, particularly in the US. The triggering event in panel price decline was the drop in the cost of poly-silicon from over $100/kg to under $20/kg. This drop in price came as a result of investment in poly-silicon capacity which broke a cartel that had been keeping prices artificially high. This article by Matthias Grossmann describes the history in detail and focuses on the conditions necessary for renewed investment in poly-silicon production. He concludes that poly-silicon prices higher than the current $20/kg will be necessary to get investors on board. As supply is coming into balance with demand, that increased price is already happening, so investment in poly silicon production is likely to resume. All this means is that rapid PV panel price declines from current levels are not likely and current price levels will prevail for some time. Current overall capital costs for large utility arrays varies from about $1.50/W to $2.00/W depending on a variety of project specific details, like local labor rates, land and regulatory costs. Interestingly, if low cost financing is available and you have the high capacity factor of a desert, this capital cost level can produce electricity competitive with fossil fuels without subsidy, as is illustrated by this project in Dubai. However 100% project financing at 4% for 27 years is not yet the norm. For StratoSolar financing we assume a working cost of capital of 8.5% over 20 years which results in about $0.06/kWh for electricity. At 4% financing we would be under $0.03/kWh. That is so low a cost for electricity that it would be immediately disruptive in all markets and would drive very rapid growth in installed capacity. This would drive down costs which would further drive down the cost of electricity. If we can prove the viability of high altitude, buoyant, tethered, platforms, the foundations laid by PV growth and the continuing improvement in PV technology will enable spectacular rapid growth for StratoSolar systems worldwide. By Edmund Kelly A complete renewable energy solution requires the attributes of dispatch-ability and reliability of fossil fuel power plants at a lower cost of generation. PV panels have come down rapidly in price in recent years creating a wave of optimism for PV. A realistic analysis projects further price drops over time, but not at the recent precipitous rate of decline. Current PV price levels still need subsidy in all markets to generate electricity competitive with that from fossil fuels. Also PV is an unreliable and intermittent source of electricity that requires backup fossil fuel generation (or excess capacity and distribution) to handle unpredictable long duration weather outages and daily energy storage for nighttime generation. Currently there is no viable large scale energy storage solution other than pumped hydro. To provide renewable energy for less than fossil fuels, the combined cost of PV generation, backup generation and energy storage generation have to be less than the cost of generation from fossil fuels.

StratoSolar is a system solution that directly attacks all the problems of PV generation and transforms PV into a real, disruptive and transformative lower cost renewable energy solution.

StratoSolar is a combination of tried and true PV technology with a new unproven high altitude buoyant tethered platform technology. The risk is concentrated on the new technology of the buoyant tethered platform. Viability depends on whether buoyant tethered platforms can be built, deployed and not damaged or destroyed by environmental hazards over the 30 plus year lifetime of the power plant. Other risks are whether the predicted capital costs are achievable and possible regulatory impediments from the FAA and local authorities. The new buoyant tethered platforms are really novel structural engineering towers. Large scale structural engineering is a well established engineering discipline. Building the first of a new class of large scale structural engineering projects could be compared with other once novel large structural engineering projects, like steel framed skyscrapers, concrete dams, oil production platforms or steel suspension bridges. This class of project always initially stretch human credibility but actually rarely fail because the structural engineering discipline is very robust. The same reasoning applies to StratoSolar platforms. By Edmund Kelly

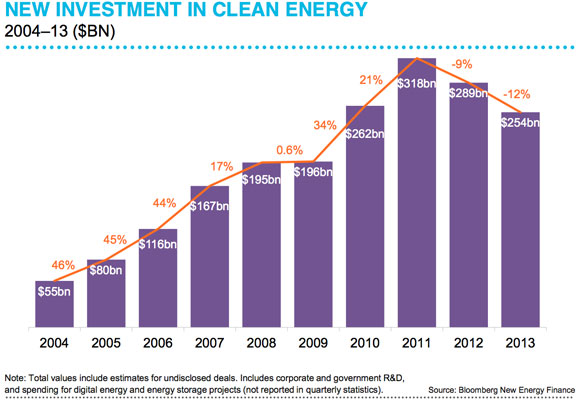

This article provides more evidence that the optimistic hopes for rapid growth in world PV installations seem to finally be running up against the economic and practical constraints. China in 2014 is a good example. China's PV goal for 2014 was 14 GW. It now appears actual installations will be about 10 GW (as was predicted earlier). In 2013 the bulk of PV installations in China were large utility scale. In 2014 they wanted to move the bulk to rooftop installations. This was motivated by growing electricity transmission bottlenecks. Rooftop installations don't need new transmission but take longer and are considerably more expensive than large installations. So China was caught between a rock and a hard place. Utility systems mean building lots of expensive long distance transmission that takes years and has political opposition. Rooftop PV is more expensive and less efficient and is also relatively slow to install. Neither option could meet the 14 GW goal. The projections for next year are also for 10 GW. That would be three years in a row at about 10 GW. This just adds one more piece of evidence to the case that none of today's carbon free energy technologies are practical or economically viable alternatives to fossil fuels. This includes wind, solar, hydro, bio and nuclear. All require government support to survive and governments cannot afford to support any or all of them at the significantly higher level needed to displace fossil fuels. The advocates of each technology are happy to take government subsidies and keep tilting at windmills as long as government keeps providing the subsidies. There are attempts at advanced versions of wind, solar and nuclear, but investment levels are miniscule. We are spending over $250B on installing clean technologies that cannot succeed, but investing a tiny fraction of that on R&D for technologies that might succeed. This is especially true for system solutions like Nuclear or large Solar. In part its because government is bad at and should not be involved in picking winners. Finding a structure to finance large scale energy R&D has proved elusive. It would take venture investments at a considerably larger scale than current venture capital funds can support. For a portfolio approach to work a fund would need maybe $100B to invest in maybe 100 ventures over maybe a decade. Given the scale of energy, one success would be enough. Clean energy investment likely to get limited support from growth of subsidies going forward11/23/2014 By Edmund Kelly World Renewable Energy Subsidies projected to grow from $110B in 2013 to $230B in 2030. Its interesting how the same information can be seen with very different perspectives. This article takes a positive spin, but growing from $110B to $230B in 15 years only represents a 5% annual growth rate. It is also very rare for articles to use the word subsidy. The word that is usually used is Policy. From the graph below, 2013 clean energy investment was $254B, of which PV accounted for about $110B. Subsidies were 110/254 or 43%. At 43% coverage, $230B of subsidies in 2030 will cover about $535B of clean energy investment. This 43% seems reasonable, as reducing costs for wind and solar generation will be offset by growing subsidies for energy storage and offshore wind costs. Numbers are numbing. These numbers seem large, but will only build a small amount of clean energy supply relative to what is needed to replace fossil fuels. The graph shows that clean energy investment has been in decline. The declines in 2012 and 2013 were due to diminishing subsidies. Reduction of one time American stimulus funds and the reduced FIT subsidies in Europe. China, and Japan have dramatically increased subsidies recently which seems to have stopped the decline. 2014 is predicted to about match 2013 at about $250B.

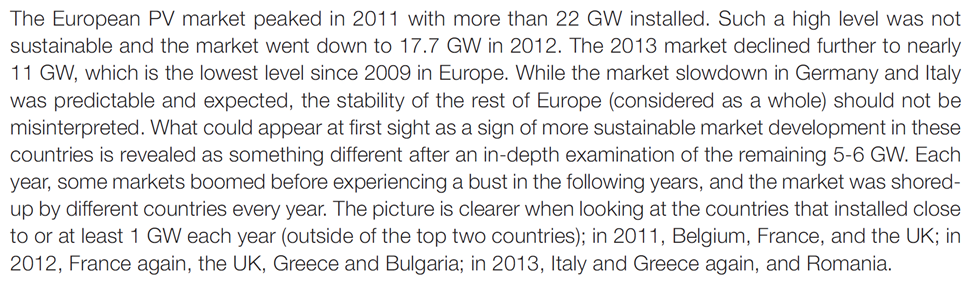

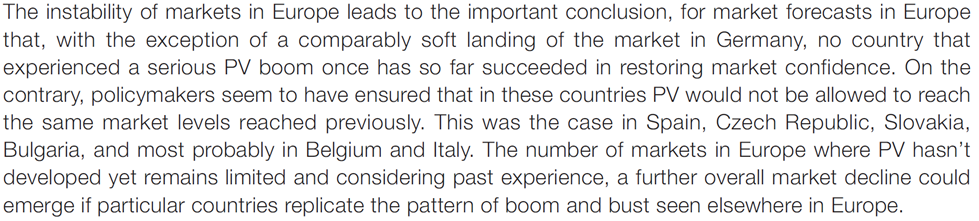

Given the general stabilization in investment since 2009 and the strong dependence on the amount of subsidy, to predict high growth means predicting higher levels of subsidy. US subsidies will almost certainly decline in 2016. Europe's recession, Japan's recession, and China's slowdown don’t bode well for increased subsidies. The projected 5% annual growth in subsidy and by inference in clean energy investment seems realistic when taken in perspective. This is not a path to reducing fossil fuel consumption. By Edmund Kelly This report titled “Beyond Boom and Bust” , was published in April 2012 and I commented on it in this blog post. It was the work of several bodies and individuals, including the Brookings Institute. It argued that US clean energy policy was producing boom and bust cycles, but making no progress in reducing atmospheric CO2. They advocated a more results driven “technology led” policy. The recent EPIA report on PV market outlook for 2014 to 2018 had an interesting section that described the recent behavior of the PV market in Europe as a series of unsynchronized national boom and busts that were hidden by looking at the overall European market statistics. To quote from page 31: PV seems to have always and everywhere followed a path of governments introducing subsidies, investors responding enthusiastically producing a rapid growth boom. Governments then belatedly see the costs mount and reduce subsidies, causing a market bust. Then investor confidence is broken and difficult to restore. Europe has few countries that have not gone through this cycle. Europe has gone from being the biggest PV market to number three or four, with little sign of a likely recovery.

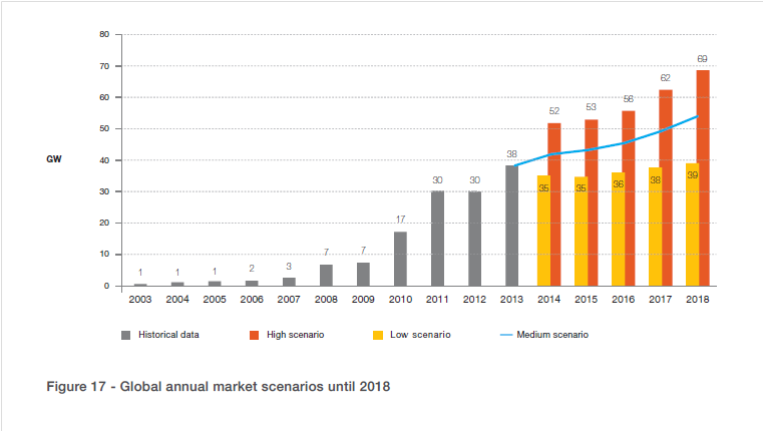

The recent US rapid PV growth is driven by US subsidies enabling profitable investment in PV. The expiration of the Investment Tax Credit in 2016 will burst this bubble, just like all the rest. The governments in Japan and China are early in the subsidy cycle so the boom phase is only building up. In a year or two the costs will be un-sustainable and the bust will inevitably follow. All of this makes it virtually impossible for PV to reduce in cost. Low and unpredictable PV market growth will not encourage investment in newer plant and equipment that can reduce costs. At current cost levels PV market cannot grow without more subsidies. As the boom and bust cycles clearly illustrate, more subsidy is unlikely to be forthcoming. As the “Beyond Boom and Bust” report argued, current US clean energy subsidy policies are not succeeding. They only considered the US, but as we can see, the problem is worldwide. Perhaps it is time to consider the “technology led” policy reforms they advocated. By Edmund Kelly This sixty page report EPIA Global Market Outlook for Photovoltaics 2014-2018 paints a pretty accurate picture of the recent history of the global PV market and has realistic projections for the near term. It has detailed information for each geography and market segment. The graph below from the report shows the near term overall world market projection with optimistic, pessimistic and realistic scenarios. The realistic middle scenario shows slow overall market growth, but no spectacular take off.

The conclusion of the report is a welcome return to reality about the future prospects for PV and a marked contrast to the over optimistic assessments that still seem to pervade the PV business. The central point of the conclusion is that “ The PV market remains in most countries a policy driven market, as shown by the significant market decreases in countries where harmful and retrospective political measures have been taken.” A policy driven market is a euphemism for a subsidy driven market. This lines up with my assessments of the prospects for PV business over the last several years as published in this blog. PV growing at this rate is fine for the PV business, but will not make PV a significant source of electricity anytime soon. It is not sufficient growth to drive costs down, so the business will need subsidy for the foreseeable future. The conclusion of the report backs this assessment as it clearly states that growth is dependent on “sustainable support schemes”. i.e. more subsidies. At some point those that promote current policies in the belief that they will reduce CO2 emissions have to stand back and make a realistic assessment of what they are accomplishing, or more accurately failing to accomplish. By putting all their eggs in the current wind and solar baskets, they are actually precluding investment in possibly better technologies. The psychology seems to be driven by a fear that admitting that current wind and solar are failing, will lead to nothing being done, and something is better than nothing. The reality is that investing only in failure guarantees failure. By Edmund Kelly If we focus on new electricity generation capacity worldwide a pattern emerges that somewhat explains the lack of progress on reducing CO2 emissions. New electricity generation investment is about $400B/y, $200B/y in wind and solar and $200B/y in coal, gas, nuclear and hydro. Another $300B/y is invested worldwide in electricity transmission and distribution.

Looking at how the investment is apportioned between countries, a convenient division is between OECD and non OECD. This is a pretty accurate division between developed nations and developing nations. Developed nations have a relatively low growth in overall electricity capacity, with most new generation replacing old generation. Developing nations are growing their overall electricity generation capacity at a rapid rate to balance their rapid GDP growth. Interestingly, from a dollar perspective OECD and non OECD spend about the same on wind and solar, about $100B/y. Developing nations spend most of the $200B/y that is spent on coal, gas, nuclear and hydro, over 66%. They also spend most of the investment for transmission and distribution, about 66% or $200B/y. Because of the rapid pace and large scale of development, developing countries follow a well proven path of investing in low risk, proven, safe, and cheap technologies. Developing countries account for the bulk of investment in electricity infrastructure: about $450B/y (200 T&D + 150 G + 100 A)of the $700B/y. (T&D is transmission and Distribution, G is conventional Generation and A is Alternative generation) All of the OECD invests about $250B/y (100T&D +50G + 100A). In the OECD, wind and solar investment exceeds other generation by a significant margin, but in the non OECD the ratio is reversed. We are at point where PV is still too expensive to compete without subsidies. So what do Europe and America do? Introduce tariffs to protect domestic producers from Chinese imports. This protection supports already inefficient subsidized industries. What is the incentive to reduce costs through innovation when profits are guaranteed and competition is blocked? PV at current price levels will not become a significant enough producer of energy to have any affect on reducing CO2 emissions. Perhaps rising PV prices will break the cycle of over optimism about PV and get some focus on investments that might lead to competitive, clean, sustainable sources of electricity. Investors in Solar projects in the US and Europe think it burnishes their image as responsible planet aware companies when all they are really doing is partaking in corporate welfare on a grand scale. Public funds are subsidizing half the costs of private PV investment and guaranteeing large profits. Their actions prop up inefficient PV industries who rely on subsidies and now protective tariffs. There is little incentive to lower cost to where the PV business can grow without subsidies and perhaps help reducing CO2 emissions. Solar investors are reinforcing the equivalent of fiddling while Rome burns. There has been a series of recent articles that paint a picture of the improving state of the PV business. This article highlights that China is starting to deal with the zombie 2nd tier companies. The first tier like Jinko, Trina, Canadian, Sun Edison are pretty strong. This Jinko report shows them profitable with panel ASPs of $0.63/W in China. This matches well with $0.75/W in the US and Europe. China is lower cost because it has cheaper financing and cheaper labor. Also there is starting to be life in the Polysilicon market as polysilcon price has rebounded from $15/kg to $20/kg, with several new factories being announced by REC in China and GTAT in Malaysia.

China is the key. As European demand collapsed last year, China's new subsidies for local deployment provided the foundation for their PV panel makers and confidence for future stability. However if prices stay stable at current levels, more subsidy will be needed to grow the market. Projects in the US are profitable with current subsidies and apparently there is enough investor confidence in solar to support projects with IRRs below 10%. Projects in Texas have been bid at PPAs of $0.05/kWh based on low financing costs and current subsidies. Chinese panel makers are becoming project developers as a means to ensure a market for their panels, following the example of US panel manufacturers First Solar and Sunpower that have successfully used this strategy to survive with uncompetitive panels. Overall PV growth projections seem to hinge on new markets in the developing world. Panel prices should stabilize at current levels of around $0.75/W, or even rise over the next few years as the industry returns to profitability. This is all good news, but does not paint a picture where the PV market is likely to grow to the level needed to make a significant impact on CO2 emissions any time soon. By Edmund Kelly Looking at the money, for 2013, world GDP was $72T, of which energy was $6T, or about 8% of GDP. That $6T can be thought of as the income of the overall energy industry. This income balances with industry profit, investment and O&M. From IEA data the energy industry investment part was about $1.5T, of which about $0.8T was in oil and natural gas infrastructure, $0.4T was investment in electricity generation and $0.3T was investment on electricity transmission and distribution.

From Bloomberg data, investment in wind and solar generation in 2013 was about $200B, with additional clean tech investment of about $50B on smart grid, biomass and bio fuels. Some of the investment in transmission and distribution is to integrate wind and solar and some smart grid spending is also related to wind and solar integration. So current investment in clean energy generation is over half of all investment in electricity generation . I have to admit I found this surprising. I always see alternative energy as the underdog, not the biggest player. That $200B bought about 45GW ($82B) of nameplate wind and about 35GW ($114B) of nameplate solar. Using average generation as the metric, conventional power plant capacity runs on average at about 50% utilization worldwide, so the world’s almost 6TW installed capacity generates an average 3TW of power. The 45GW of new wind generates an average of about 12GW and the 35GW of new solar generates an average of about 5GW, for a total of about 17GW of new average generation. That's 17/3000 or about 0.5% of current average electricity generation. The other $200B bought about 140GW of coal, gas, hydro and Nuclear power plants, mostly in China and India, that generate more than 70GW of average power or about four times the 17GW average of the new wind and solar. When we account for the cost of fuel, wind and solar electricity averages about two to three times the cost of electricity from other sources. Most of the investment in new electricity generation is driven by economic growth which needs to add about 3% of new generation every year. If just that increase was met with current wind and solar, it would cost close to $1T/y. That does not cover replacing the existing generation. Of the $200B spent for wind and solar, government subsidies account for at least half, or $100B. This is a look at the money. The bottom line is that wind and solar are already the biggest money part of electricity generation but are not providing much electricity. To scale wind and solar up just to meet current new generation demand would mean they would probably be the biggest industry on the planet. By Edmund Kelly |

Archives

December 2023

Categories

All

|

|

© 2024 StratoSolar Inc. All rights reserved.

|

Contact Us

|

RSS Feed

RSS Feed